- TNR Gold Corp. (TNR) is arranging a non-brokered private placement of up to 5 million units at $0.05 per unit to raise up to $250,000

- The proceeds of the private placement will be used for exploration, maintenance of the Shotgun Gold Project and for general working capital purposes

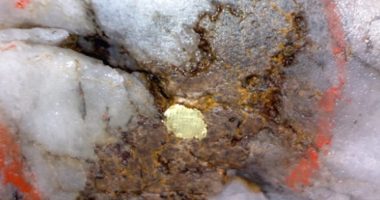

- TNR provides significant exposure to gold through its 90 per cent holding in the Shotgun Gold Project in Alaska

- The issuance of private placement securities to non-arms’ length parties constitutes related-party transactions under Multilateral Instrument 61-101

- Because TNR’s shares trade only on the TSXV, the issuance of securities is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101

- TNR Gold Corp. (TNR) is unchanged trading at $0.05 per share as of 2:40 p.m. EST

TNR Gold Corp. (TNR) is arranging a non-brokered private placement to raise up to $250,000.

The company will issue up to 5 million units priced at $0.05 per unit.

Each unit will consist of one common share of TNR and one-half of a non-transferable common share purchase warrant.

Each whole warrant will be exercisable into one common share in the capital of TNR at an exercise price of $0.075 per share for two years from the date of issue.

The proceeds of the private placement will be used for exploration, maintenance of the Shotgun Gold Project and for general working capital purposes.

TNR provides significant exposure to gold through its 90 per cent holding in the Shotgun Gold porphyry project in Alaska.

The project is in southwestern Alaska near the Donlin Gold project.

All private placement securities will be restricted from trading for a period of four months plus one day from the date of closing.

Kirill Klip, Executive Chairman of TNR and a non-arm’s length party, will participate in this private placement.

The issuance of private placement securities to non-arm’s length parties constitutes related-party transactions under Multilateral Instrument 61-101.

Because TNR’s shares trade only on the TSXV, the issuance of securities is exempt from the formal valuation requirements of Section 5.4 of MI 61-101 and exempt from the minority approval requirements of Section 5.6 of MI 61-101.

TNR Gold Corp. (TNR) is unchanged trading at $0.05 per share as of 2:40 p.m. EST.