- UGE International’s (UGE) common shares are now eligible for clearing and settlement through the Depository Trust Company

- The DTC is a subsidiary of the Depository Trust & Clearing Corporation, which manages the clearing and settlement of publicly traded companies

- DTC eligibility will enhance liquidity of the company’s common shares in the United States

- UGE develops, owns and operates commercial and community solar projects in the U.S. and strategic markets abroad

- UGE International (UGE) is up by 1.73 per cent and is currently trading at C$1.76 per share

UGE International’s (UGE) common shares are now eligible for clearing and settlement through the Depository Trust Company.

The DTC is a subsidiary of the Depository Trust & Clearing Corporation, a U.S. company that manages the electronic clearing and settlement of publicly traded companies.

DTC eligibility will enhance liquidity of the company’s common shares in the United States.

Nick Blitterswyk, UGE’s CEO, commented,

“By becoming DTC eligible, UGE International’s common shares can be transferred electronically between U.S. brokerage firms. This is important for American investors, since the DTC system allows participating brokerage firms to electronically settle trades with other member firms. This translates into ease of trading our company’s shares, lower trading costs and the potential for increased liquidity.”

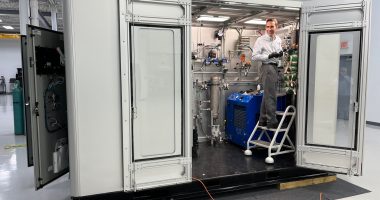

UGE develops, owns and operates commercial and community solar projects in the U.S. and strategic markets abroad.

UGE International (UGE) is up by 1.73 per cent and is currently trading at C$1.76 per share as of 12:22 pm ET.