Regular readers of The Market Herald will be familiar with Voyageur Pharmaceuticals (TSXV:VM/OTC:VYYRF).

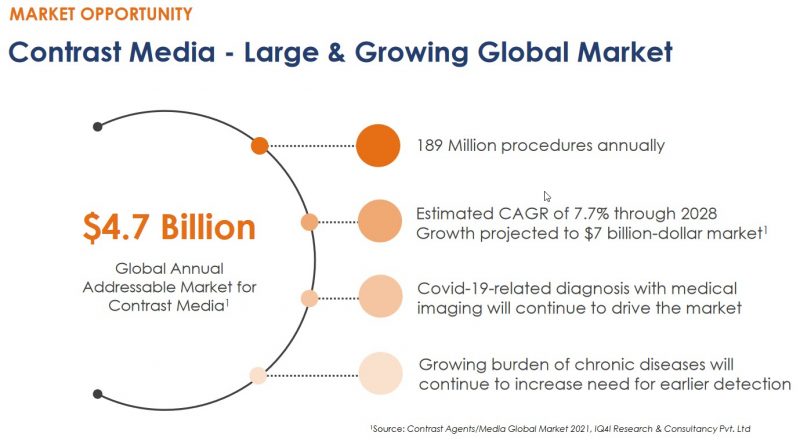

This is the resource/biotech company poised to become a leader in the high-margin, multi-billion-dollar market for radiology drugs.

Biotech company perfectly positioned for the New Economy

Through its fully vertically-integrated business model, the company will have significant cost advantages in producing radiology drugs as it advances plans for its manufacturing facility. However, Voyageur has now come out with further, exciting refinements in this business model.

On October 31, 2022, Voyageur Pharmaceuticals announced “a carbon credit de-carbonization strategy”. This was part of an overall news release where the Company announced that it has integrated a carbon-neutral design into the plans for its manufacturing facility.

Voyageur’s CEO, Brent Willis, framed this news for investors.

“Building the first carbon neutral pharmaceutical facility in Alberta, Canada, will be a major milestone for Voyageur. The added benefit of de-carbonizing our customer base by utilizing our carbon credits will make our product line unique and attractive to ensure potential high growth.”

A first-of-its-kind manufacturing plant, that will utilize the 5,000 tonnes per year of high-grade (pharmaceutical grade) BaSO4 that the company can extract from its 100%-owned Frances Creek Barium Sulfate Project.

The timeline for construction of this plant is estimated at ~18 months from the time that financing is finalized. At present, Voyageur is importing barium API (active pharmaceutical ingredient) as it enters the “contrast media drug” (radiology drug) market.

The previously released PEA for Voyageur’s manufacturing facility estimated capital costs of C$36 million. However, in this new release, Voyageur noted that:

Management has reduced this cost 37% to $22.5M, reduced the timeline, and added iodine, fullerene production and carbon capture = estimated $30M.

Voyageur’s strategy is to create the first fully-integrated and net carbon zero pharmaceutical manufacturing company. The just-announced concept of adding a de-carbonizing sales plan by transferring carbon credits to the customers is a unique business strategy from the Company.

Voyageur is equally excited about the use of fullerene, itself, as a supply input in its manufacturing process for these contrast media agents.

What is fullerene?

To answer that question requires referring to another recent news release from Voyageur. On October 24th, the company announced “the development of fullerene contrast agents for medical imaging applications”.

Here, the science gets quite technical. Fullerene is:

An allotrope of carbon with atoms connected by single and double bonds to form a closed (or partly closed) mesh that can potentially act as a versatile delivery system for a wide range of biomedical applications.

While investors may have some trouble wrapping their heads around the science, CEO Willis explained the strategy of adding fullerene as a manufacturing input.

“Voyageur has been on a multi-year quest to find a high quality, dependable supply of fullerenes for its radiology contrast media drug pipeline. RCC has revolutionised the carbon capture market by creating high-volume low-cost fullerene allotropes, as a biproduct of their carbon dioxide (CO2) capture process. We now have another potential mineral-based contrast, that we can develop to become fully integrated, from the exhaust stream of hydrocarbon engines, into the vial of an injectable drug.”

This release adds further details to Voyageur’s carbon-capture strategy.

RCC, a carbon capture company located in Calgary, Alberta, has proven technology that removes CO2 and other pollutants from hydrocarbon exhaust streams. The CO2 is converted into oxygen and carbon and creates fullerene allotropes and nanotubes that can be applied to a wide variety of products to enhance strength, durability and, in the case of contrast materials, ease of delivery.

Voyageur is adding a superior manufacturing input to create an additional line of radiology drugs. At the same time, this fullerene supply has provided Voyageur with the opportunity to implement its own carbon credit plan with its radiology drug customers.

It’s another example of the deep thinking behind the Voyageur Pharmaceuticals business model.

With Frances Creek, Voyageur has a supply of one of the world’s highest grade BaSO4 (outside of China) – valuable in its own right. Instead, the company has developed a fully vertically-integrated business model, to add maximum value to this precious commodity.

Investors also need to note the improved economics in the Voyageur Pharmaceuticals manufacturing plant. The projected 37% savings on construction costs (down to CAD $22.5 million) further improve the already-robust IRR.

Operating gross margins were already estimated at 75% over the life of the Project.

The Voyageur Pharmaceuticals story keeps getting better.

For more information visit Voyageur Pharmaceuticals.

FULL DISCLOSURE: This is a paid article of The Market Herald.