With commodities plunging and interest rates likely remaining higher for longer, global stocks are suggesting a pessimistic outlook.

Oil is down over 30 per cent YoY and has fallen for most of the week, dipping below the US$70 per barrel mark on concerns of near-term supply outweighing demand.

Lithium and copper, both key EV inputs, have lost roughly 60 per cent and 10 per cent YoY, respectively, with steel, iron ore and lumber, all key infrastructure inputs, down 31, 27 and 64 per cent, reflecting widespread expectations of a monetary policy-induced recession toward the end of this year and into the next.

Should inflation fail to approach the Bank of Canada’s target of 2 per cent, the institution has stated that its benchmark interest rate would remain elevated, upping the chances of a pronounced economic contraction.

Sensitive to these threats to production, the TSX is down 0.5 per cent over the past year, while Emerging Markets (EM) are down by 1 per cent and the U.S. has gained only 2.7 per cent.

The only source of light for global stocks is Developed International, which has added over 11 per cent YoY, likely due to the region’s relative undervaluation at a price-to-earnings ratio (PE) of 14 versus the U.S.’s 20, and its reliable rule of law compared to EM, despite its lower PE of 11.

What this global trend is signaling is the high likelihood of reduced business activity and an ensuing decrease in consumer spending, meaning it’s reasonable to expect investors to ditch FOMO for healthy skepticism and apply more stringent thresholds to new portfolio holdings over the next year or two.

These thresholds, depending on the company, your financial goals, and your appetite for risk, may consist of:

- Irreplicable distribution networks that enable pricing flexibility

- A fortress balance sheet for easier borrowing and higher cost absorption

- High-profile clientele to maintain positive growth momentum during down markets

- A well-defined sense of undeniable upside potential may also be sufficient, combined with thoroughly researched ironclad conviction to withstand share-price volatility, supposing earnings are still far out into the future

With this thesis in mind, here are stories from three applicable companies that had TMH readers buzzing this week and merit further consideration. The first is a Canadian logistics powerhouse, the second is fast becoming a leader in allergen-free, plant-based nutrition, while the third offers exposure to a gold resource poised to capitalize on the metal’s recent all-time-highs over US$2,000 per ounce during 2023 exploration:

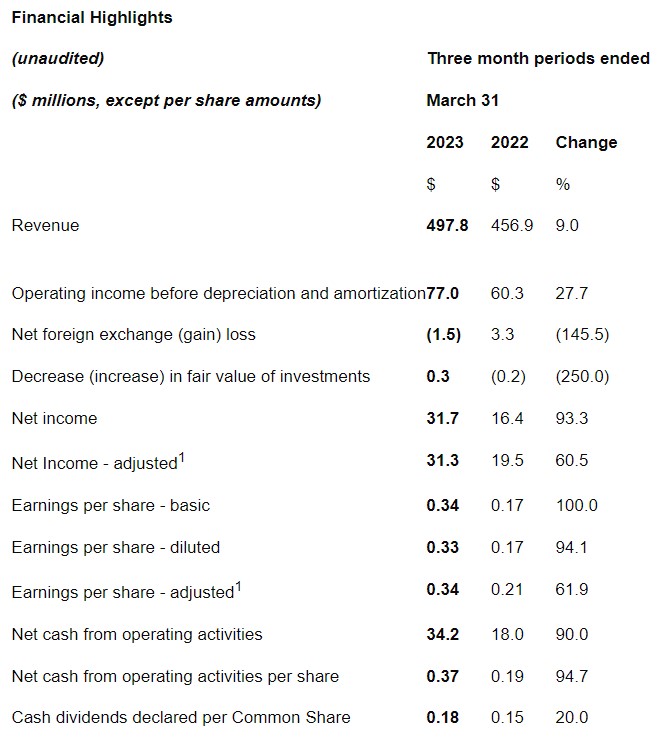

Mullen Group (TSX:MTL) reports 2023 Q1 results including record Q1 revenue

The quarter featured improvements in nearly all financial metrics the company measures.

Senior Accounting Officer Carson Urlacher spoke with Shoran Devi about the news.

Mullen Group is one of Canada’s largest logistics providers. It operates in over 5,000 communities throughout Canada and in every state in the continental U.S.

Mullen Group (MTL) returns exceed 20 per cent over the past year.

Else Nutrition’s (TSX:BABY) impressive rollout continues

Else Nutrition (BABY) is now on shelves at over 7,000 CVS Pharmacy locations.

Products under the expansion include the best-selling Else Baby Super Cereal and Else Toddler Organic SKUs.

The company views its partnership with CVS, the largest pharmacy chain in the U.S., as evidence of the growing demand for healthy and minimally processed plant-based products.

CEO Hamutal Yitzhak spoke with Shoran Devi about the news.

The milestone preceded the announcement of Else’s expansion into over 600 Sobeys and related banner stores across Canada. The company also boasts a presence in Walmart and best-seller status in its category on Amazon as it pursues further global growth.

Else Nutrition develops clean and plant-based food and nutrition products for infants, toddlers, children, and adults.

Else Nutrition (BABY) has shed almost 35 per cent over the past year, but is up over 41 per cent year to date.

Magnum Goldcorp (TSXV:MGI) details upcoming financing

The company will undertake a flow-through private placement for up to $400,000 and a non-flow-through private placement for up to $300,000.

It intends to allocate the proceeds toward further exploration on its LH Property, as well as general working capital purposes.

Under its 2-year area-based work permit for the property, Magnum intends to drill an additional 6 diamond drill holes (1,125 m) in late June or early July toward an initial resource estimate. It anticipates that drilling will return additional moderate-to-high-grade gold-bearing mineralization.

The company sees a strong positive correlation between pyrrhotite abundance and strongly elevated to highly anomalous gold values.

Intercepts of semi-massive to massive pyrrhotite and/or arsenopyrite mineralization visually identified in drill core are expected to return strongly elevated to highly anomalous gold values on subsequent analysis.

CEO Doug Mason spoke with Shoran Devi about the news.

Magnum Goldcorp is engaged in the acquisition and exploration of mineral resource properties.

Magnum Goldcorp (MGI) has lost over 41 per cent over the past year, but is sitting on 75 per cent gains year to date.

This is sponsored content issued on behalf of Mullen Group, Else Nutrition and Magnum Goldcorp, please see full disclaimer here.