For 13 years, excessively low-interest rates fueled an unprecedented boom – and bubble – in the residential real estate markets of major urban centers. Canada’s housing boom started even earlier.

Now the party has come to an end. Recent, grim headlines paint a dire picture.

- Canada housing crash: Fast-rising borrowing costs predicted to deepen slump

- Real estate: Canada’s housing crisis is just beginning, economist says

The timing of this crash in residential real estate could not be worse. Equity markets have collapsed. So have bond markets. Rising interest rates threaten to plunge economies into a deep recession.

In times of such financial stress and uncertainty, investors typically look to real estate and/or gold for security. But even gold is well off of its previous highs.

Can savvy investors still find shelter in real estate? Yes. Introducing CIBT Education Group Inc. (TSXV:MBA / OTC:MBAIF).

For many readers of The Market Herald, this is already a familiar name. We most recently covered this company in a full-length feature article.

CIBT Education offers small-cap GROWTH and STABILITY

We highlighted how, as an investment, CIBT has outperformed most other small caps over both longer and shorter terms. We also connected the dots and how/why the company looks very likely to continue to be a strong performer going forward.

The Market Herald had the opportunity to speak with CIBT’s President, CEO and Chairman, Toby Chu. Among the insights he offered in that previous conversation:

When CEO Toby Chu was talking about his recent interactions with investors (in investor road shows and industry events), he remarked to The Market Herald how he was seeing an increasing interest from institutional investors.

Why is Smart Money sniffing around CIBT Education Group with increasing interest?

The company has generated consistent, long-term growth in its operations. Its future growth prospects are very strong – and look like money in the bank.

However, is CIBT’s biggest attraction to Smart Money due to what’s going on externally? More on that later.

CIBT’s unique, recession-proof real estate niche

Most (all?) other real estate sub-sectors are under enormous strain from soaring interest rates. CIBT is forecasting continued robust growth.

What separates this company from other real estate investments? CIBT Education Group occupies a unique real estate niche. It’s all about “education.”

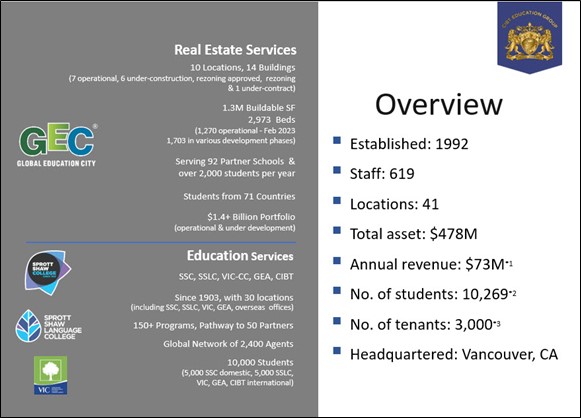

CIBT’s market is student housing. This is an education services company, operator of Sprott Shaw College, Sprott Shaw Language College, and Vancouver International College Career Campus. CIBT subsidiaries provide educational programs in healthcare, eCommerce, trades, technology & language to nearly 10,000 domestic and international students annually. This is complemented by rental housing and a full array of related student housing services.

A fully integrated business model. Deep experience in education.

CIBT’s student housing specialty is a nearly recession-proof business. Education is one of the last expenditures to be reduced in any economic downturn.

Even better (for CIBT investors) are the demographics of CIBT’s student housing population. Roughly 75% of these students are international students.

International students generally have more-affluent parents. Parents are even less likely to make cuts in education spending on their children, especially when they are studying abroad – no matter how serious economic conditions get.

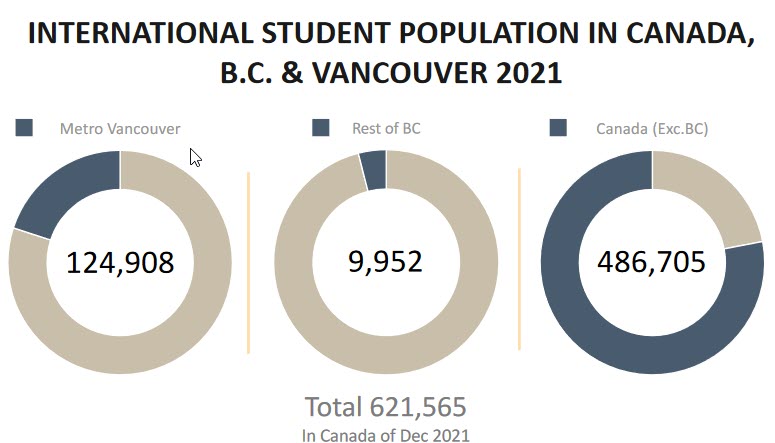

CIBT’s market focus is the Canadian student housing market, in general, and the Metro Vancouver market, in particular.

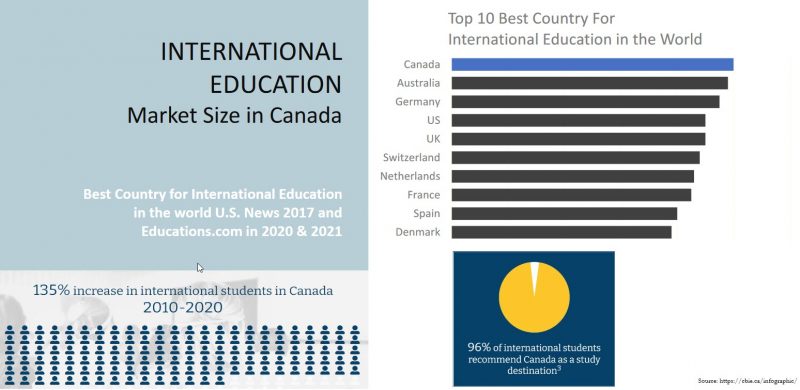

Canada has become the preferred destination for international students. And Metro Vancouver hosts a disproportionately large share of Canada’s international student population based on province size.

Vancouver student housing alone is a very robust CAD$1.6 billion market. CIBT Education is the largest provider of off-campus housing in this market.

Why CIBT offers the best investment shelter in “shelter”

Student housing is generally a bellwether market. Housing international students are especially recession-proof. And the Canadian student housing market is the strongest of all.

CIBT’s market positioning could not be better. The company’s financial strength is reflected in its corporate results.

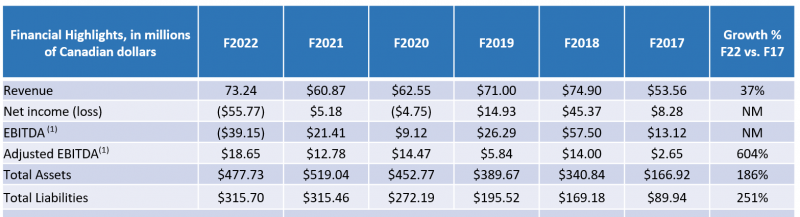

1 EBITDA and Adjusted EBITDA are non-IFRS Financial Measures as further described at the end of this article. Information on non-IFRS Financial Measures is incorporated by reference to the company’s Management Discussion and Analysis (“MD&A) for the applicable fiscal years ended August 31, as presented in the above table, located under CIBT’s profile on SEDAR (www.sedar.com). Reconciliation of EBITDA and Adjusted EBITDA to the most comparable IFRS measure is generally located under the title “Non-IFRS Financial Measures” near the end of each respective MD&A.

CIBT Education Group’s annual audited financial statements for the year ended August 31, 2022 (fiscal 2022) are available under CIBT’s profile on SEDAR (www.sedar.com).

All GEC® rental projects performed well despite the pandemic, reflecting that the company’s student rental and education businesses are counter-cyclical to the economic cycles and complementary to each other. Rental revenues increased by 88% in fiscal 2022 compared to fiscal 2021.

CEO Toby Chu addressed an issue reflected in the fiscal 2022 results when speaking with The Market Herald.

“One of our development projects in Richmond, British Columbia, where a GEC® limited partnership paid a deposit for the future purchase of two towers from a local developer, encountered an unfortunate setback. According to the developer’s filed court documents in the Companies’ Creditors Arrangement Act (the “CCAA”), the developer’s lender ceased funding in March 2020 which led to the developer filing for creditor protection under the CCAA in April 2022.

Based on facts and circumstances and the best information available on August 31, 2022, certain balances associated with these deposits and related assets were impaired, resulting in a non-cash charge of $66.94 million, which impacted net income (loss). Without this non-cash charge, net income for fiscal 2022 was $11.17 million 1.

At the end of each reporting period, the company will assess if any portion of this impairment may be reversed. There is no debt owed by GECH associated with this project. We are pursuing legal action against the lender for damages and other relief.”

Many businesses wilted due to the difficult economic conditions during the Covid-19 pandemic. Some were literally driven out of business.

CIBT derives the bulk of its revenues from its education business and 25% from its (occupied) rental housing units via its real estate subsidiary Global Education City Holdings Inc. (GECH). Despite the impact of the pandemic, which was most prominent in the first six months of fiscal 2022, revenues increased by 20%.

As the economy re-emerges from Covid, many businesses are struggling to equal their pre-pandemic performance level. Not CIBT.

Investors will note the company’s exceptional financial performance in 2018. CEO Toby Chu explained that CIBT’s revenues do not grow in a straight line.

Adding incremental rental units requires bringing new student housing facilities online. Each new facility produces a strong bump in revenues. The company added significant projects in 2018, generating robust gains on both the top and bottom lines.

CIBT Education is preparing to bring its next student housing facility online at the beginning of 2023: GEC King Edward.

This will add 190 additional beds (units) and 46,408 Gross Buildable square feet to CIBT’s inventory of student housing. Prospects for more top-line and bottom-line growth in 2023.

CIBT Education offers counter-cyclical strength with demonstrated stability

With its real estate revenues coming from rental housing, CIBT has lower exposure than conventional developers because the future rental rate adjustments to the renters will reflect all the increased costs. Combine this with the recession-proof nature of this business, and CIBT Education offers investors a countercyclical bellwether in real estate.

Investment icon Warren Buffett once famously remarked, “It’s only when the tide goes out that you learn who’s been swimming naked.”

In Canada’s once unstoppable real estate juggernaut, the tide is now going out – quickly. Many real estate investments are about to be exposed (as overvalued), especially those connected to the residential real estate bubble.

In comparison, CIBT remains finely attired to a foundation of financial stability decorated with strong growth potential.

The company’s $500+ million property portfolio is comprised of 7 off-campus student housing facilities currently in operation, with 8 more under development. The best is literally yet to come.

And the Smart Money is taking notice.

CEO Chu elaborated on what was being discussed as increasing numbers of institutional investors have been approaching him at investor events.

“During my recent roadshow visiting overseas institutional and accredited investors, the stock markets were impacted by geo-political issues, inflations, volatilities and depressed stock prices, forcing smart investors to look at other investment opportunities. I was able to introduce a niche market in the real estate sector that will provide stable cash flow income, long-term capital gain, and “real” estate that is tangible. Several institutional investors have identified Canada’s student housing as their next biggest opportunity.”

The basic investment proposition here is more than enough to generate interest in CIBT among institutional investors. But that’s only the beginning of the company’s attraction to the Smart Money.

The Smart Money real estate play for today

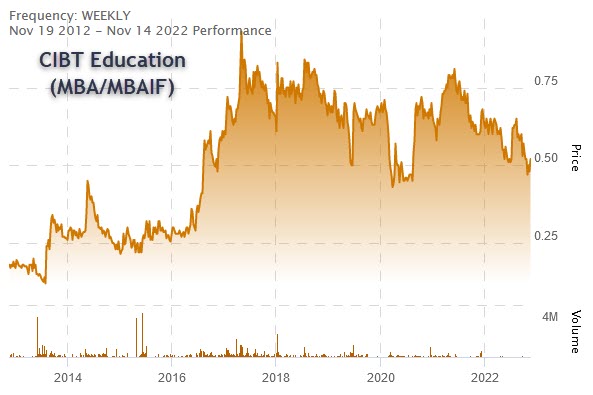

Readers of The Market Herald have already seen the 10-year chart for CIBT Education Group. It’s a pretty picture.

The long-term charts of most public companies look like they have fallen off a cliff, either during the pandemic, afterward, or both. CIBT is trading below the $40 million market cap as of November 28, 2022, a small-cap company with the chart of a blue-chip stock.

But should this chart look much better?

Consider this. Over those last 10 years, CIBT Education Group was competing for investor dollars with all the high-flying stocks in real estate. As good as CIBT has performed, it would have looked second-best versus all of the other (now) excessively valued real estate stocks.

As the tide goes out in real estate, CIBT stands virtually alone.

CIBT produced strong long-term returns over the past decade in heavy competition for investor dollars. Now that competition for investor dollars is evaporating.

Instead of being “a second-best real estate investment,” the company is now “the counter-cyclical real estate bellwether” as a large bubble in other real estate markets unwinds.

A Smart Money real estate investment.

But that still doesn’t fully present the strength of the investment fundamentals here.

Huge market, huge growth potential, huge barriers to entry

CIBT Education Group reported annual revenues for the year ended August 31, 2022 (fiscal 2022) of CAD$73.2 million. The company is the largest off-campus student housing provider in the CAD$1.6 billion Vancouver student housing market.

As noted in our previous feature, CIBT’s largest competitor in this market is the federal government. And the federal government wants to have as little market share here as possible – to minimize the tax dollars required for these capital investments.

As far as private sector competitors go, the barriers to entry into student housing were large. Today, they are virtually prohibitive.

Real estate prices remain near top dollar. Yet the explosion in interest rates has sent the costs of financing these capital investments into orbit.

CIBT Education Group has rental revenues for fiscal 2022 of CAD$18.55 million in a $1.6 billion market and near-zero competition as it expands its market share. Enough to make institutional investors salivate.

As investors contemplate the growth multiples here, don’t forget CIBT’s current market cap: below CAD$40 million.

Add the future growth potential, the barriers to entry that lock in this growth potential, and the counter-cyclical strength to prosper during a major downturn in real estate. This is a company that should be trading at a higher premium than its current state.

It is the sort of investment setup that institutional investors dream about: huge growth potential, minimal competition, and a fabulous entry point.

Institutional investors are also gravitating towards ESG-friendly stocks. CIBT Education puts the “G” in ESG. The company’s corporate accolades are simply too numerous to list.

The Smart Money real estate investment for 2022.

For retail investors worried they might forget about this “smart money” investment opportunity, CIBT Education Group makes it easy for investors. Just remember the company’s symbol: “MBA.”

Is your portfolio ready to graduate to this Smart Money real estate stock?

DISCLOSURE: This is a paid article by The Market Herald. Financial results included in the article are deemed to be from CIBT Education Group Inc.