Written by: Jessica N. Abraham

The rapidly emerging battery metals market just gained a major driver that will last for decades.

That driver is the US Inflation Reduction Act (IRA), which was passed on August 7th, 2022.

The bill will funnel hundreds of billions of dollars into clean energy while accelerating America’s transition away from fossil fuels. including making electric vehicles (EVs) more affordable.

That’s very good news for investors already in, or considering entering, the battery metals market.

Especially since the biggest driver behind the battery metals market is the rapidly growing adoption of EVs.

In 2020, global EV sales grew by 38%.

In 2021, they more than doubled.

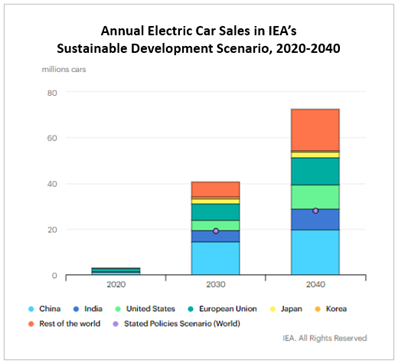

Looking forward, EVs and battery storage are set to continue accelerating rapidly over the coming decades, according to top research analysis, such as from the International Energy Agency (IEA).

The IEA forecasts EV sales in 2040 could be 7x the number of all the EVs currently on the road today.

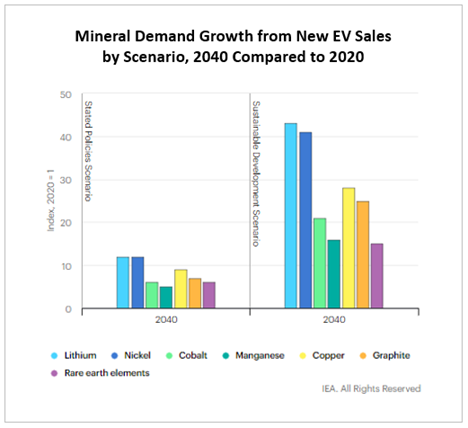

More EVs sold means more overall mineral demand. A lot more.

In particular, the IEA’s Sustainable Development Scenario projects that demand for cobalt will increase by 21x between 2020 and 2040.

Cobalt demand is already growing.

In 2021, there was an unprecedented 22% growth in demand for cobalt.

Last year was also the first time that the EV sector represented the largest demand for cobalt, totalling 34% of global demand.

By 2026, EVs are expected to represent 50% of global cobalt demand, according to The Cobalt Institute.

“Securing access to raw materials is crucial if the world is to achieve a sustainable and just transition to a greener future. Cobalt’s role in batteries and recycling makes it one of the critical materials of a climate-neutral future”.

– David Brocas, Head Cobalt Trader at Glencore

and Chairman of the Cobalt Institute’s Executive Committee

Today, about 74% of the world’s EVs run on batteries containing cobalt, mainly due to the mineral’s ability to provide superior energy density, performance and safety.

And now the US Inflation Reduction Act (IRA) is set to further feed all these global growth trends for EVs, battery metals, and specifically cobalt.

Even more specifically, the IRA is expected to supercharge multiple cobalt-related sectors in Canada, from EV manufacturing to battery manufacturing, cobalt refining, and cobalt exploration and production.

Here’s how.

EV Manufacturing & Battery Metals Supply

The IRA bill includes big incentives for consumers to buy EVs, including a $4,000 tax credit when buying used EVs and $7,500 for new EVs…but only if the EVs are made in North America.

That’s fortunate for Canada.

“The emphasis on North American produced vehicles underscores the integrated nature of the automotive industry.”

– Brian Kingston, head of the Canadian Vehicle Manufacturers’ Association

Before an EV can qualify, a portion of the critical materials in its battery must be extracted or processed in a country that has a free trade agreement with the US, such as Canada.

There are 2 goals behind this free-trade-related requirement:

- Accelerate building out domestic and/or friendly supply of critical minerals (such as cobalt)

- Break China’s stranglehold on the supply of those critical minerals

That’s right. Under the IRA, tax credits wouldn’t be available for EVs that source battery materials mined internationally from places like the Democratic Republic of Congo (over 60% of the world’s cobalt is mined there) or refined in places like China.

That’s a big blow for China since the country currently processes between 50 to 100% of the world’s lithium, nickel, cobalt, manganese and graphite, all of which are used in EV batteries.

And it couldn’t have come at a worse time, what with China’s battery metals sector coming under scrutiny for ties to potentially coercive labour practices, as recently reported by the New York Times.

But what’s bad news for China is great news for Canada since the IRA bill requires 40% of an EV’s battery metals to be produced in North America (or to come from US trade partners).

That requirement jumps up to 80% by 2027.

“Requiring EV batteries to contain materials from ‘free trade’ partners means more investment certainty for Canadian mineral and battery projects.”

– Matthew Fortier, CEO of the Accelerate alliance, made up of a range of automotive, mining

and battery firms dedicated to building Canada’s EV supply chain

Canada is already seeing benefits from this IRA-related battery metals requirement, as reported by Mining.com on August 22, 2022.

That story told how Volkswagen AG (EUR: VOW3) and Mercedes-Benz Group AG (EUR: MGB) have signed agreements with Canada to lock up access to battery-related raw materials, including nickel, lithium and cobalt.

Investors can expect to hear about more agreements of this sort, which will not only shorten supply chains for any North American-based EV manufacturing but will also help auto manufacturers meet the IRA bill requirements. (More about Canadian cobalt supply in a moment.)

EV Batteries Manufacturing

The IRA bill is also bad news for China – and welcome news for companies operating in Canada – when it comes to which EV batteries will qualify for tax incentives.

China manufactures about 80% of the cells that power lithium-ion batteries (the type of battery that powers nearly all EVs today). But as we’ve already seen, China would be locked out as a sector supplier under the IRA bill.

That means Canada could receive a tremendous shot in the arm for its ongoing efforts to establish and grow a world-class EV battery manufacturing sector, which would require cobalt and other battery metals.

A recent example of those efforts is the July 2022 announcement that Canada’s Federal government and the government of Ontario had signed a deal with global metals refiner Umicore SA (EUR: UMI),

Umicore’s plans include investing $1.5 billion to build the cathode manufacturing plant, which would be carbon-neutral, cover about 350 acres, employ 1,000 people, and produce components essential to EV batteries.

Construction is slated to begin in 2023, with operations expected to start by the end of 2025.[13]

Meanwhile, Tesla Inc.’s (NASDAQ: TLSA) CEO Elon Musk recently hinted at an annual shareholder’s meeting that the company’s next battery manufacturing Gigafactory could be located in Canada.

While Musk’s hint came a couple of days before the IRA bill was passed, it now makes even more sense for Tesla to consider Canada as an ideal site for manufacturing batteries that will qualify for the bill’s tax incentives.

Cobalt Refining

As we already saw, the IRA bill requires a portion of the critical materials in EV batteries to be extracted or processed in a country that has a free trade agreement with the US.

That’s more good news for Canada since the province of Ontario is home to North America’s only battery-grade cobalt refinery, which Electra Battery Materials Corporation owns (formerly First Cobalt Corp.) (TSX: ELBM) (NASDAQ: ELBM).

Even before the IRA bill, Electra’s cobalt refinery had significant support.

It recently received investments of $5 million CAD from Canada’s Federal government, $5 million CAD from Ontario’s provincial government, and a loan commitment of $45 million CAD from mining and commodity trading giant Glencore (LSE: GLEN) to refurbish and reopen the refinery.

The cobalt refinery will be able to supply materials for 1.5 million EVs annually once it restarts, which will be even more significant in light of the new IRA bill requirements for EV batteries.

“The goal is to leverage Electra’s existing footprint in order to bridge North America’s mineral wealth with a growing domestic EV production base, completing the onshoring of the entire electric vehicle value chain and reducing vulnerabilities on foreign supply.”

– Trent Mell, CEO of Electra

But Electra isn’t stopping with just one cobalt refinery in Canada.

They’re already in discussions with Quebec to build a new cobalt refinery in that Canadian province on the strength of significant interest from the auto industry and government stakeholders for a second refinery in North America.

Investors should only expect that interest to keep growing.

Cobalt Exploration & Production

Canada is already the world’s fifth-largest producer of cobalt.

Now, with the added requirements of the IRA bill, the pressure and incentives are higher than ever to find and produce cobalt in Canada.

Of particular interest is the region around the town of Cobalt, Ontario.

Between 1905 and 1961, the region’s Agaunico Mine produced over 4.3 million pounds of cobalt (Cunningham-Dunlop, 1979), which is greater than that of any other mine in the Cobalt Mining Camp.

By 1961, production stopped when cobalt prices dropped due to global oversupply (Thomson, 1964).

The region’s established mining industry means the infrastructure needed to explore for and produce cobalt is already in place, including access to abundant water, affordable power and an experienced labour force.

Today, several mineral exploration companies have cobalt mineral claims in the area, including TSX Venture Exchange Tier 2 battery metal exploration company Fuse Cobalt Inc. (TSX.V: FUSE) (OTCQB: FUSEF) (FRA: 43W3).

Glencore previously owned 2 cobalt properties in the Cobalt, Ontario region before the battery metals sector started heating up.

Today, those 2 cobalt mining exploration properties are 100% owned by Fuse Cobalt.

The properties have the advantage of being less than half a mile from Electra’s cobalt refinery, as seen in the map below:

Since any cobalt produced from these properties would qualify under the IRA bill’s requirements, Fuse Cobalt now has a new factor that can play into the market’s valuation of those exploration assets, especially since the company’s previous exploration efforts on the properties returned significant cobalt values.

For players in the battery metals space, access to cobalt production from a domestic, IRA-friendly mining jurisdiction such as Ontario represents multiple advantages, from avoiding regions of geopolitical conflict to greater convenience and lower operating expenses.

No surprise then that Glencore arranged for the option to enter an off-take agreement where Fuse Cobalt would sell all ores and/or concentrates it produced from its 2 properties and for the option to buy 51% of Fuse Cobalt upon the discovery of $100 million or more in underground mineral value.

Electra, meanwhile, recently signed a Memorandum of Agreement (MOU) with Fuse Cobalt regarding a potential definitive cobalt raw material supply agreement.

“Having a domestic source of cobalt raw material produced ethically and with low-carbon emissions will help us to better address the demand for onshore EV battery materials. We look forward to working with Fuse Cobalt as they advance development of their projects and begin production.”

– Electra’s CEO, Trent Mell

The next steps for Fuse Cobalt include their 2022 exploration program scheduled to start in September. The program will expand the company’s understanding of the mineral potential of their 2 properties.

Guiding the company is a leadership team with proven backgrounds in raising capital and world-class business building, like Chairman Greg Reimer, who was the former Executive VP of BC Hydro’s Transmission & Distribution business group.

Fuse Cobalt also benefits from an experienced advisory team. Recent additions include cobalt exploration expert Matthew Halliday, P. Geo, with over 15 years of experience in mineral exploration and development, and cobalt exploration and mineral extraction expert Frank J. Basa, P. Eng, with 37+ years of experience, including decades of cobalt mineral exploration experience in the immediate area.

Summary

The US Inflation Reduction Act (IRA) is set to drive the growth of EV sales, battery metals prominence, and, specifically, cobalt demand.

In particular, the IRA could be an unprecedented driver in Canada behind EV manufacturing, battery manufacturing, cobalt refining, and cobalt exploration and production.

Investors interested in the potential of the battery metals market can consider taking a closer look at Fuse Cobalt, with its 2 strategically located cobalt properties and its latest exploration program about to start creating news flow for the company.

To keep up to date with Fuse Cobalt’s latest news alerts, visit www.fusecobalt.com (TSX.V: FUSE) (OTCQB: FUSEF) (FRA: 43W3) or speak to your financial advisor.

Prepared by Jessica N. Abraham on behalf of Fuse Cobalt Inc., a Stockhouse Publishing client.