- Trillion Energy (TCF) is reporting a significant increase to its SASB gas reserves in Turkey

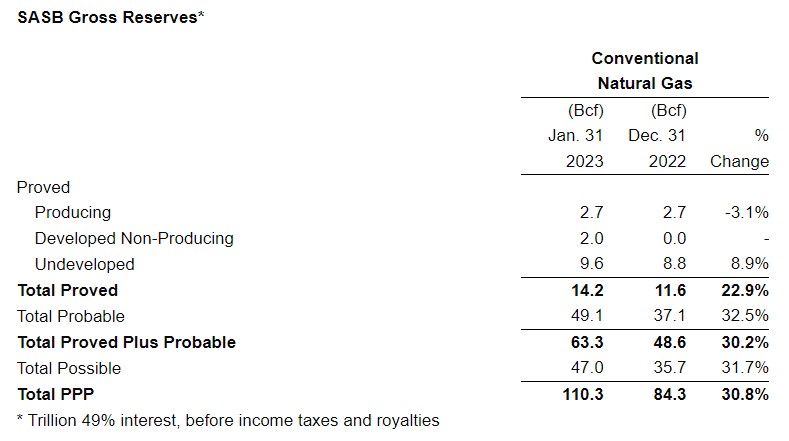

- Proved and probable conventional natural gas reserves increased to 63.3 BCF, up from 48.6 BCF (year-end 2022), an increase of 30 per cent

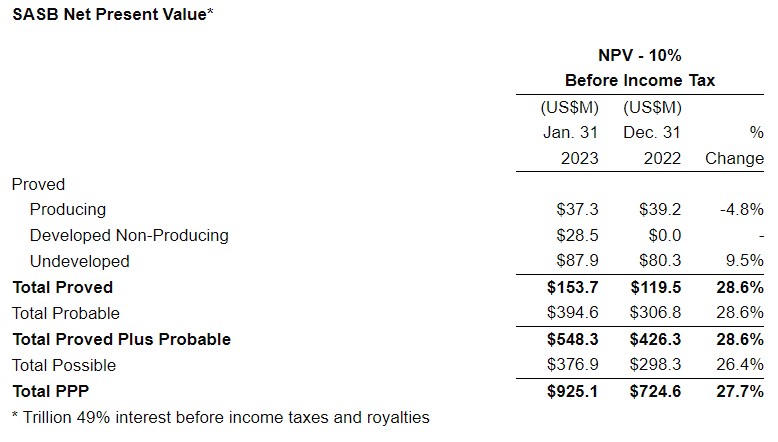

- Net present value of proved and probable natural gas reserves (NPV10%) increased to US$548 million net to Trillion, up from US$426 million (yearn-end 2022), a 29 per cent increase

- The company will also undertake a C$15 million private placement of convertible debentures led by Eight Capital to further develop its Turkish assets

- Colin Robson, VP Corporate Development, spoke with Brieanna McCutcheon about the news

- Trillion Energy International is focused on natural gas production with assets in Turkey and Bulgaria

- Trillion Energy International (TCF) opened with a gain of 2.5 per cent trading at $0.41 per share

Trillion Energy (TCF) is reporting a significant increase to its SASB gas reserves in Turkey.

The company’s January 31, 2023 reserve report update by GLJ, Ltd. is strengthened by additional discoveries made after year-end, as follows:

Convertible debenture bought-deal private placement

Trillion signed an agreement with Eight Capital, who will purchase for resale, together with a syndicate of underwriters, 15,000 Trillion Energy units priced at C$1,000 each for gross proceeds of C$15 million.

Trillion will use the funds for working capital, general corporate purposes, and capital expenditures related to the development of its assets in Turkey.

Each unit consists of a C$1,000 principal amount secured convertible debenture and 1,667 common share purchase warrants.

Each warrant is exercisable for one common share priced at C$0.50 and expiring on June 29, 2025.

The debentures will mature on April 30, 2025, and will accrue interest at 12 per cent per annum.

Conversion into common shares may occur up to the earlier of the maturity date and the date fixed for debenture redemption, at a price of C$0.60 per common share.

Trillion is entitled to redeem the debentures at 105 per cent of par plus accrued and unpaid interest at any time following April 30, 2024.

The debentures include a negative pledge, such that Trillion will not be able to incur new debt in excess of 40 per cent of the after-tax value of PDP reserves, discounted at 10 per cent.

All securities issued are subject to a four month hold period in Canada commencing on the date of closing.

The placement is expected to close on or about April 20, 2023.

Colin Robson, VP Corporate Development, spoke with Brieanna McCutcheon about the news.

Trillion Energy International is focused on natural gas production with assets in Turkey and Bulgaria.

Trillion Energy International (TCF) opened with a gain of 2.5 per cent trading at $0.41 per share.

This is sponsored content, please see full disclaimer here.