The latest survey from the Bank of Canada on the financial sector found concern lingers among investors, but there is still confidence around companies.

While respondents’ belief that the likelihood of a shock that could impair the financial system had decreased since the last survey, many raised concerns about these associated risks:

- Geopolitical tensions

- High inflation

- Unemployment

- Household debt burdens

It is in this market where Olympia Financial Group (TSX:OLY) has found repeat success.

The Calgary-based financial services company announced its operating and financial results for the period ended March 31, 2023.

Highlights:

- Total revenue increased 58 per cent $23.62 million from $14.92 million, mainly due to an increase in trust income in the Investment Account Services division.

- Service revenue decreased 4 per cent to $11.84 million from $12.29 million, mainly due to the decreased annual fee for the 2023 year in the Investment Account Services division.

- Interest revenue and trust income rose more than 100 per cent to $11.78 million from $2.63 million, due to higher interest rates on trust fund placements made over the previous 12 months, as well as increased funds held in trust.

- Direct and administrative expenses (excluding depreciation and amortization) increased by 42 per cent to $16.10 million from $11.34 million, mainly due to increased salaries, bonuses, and management fees.

- Total net earnings and comprehensive income increased more than 100 per cent to $5.23 million from $2.28 million.

- Basic and diluted earnings per share attributable to shareholders of Olympia increased more than 100 per cent to $2.17 per share from $0.95 per share.

Craig Skauge, Executive Vice President of Olympia Financial Group, said that both revenue and earnings continued to grow considerably in Q1 2023.

“The combined value of the strategic acquisitions made by Olympia in 2021 and the impact of increases in interest rates over the past year continue to be shown in the numbers announced today.”

This comes as the company’s Board of Directors declared a monthly cash dividend on its common shares of $0.45 per common share earlier this month. The dividend will be payable to shareholders on May 31, 2023.

Olympia Trust Company administers self-directed registered accounts and provides foreign currency exchange and corporate and shareholder services.

While the financial sector has left many investors nervous with what has happened with U.S.-based regional banks, companies such as Olympia Financial Group have proven that quarter-after-quarter its business has only improved. Before this stock climbs any higher, investors would be wise to deepen their due diligence into what OLY has to offer.

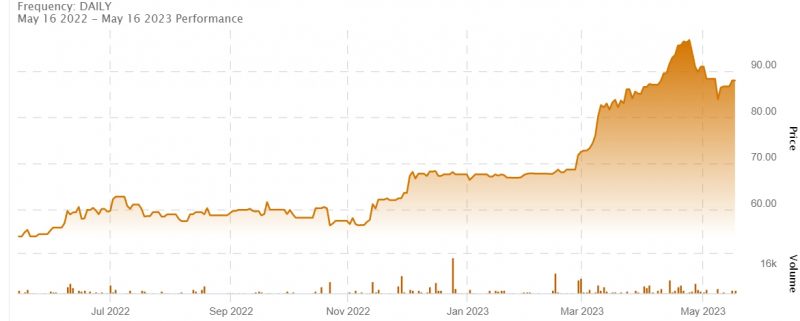

Olympia Financial Group (OLY) opened the day trading at C$88.25 and in a year, its stock has risen 64 per cent, 27.5 per cent of that growth came since the beginning of the year.

To keep up with the latest updates from the company, visit olympiafinancial.com.

This is sponsored content issued on behalf of Olympia Financial Group Inc., please see full disclaimer here.