- Transcontinental (TCL.A) has reported a steady performance for the quarter ending July 26, 2020, despite prevailing market uncertainty

- Total revenue for the period fell 19.4 per cent, from C$728.9 million in the third quarter of 2019 to $587.4 million this year

- However, operating earning saw a bump of 33 per cent to $75.3 million from $56.6 million last year

- While the impact of the COVID-19 pandemic remains uncertain, the company anticipates strong continued cash flow from all its operations

- Transcontinental (TCL.A) is currently up 3.59 per cent and is trading at $15.28 per share

Transcontinental (TCL.A) has reported a steady performance for the quarter ending July 26, 2020, despite prevailing market uncertainty.

The Montreal-based company posted a 19.4 per cent drop in revenue for the period, from C$728.9 million in the third quarter of 2019 to $587.4 million this year. This was largely due to lower volumes in the company’s printing sector, which was dealt a significant blow by the COVID-19 pandemic.

Transcontinental’s disposal of its paper packaging operations, which occurred at the end of the first quarter, along with the sale of its specialty media assets and event planning activities in 2019, also contributed to the decrease.

However, the company’s operating earning saw a bump of 33 per cent year-over-year, from $56.6 million to $75.3 million.

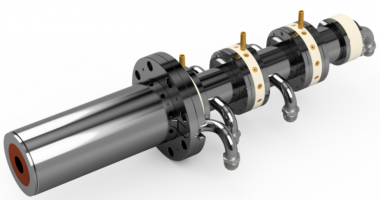

Transcontinental attributed this to higher volumes and operational efficiencies in its packaging sector, along with the impact of cost reduction measures and the Canada Emergency Wage Subsidy, which relate primarily to the printing sector.

François Olivier, President and CEO of Transcontinental, said the solid results reflect the company’s transition to flexible packaging.

“I am very satisfied with our excellent performance for the quarter, which once again highlights our resilience, our agility and our operational efficiency.

“Although the economic climate continues to be uncertain, we remain confident in our ability to generate significant cash flows and are strongly positioned to take advantage of future business opportunities and pursue our transformation,” he added.

Today’s financials also noted the potential impact of a recent spike in the price of resin on Transcontinental’s packaging sector, which is expected to have a negative influence on the company’s performance during the fourth quarter of the year.

That said, over the long-term this is expected to be offset by the previously implemented operational efficiencies.

Transcontinental (TCL.A) is currently up 3.59 per cent to $15.28 per share at 3:53pm EDT.