- Walker River (WRR) has intercepted up to 166.37 g/t gold from its Lapon Project in Nevada

- The result is included within 7.62 g/t gold over 48.8 m

- Drill results confirm the discovery of a new high-grade gold zone

- The 2022 drilling program will focus on this new zone to extend gold mineralization on the property

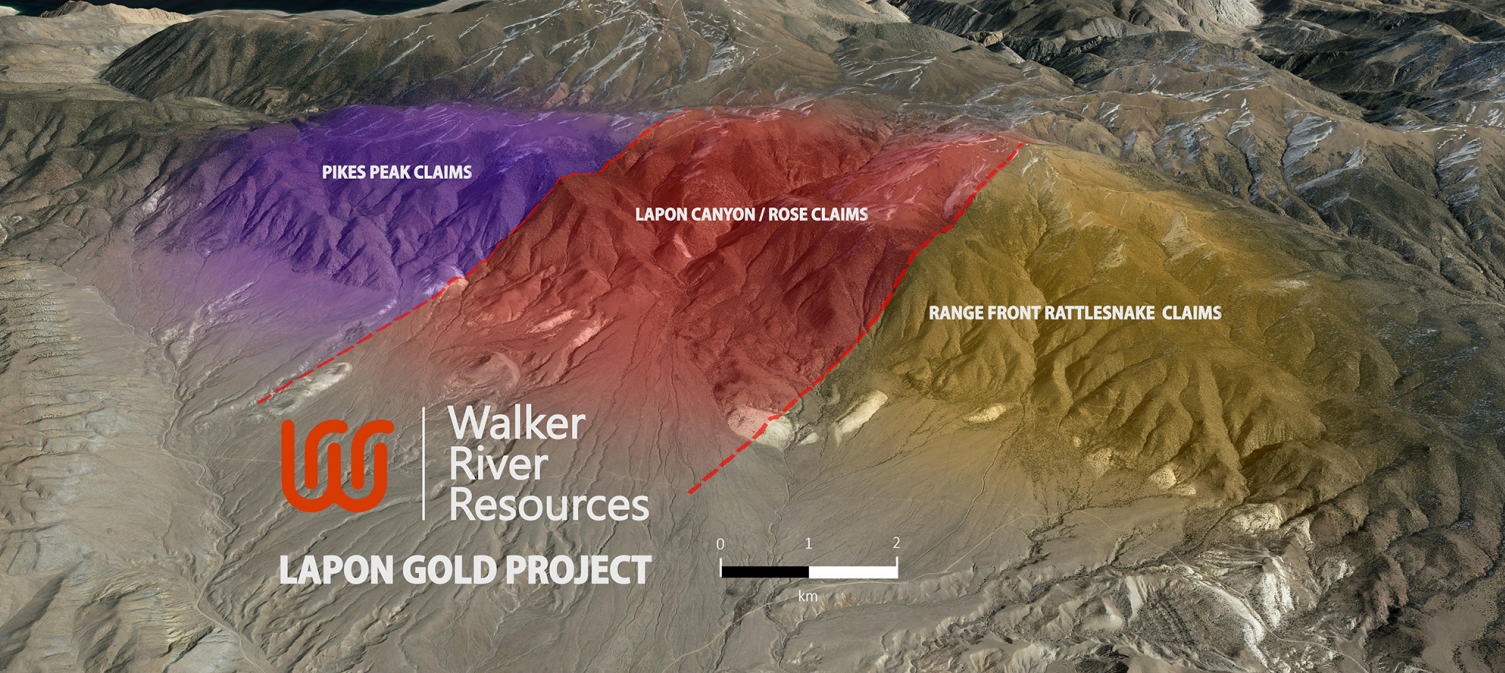

- Walker River is a mineral exploration and development company with two projects in Nevada

- Walker River (WRR) is up by 14.29 per cent trading at $0.12 per share

Walker River (WRR) has intercepted up to 166.37 g/t gold from its Lapon Project in Nevada.

The results stem from late 2021 reverse circulation drilling at the project’s Lapon Canyon.

Results confirm the discovery of a new high-grade gold mineralized zone.

The presence of significant gold mineralization in granite has also motivated the company to assay granites from previous drill hole samples not sent to the lab.

It believes these results justify longer and deeper holes at Lapon Canyon.

The 2022 drill program at Lapon Canyon will consist of geological modelling, as well as exploration for new gold mineralization focused on the new high-grade zone.

Drilling at the project’s Pikes Peak will also begin as soon as possible. Sampling by Walker River returned 9 g/t gold and 2.2 per cent copper from outcrop.

Summary of drill results

Hole | From (m) | To (m) | Length (m) | Assay (g/t gold) | Gold Metal Factor (g/t x m) | Notes |

| LC 21-80 | 10.7 | 59.5 | 48.8 | 7.62 | 372 | |

| incl | 55 | 59.5 | 4.5 | 77.62 | 347 | |

| and | 55 | 56.5 | 1.5 | 166.37 | 249 | |

| and | 58 | 59.5 | 1.5 | 65.00 | 97.5 | |

| LC 21-81 | 10.7 | 71.6 | 60.9 | 5.68 | 346 | |

| incl | 41.2 | 59.5 | 18.3 | 17.76 | 325 | |

| and | 47.3 | 48.8 | 1.5 | 99.78 | 150 | |

| and | 53.4 | 54.9 | 1.5 | 39.98 | 60 | |

| and | 57.9 | 59.4 | 1.5 | 50.98 | 76 | |

| LC 21-82 | 0 | 122 | 122 | 1.84 | 224 | |

| incl | 64 | 111.3 | 47.3 | 4.28 | 202 | |

| and | 85.3 | 122 | 36.7 | 3.46 | 127 | In granite |

| and | 85.3 | 94.5 | 9.2 | 8.61 | 79 | In granite |

| LC 21-76 | 13.7 | 15.2 | 1.5 | 25.57 | 38 |

Walker River is a mineral exploration and development company with two projects in Nevada.

Walker River (WRR) is up by 14.29 per cent trading at $0.12 per share as of 10:53 am EST.