- Xebec Adsorption (XBC) has raised more than C$207 million in two separate financings to fund its acquisition of HyGear Technology and Services

- Under the first, the company issued 24.7 million subscription receipts at a price of $5.80 each for a total of $143.7 million

- The second was a private placement with Caisse de dépôt et placement du Québec, which purchased 10.9 million subscription receipts at a price of $5.80 each for a total of $63.2 million

- In addition to funding the cash component of the HyGear acquisition, the proceeds will also be used to complete a number of other potential acquisitions and growth opportunities

- Xebec Adsorption is currently down 0.24 per cent to $8.25 per share

Xebec Adsorption (XBC) has raised more than C$207 million in two separate financings to fund its acquisition of HyGear Technology and Services.

Under the first, the Montreal-based clean energy provider 24.7 million subscription receipts at a price of $5.80 each, raising a total of $143.7 million.

This offering was completed through a syndicate of underwriters co-led by Desjardins Capital Markets and TD Securities, which included National Bank Financial, Canaccord Genuity Group, Raymond James, Beacon Securities and Stifel Nicolaus Canada.

Xebec then raised a further $63.2 million by issuing 10.9 million subscription receipts to Caisse de dépôt et placement du Québec, also at a price of $5.80 each.

Much of the proceeds will be used to satisfy the cash component required to wholly acquire Green Vision Holding BV, the parent company of HyGear, which was outlined in an announcement earlier this month.

A portion will also go towards the proposed purchase of an industrial gas generation technology and manufacturing business and a specialty compressed air and air treatment services company.

According to the previous announcement, Xebec will acquire 100 per cent of Green Vision for a total of €82.0 million (approximately C$127.3 million) and the assumption of €18.4 million ($28.6 million) in debt.

Of the purchase amount, HyGear’s shareholders will receive roughly $65.2 million in cash and 10.3 million common shares in Xebec at a price of $6.03 each.

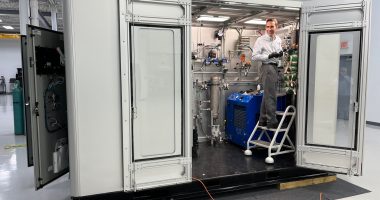

Xebec said the HyGear acquisition positions the company to execute and accelerate its renewable gas strategy, and opens the door to new markets with the addition of HyGear’s hydrogen technology, which will be used to launch a commercially viable green hydrogen product offering.

Xebec Adsorption is currently down 0.24 per cent to $8.25 per share at 11:42am EST.