- Ur-Energy (TSX:URE) has secured C$1.25 million in CARES act funding

- The two subsidiaries are Lost Creek ISR and UR Energy USA

- Loans can be forgiven if they are spent on payroll payments

- Ur-Energy has said the loans will allow the company to retain its staff

- Ur-Energy (URE) is down 2 per cent at $0.72 per share with a market cap of $115 million

Two of Ur-Energy’s (TSX:URE) subsidiaries have secured US Small Business Administration Paycheck Protection Program loans totalling C$1.25 million.

The Colorado based company has secured the loans through its subsidiaries Lost Creek ISR and UR Energy USA Inc.

The loans are part of the US coronavirus aid package, and are fully funded through the coronavirus aid, relief and economic security (CARES) act.

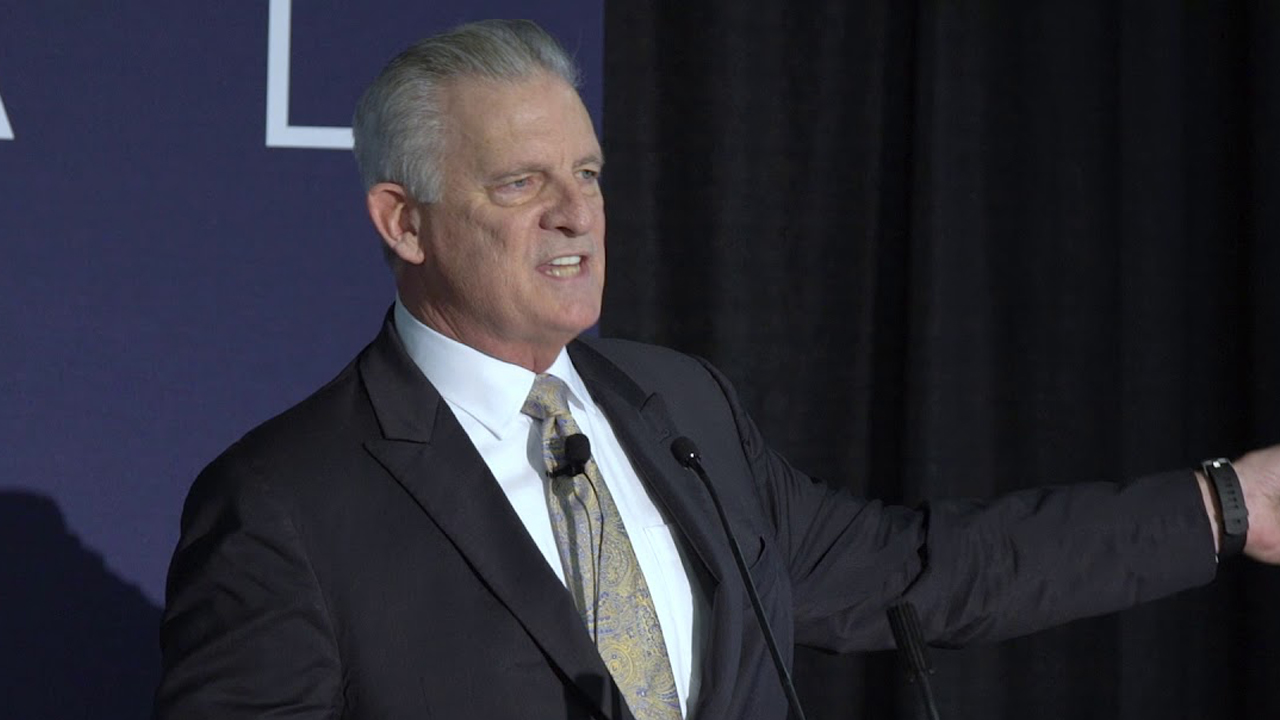

CEO of Ur-Energy, Jeff Klenda, said the company was grateful to receive the stimulation loans, but understood the significance of COVID-19’s impact was far greater than merely financial impacts.

“Our hearts go out to the thousands of families who have suffered such tremendous losses during these most unprecedented times…we must all stay the course set before us, help those in need and, together, I am confident that we will persevere.

“As intended by the CARES Act, this additional funding will provide a longer ‘runway’ to maintain current operations and avoid unnecessary dilution in the depressed uranium market; it also provides continued operational readiness when we are able to ramp-up production,” he said.

The company has stated that the process was worked through relatively quickly, and the results were outstanding.

Ur-Energy has stated the loans will benefit the company over the next 8 weeks, with proceeds primarily being used to secure the ongoing employment of the company’s workforce.

As part of the loans, if the company can prove it has spent 75 per cent of the money on staffing, it can seek significant forgiveness of the loans. This is precisely what the company intends to do.

In order to get the last 25 per cent of the loans forgiven, the company can spend the remainder on staffing, payments on mortgage obligations, or on commercial rent payments for commercial leases.

Ur-Energy (URE) is down 2 per cent at $0.72 per share at 11:23am EST.