- The U.S. Federal Reserve raised its key interest rate by 25 points to the range of 4.75-5 per cent following its March policy meeting

- The decision makes it the central bank’s ninth consecutive rate hike to fight inflation

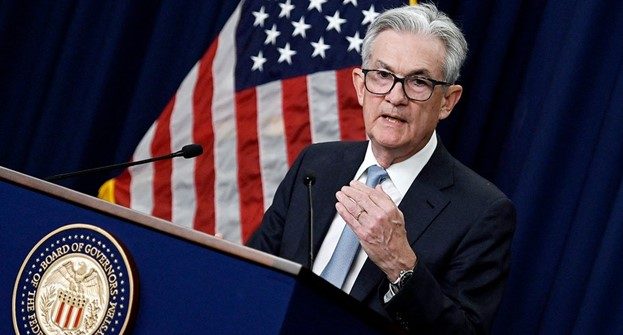

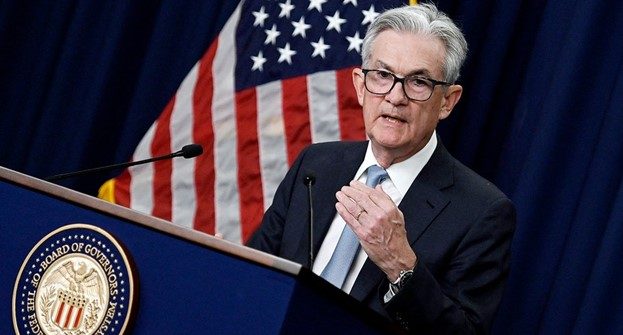

- Fed Chair Jerome Powell called the banking system “sound and resilient”

- Federal Reserve officials also forecast slower economic growth, lower unemployment, and higher inflation in 2023

The U.S. Federal Reserve raised its key interest rate by 25 points to the range of 4.75-5 per cent following its March policy meeting.

The decision makes it the central bank’s ninth consecutive rate hike to fight inflation and came inline with market forecast. However, the central bank signaled that it will likely pause any further increases in the borrowing costs.

Fed Chair Jerome Powell called the banking system “sound and resilient”. He reassured investors that Silicon Valley Bank’s collapse did not indicate wider weaknesses in the banking system.

The Federal Reserve’s Monetary Policy Statement showed that that Fed Committee remains highly attentive to inflation risks. The committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.

FOMC Economic Projections

Federal Reserve officials forecast slower economic growth, lower unemployment, and higher inflation in 2023. That is according to median forecasts published by the Federal Open Market Committee’s summary of economic projections, also known as the dot-plot.

The projections show that Fed officials expect the economy to grow just 0.4 per cent this year, 1.2 per cent in 2024 and 1.9 per cent in 2025. Forecast show core inflation to peak at 3.6 per cent this year before cooling to 2.6 per cent next year and 2.1 per cent in 2025. It indicates unemployment rising to 4.5 per cent this year, 4.6 per cent next year and remain at that level through 2025.