- Vendetta Mining Corp. (VTT) has closed the second tranche of its non-brokered private placement for gross proceeds of $4,472,000

- Under the second tranche, the company issued 54,206,060 common shares to Singapore J&Y Investment PTE. Ltd.

- Under the first and second tranches of the private placement Vendetta issued a total of 59,660,605 shares for aggregate gross proceeds of $4,772,000

- Singapore J&Y Investment PTE. Ltd. is a Singapore based private investment firm operating in the mining and financial sectors

- Vendetta Mining is a Canadian junior exploration company

- Vendetta Mining Corp. (VTT) opened trading at C$0.05 per share

Vendetta Mining Corp. (VTT) has closed the second tranche of its non-brokered private placement for gross proceeds of $4,472,000.

Under the second tranche, the company issued 54,206,060 common shares priced at $0.0825 per share.

Vendetta utilized $1,806,492 of the proceeds from the second tranche of the private placement to retire the remaining outstanding balance of the loan from Nebari Holdings LLC. The remaining proceeds will be used for general working capital purposes.

No finder’s fees were paid under the second tranche of the offering.

Under the first and second tranches of the private placement, Vendetta issued a total of 59,660,605 shares for aggregate gross proceeds of $4,772,000.

In connection with the private placement, Vendetta and the investor (Singapore J&Y Investment PTE. Ltd.) have entered into an investor rights agreement. The investor has exercised its right to nominate a director to Vendetta’s board.

Singapore J&Y Investment PTE. Ltd. is a Singapore-based private investment firm operating in the mining and financial sectors.

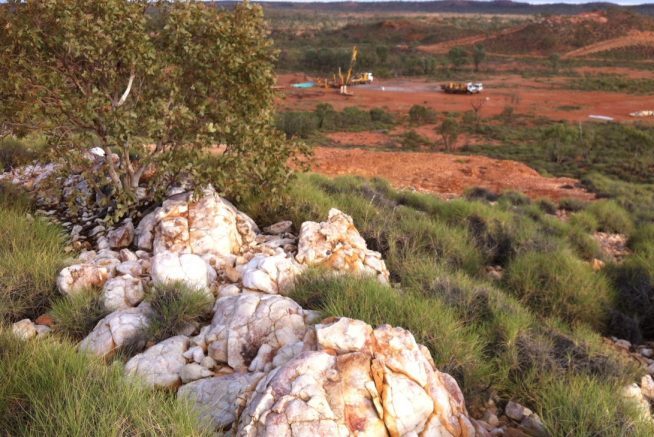

Vendetta Mining is a Canadian junior exploration company engaged in acquiring, exploring, and developing mineral properties, emphasizing lead and zinc. It is currently focused on advancing the Pegmont Lead-Zinc project in Australia.

Vendetta Mining Corp. (VTT) opened trading at C$0.05 per share.