Weekly Market Movers

142 posts

- Energy

- Environment

- Finance

- Health Care

- Market News

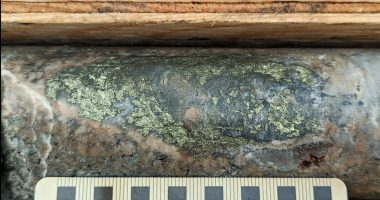

- Mining

- Psychedelics

- Technology

- Weekly Market Movers

The best-performing stocks of 2023

While the TSX has traced an uncertain pattern this year, we can always learn from the best-performing stocks of 2023.