The gaming industry has proven highly successful for many investors but has also been very fragmented. Technology evolves at what feels like a faster and faster pace all the time, and it can feel daunting, but it also means new opportunities emerge constantly.

A key company for any investor to look out for in this space is one that can combine assets from various areas in the industry.

Enter: X1 Entertainment Group (CSE:XONE, Forum), a diversified portfolio company with three main business units: media and network, agency services, as well as gaming and Esports.

It owns and operates a growing Esports franchise, RixGG, a traditional Esports team competing in tournaments as well as an established creator economy.

X1 has a few verticals they are currently focused on, such as X1 Talent, X1 Esports and X1 Media. These are all separate entities of the company that work together to provide a well-rounded and full user experience.

Brands will come on board to sponsor the team and also want to promote their service across their social media platforms. Through the platforms that X1 acquires, these brand campaigns extend to areas and demographics that most other companies have yet to reach. This provides the company with a strong revenue stream via advertisement deals and partnerships. The business of the company is the competitive playing of video games by teams for cash prizes and operations ancillary to such competition, such as merchandising and the hosting of tournaments. It engages in the acquisition and development of Esports teams and digital content creation, which is considered one business segment.

Everything links together under this company, from the live tournament team competing in front of an audience of potentially tens of thousands or even hundreds of thousands.

The company went public in June 2022, and Chief Executive Officer Mark Elfenbein said in a news release at the time that in addition to their existing assets, there is a great opportunity to acquire companies within the games and creator economy markets that the team believes can benefit tremendously from being a part of the X1 ecosystem.

This company has achieved several high-profile acquisitions just months after going public.

Under the umbrella:

X1 Entertainment Group is the parent brand under which live many different divisions service the entire Esports market, each one feeds up via acquisitions made by the company for both its platforms and leadership team.

X1 Talent:

This past summer, X1 signed a definitive agreement to acquire X1 Talent (formerly Tyrus, LLC).

Tyrus Talent is a boutique talent management group for digital content creators. It works with creators in the gaming and lifestyle verticals, providing them with paid opportunities. It also offers more integrated services such as social media management, platform management, video editing, and short-form content editing.

CEO Elfenbein commented that the Tyrus platform bridges the gap between international brands and the gaming ecosystem.

“The addition of the company to our portfolio will help to establish X1 as an advertising sales organization with access to some of the most sought-after content creators in the video games category.”

Since 2017, Tyrus has partnered with content creators providing comprehensive management of YouTube, TikTok, Twitch and other social media channels. It also provides consultation on personal brand growth strategies and partnership management.

Tyrus has a contract with Warner Bros. to deploy their product releases with the specific talent that is well known in those communities. The Bank of Montreal (TSX:BMO) has also been using Tyrus’ talent to speak to this emerging audience in a unique way.

BMO launched a channel on Twitch, one of the top streaming services in the gaming community and hired Tyrus to bring in their most popular Canadian gaming personalities to go on the BMO channel to play games, get access to those users, speak to financial literacy questions with BMO representatives, and also play games at the same time.

As per the agreement, the company will acquire 100 per cent of Tyrus’ issued and outstanding membership interest. The total consideration is estimated to be approximately US$350,000.

The purchase price is payable in parts. US$150,000 will be paid in cash payments, due within 60 days of closing, and the issuance, of 555,555 fully paid common shares in the capital of the company at $0.45 per common share. A bonus payment of US$100,000 may be payable if Tyrus reaches US$1,750,000 in its first full year of revenue, which may be settled in cash or common shares at the option of the company.

X1 Entertainment now holds all issued and outstanding securities of Tyrus, which will operate as a subsidiary of X1.

“The Tyrus transaction offers tremendous opportunity for X1 to partake in the growing global creator economy, which is an industry of over 50 million individual content creators where Tyrus is extremely well-positioned,” said CEO Elfenbein.

Since 2017, Tyrus has built a client roster of over 60 high-profile content creators with a combined reach of over 20 million followers.

Tyrus provides comprehensive management of YouTube, TikTok, Twitch and other social media channels, as well as consultation on personal brand growth strategies and partnership management.

“Becoming part of the X1 family will allow Tyrus to extend its reach and engage with new and exciting talent in the gaming and Esports community,” said Tyrus’ CEO, Amanda Solomon.

In the execution of the terms of a membership interest purchase agreement dated July 15, 2022, X1 Esports acquired 100 per cent of the issued and outstanding membership interest of Tyrus for a total amount of up to US$350,000.

X1 Media:

ShiftRLE and Octane GG

ShiftRLE It was around this time that X1 acquired ShiftRLE, an online news outlet focused on the popular video game Rocket League.

According to Active Player, Rocket League is one of the world’s leading Esports, with global averages of 80 million players per month.

“Adding ShiftRLE to the X1 portfolio will be an excellent addition, which will not only help us to deliver on our core strategic priorities of building a diverse video game ecosystem and providing global brands access to a GenZ audience but will strengthen X1’s position in video games media,” CEO Elfenbein added.

“We are thrilled to become a part of the X1 family moving forward as they see the potential we have in the growth of Rocket League as an Esport,” said Jalen Jones, a co-founder of ShiftRLE.”

The finalization of the proposed acquisition is subject to the fulfilment of or waiver of closing conditions under the APA, including X1 entering into consulting agreements with key persons at ShiftRLE.

In line with the terms of the APA, X1 will acquire 100 per cent of the assets made up of ShiftRLE and have the benefit of ongoing services by the key personnel of ShiftRLE.

This acquisition will be for an aggregate price of US$50,000 cash, 333,333 common shares in the capital of X1 with a deemed issue price of C$0.45 per common share, and a 7 per cent share of gross revenues ShiftRLE earns in the first 36 months following closing to a maximum of US$250,000.

X1 Sports has signed consulting agreements with four vendors, who will be responsible for the continued operation of Shift.

The company also distributed 333,333 common shares and US$50,000 in cash to the vendors.

The vendors will also be eligible to receive earn-out payments for 36 months from the closing date as payment of a 7 per cent share of gross revenues Shift earns to a maximum of US$250,000.

“Not only has the Shift community grown considerably over the past year, but we believe that Rocket League has tremendous global appeal with fans looking for the content that Shift can offer,” CEO Elfenbein added.

Las Vegas-based ShiftRLE, led by co-founders Achilleas Fotiou and Jalen Jones, has demonstrated consistent user audience growth since launching in 2020.

Octane.GG:

Most recently, in October 2022, X1 Esports closed its agreement to acquire Rocket League Community, Octane.GG.

In connection with the acquisition of the assets comprising the business of Octane, the company has entered into consulting agreements with two individuals who will be responsible for the continued operation of Octane.

Octane.GG is an online statistical and news outlet focused on Rocket League coverage.

The company is making a cash payment of US$35,000 as consideration for the acquisition of the assets.

CEO Elfenbein noted that as Rocket League continues to grow in global popularity, owning multiple assets within this Esport allows the opportunity to launch an all-encompassing Rocket League destination site containing breaking news, statistics, video highlights, and fantasy sports.

Octane is the leading Rocket League Esports statistics platform providing in-depth match statistics across the top events in the space.

The company anticipates utilizing Octane’s Rocket League statistics database in launching future offerings, such as a possible Rocket League fantasy product.

X1 Esports:

Established in 2020, RixGG is one of the fastest-growing Esports organizations in Europe. RixGG is currently focused on competitive gaming and merchandising and is expanding into content creation. RixGG has been developing its commercial relationships, its overall brand and the in-house marketing technology required to run a digitally based esports organization.

RixGG has had early success with teams in major games such as Rocket League, Valorant, Fortnite and League of Legends.

RixGG has established itself at the top of EU gaming competitions with their Valorant team and, more recently, entered the Counter Strike Global Offensive (CSGO), which brings a very large audience of First Person Shooter (FPS) competitive gamers.

They have leveraged many of their strong partnerships with content creators who are very well integrated into the gaming communities across a wide variety of top titles in the industry.

The company’s goal from day one has been to become a tier-one esports organization, and they have set itself on a path to make this a reality.

Meet the team:

CEO Elfenbein explained that it is important to have people with a lot of experience navigating public markets and the compliance side of things. The company’s acquisitions are shaping this management team.

“When we do an acquisition, we’re taking the heads of those companies strategically, which is a big criterion on who we acquire so we could extend them for X1 corporate roles.”

As Chief Executive Officer, he oversees the company’s operations. With more than 20 years of experience in a leadership role, he has previously served as chief revenue officer, president, or CEO of five publicly traded companies in the areas of music, gaming, mobile and artificial intelligence (AI), which combined, raised financing in excess of $1 billion. during this period, he was Chief Revenue Officer at Sentient Technologies, which raised nearly $180 million, the largest sum at the time for an AI company. prior to that, he was president and CEO of Slyce Technologies, where he led the company’s deployment of a visual search technology that was successful among Fortune 500 companies. He has also earned a B.B.A. degree from the University of Manitoba.

He added that his management had been very involved in taking companies public through the Canadian markets.

Director Latika Prasad has been an officer and/or a director of private and publicly traded companies for more than 30+ years. she is currently a Director of Turmalina Metals Corp. (TSXV:TBX) and is also the Corporate Secretary of Realgold Resources Corp. Since December 2016. previously, she was a Director at Southern Empire Resources Corp. from March 2020 TO June 2021 (TSX.V: SMP) and Director / Assistant Corporate Secretary at Wabi Exploration Inc. (CNSX:WAB) from September 2015 to July 2017. She served as the Chief Financial Officer of Azincourt Resources Inc. (TSXV:AAZ) as well, from October 2011 until June 2013 and as a Director from May 2011 to April 2013. She also acts a lot on X1’s finance side.

Director Samantha Shorter has more than a decade of experience in providing reporting, assurance, and accounting services to publicly traded companies, including technology companies. She completed a Bachelor of Commerce with honours at the University of British Columbia. She is a chartered professional accountant (CPA, CA) and certified internal auditor.

On the Advisory Board, Amanda Solomon specializes in gaming and Esports, she has driven brand integration, influencer marketing campaigns, and talent partnerships with companies like Epic Games, Oneplus, Samsung and Gucci. She received her undergraduate degree in marketing from San Diego State University and received an MBA in marketing from Chapman University. She has an accounting degree from the University of California and is currently completing her Master of Studies in Entertainment Law from the University of Southern California.

“She’s very entrenched in the gaming advertising business. She sits on many different boards out there,” CEO Elfenbein said.

Investment summary:

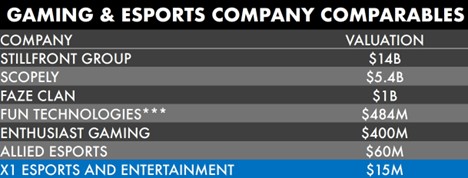

When all the industry numbers came out in 2016, they were predicting Esports to be at about $90 billion by 2021. However, the real number was $180 billion when the time came. The new estimate shows that the industry in 2025 will hit about $275 billion in valuation, if not more.

This arena is seeing continued growth. This would prove to be beneficial for a company like X1 because it is looking to acquire many businesses in this fragmented space. There are lots of startups out there that weren’t around a year ago, getting some traction but may be experiencing some difficulty growing. This is where the X1 ecosystem could realize the upside of what it can obtain.

For investors that are thinking about getting into the video game industry or this new burgeoning content creator economy, X1 could be a solid proxy for that next level.

For regular updates, visit x1ent.com

FULL DISCLOSURE: This is a paid article produced by The Market Herald