When we last caught up Vox Royalty Corp. (“Vox”) (TSX-V.VOX, OTCQX: VOXCF, Forum) in Part 2 of our 3-part series on the company, we demonstrated that Vox is “a different kind of precious metals royalty play” boasting a vast and varied portfolio of over 50 royalties and streams spanning eight mining jurisdictions.

Part 2 was a follow-up to a company introduction in Part 1 of our recent Stockhouse Metals & Mining Investor series, focusing on Vox as “The High-Growth Mining Royalty Company Focused on Sector-Leading Returns.”

In Part 3, let’s take a deeper dive into (a) the advantages Vox possesses over other traditional resource investments, (b) Vox’s recent financial performance, and (c) the achievements of some its operating partners across various royalty-linked projects.

The Vox Business Model

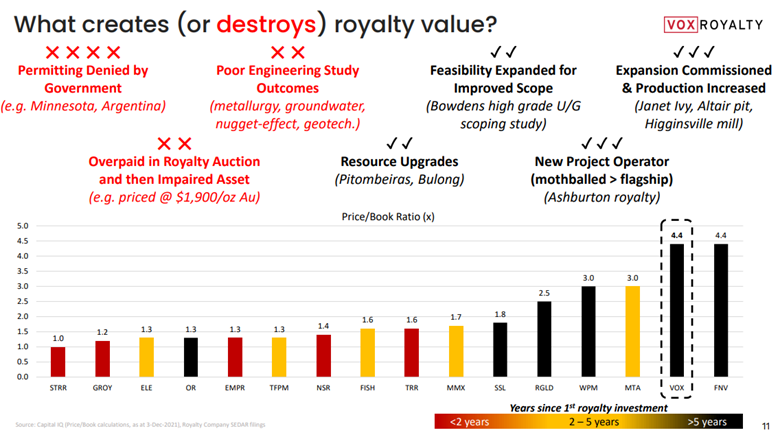

A royalty play can offer a hedge against the volatility often associated with the metals and mining marketplace, particularly in a difficult market. Royalty companies possess several inherent advantages, including:

- The potential to be sector and market outperformers during periods of high inflation since they are not exposed to rising mining input costs;

- Asset portfolios without single-asset risk common to mining companies;

- Exploration and mine expansion upside at no additional cost;

- No direct CAPEX or cost overrun exposure

- Less limitations for growth, as execution risk does not rise with each acquisition; and

- No dilution to royalty economics when operators raise equity.

Royalty and streaming companies also diversify their risk by investing in projects that are in different stages of development. Rather than only acquiring royalties on mines that are in production, these companies also buy royalties over projects that are still in the exploration or development stage. Higher risk, yes, but also the potential for higher return as these royalties are often priced below their intrinsic market value based on early-stage, high-grade drilling results, along with the size and scale of its property holdings. A mining-friendly jurisdiction with an experienced management team and workforce also comes into play when measuring real value.

Vox in the News

Financial Results

On August 15th, 2022, Vox announced back-to-back record quarterly revenues and royalty receipts in its Q2 2022 Results.

Second Quarter 2022 Highlights:

- Record Q2 royalty receipts of $3,165,030. Royalty receipts were allocated $1,750,754 to the income statement, a new quarterly revenue record, and $1,414,276 capitalized as a reduction to the acquisition purchase price of the Wonmunna royalty, covering the period April 1, 2022 to May 25, 2022 (the pre-acquisition period);

- Record year-to-date royalty receipts of $4,636,049;

- Record year-to-date revenues of $3,221,773, representing an increase of 74% over the comparable period;

- Record gross profit of $1,444,878 and $2,609,171 for the three and six months ended June 30, 2022;

- Increased producing royalty asset count to six during the quarter, with inaugural revenues received from the Wonmunna iron ore royalty, an uncapped 1.25% to 1.50% GRR (payable at 1.50% for >A$100/t iron ore pricing);

- Completed the acquisition of six royalties during Q2 2022, including the producing Wonmunna royalty asset; and

- Achieved full revenue payback on the Segilola gold royalty purchase price of C$900,000 during the quarter, within 6 months of first royalty receipt.

Operator Updates

On June 9th, 2022, August 10th, 2022 and August 18th, 2022, Vox provided development and exploration updates from a number of its royalty operating partners. These updates include:

Key Updates

Official opening of the Binduli North heap leach mine covered by the Janet Ivy gold royalty, released by Zijin Mining Group Co., Ltd.’s subsidiary, Norton Gold Fields Pty Ltd – this news followed a significant increase in forecasted royalty ore tonnages covered by the Janet Ivy royalty and construction plans for an 8-megawatt solar farm;

The Department of Mines, Industry Regulation and Safety of Western Australia approved an amended Mining Proposal on June 29th, 2022, submitted by MinRes, to expand the annual production rate at Wonmunna from 10Mtpa to 13.5Mtpa, representing a significant increase from the original ~5Mtpa production rate;

Exceptional drilling results at the Sulphur Springs copper-zinc project by Develop, which are expected to result in a significant resource upgrade based on Develop management guidance;

Construction update for the Otto Bore gold mine by Northern Star;

Final high grade drilling results at the Myhree gold deposit by Black Cat, which is covered by the Bulong royalty;

JORC 2012 resource estimate filed for the Paulsens Gold mine by Black Cat, which include Vox’s Merlin and Electric Dingo gold royalty assets; and

The completion of a Preliminary Economic Assessment and permitting update on the Kenbridge nickel project by Tartisan, indicating a potential 9-year mine life with a goal of production in approximately 3 years.

Spencer Cole, Chief Investment Officer, commented:

“The past few months have seen strong progress by our operating partners on a number of Vox’s gold and base metal royalty properties. Demonstrating the depth of Vox’s royalty portfolio, a number of exploration-stage royalties are being actively progressed towards development ahead of Vox management expectations.”

The bottom line

A royalty play is an alternative form of commodities exposure often more attractive than traditional mining equity exposure. Vox boasts immediate cash-flowing royalties generating recurring revenue and royalties over several long-life, economically robust development-stage assets with great operating counterparties.

Vox has all the earmarks of an exciting investment opportunity, poised for continued growth and alpha.

For regular updates, visit www.voxroyalty.com.

FULL DISCLOSURE: This article was sponsored by Vox Royalty Corp. and produced by Stockhouse, with input from Vox Royalty Corp. This article is provided for general information purposes only and does not constitute investment advice or an offer to buy any securities within the United States (as defined in Regulation S under the United States Securities Act of 1933, as amended). In making any investment decision, investors must rely on their own examination of a company, including the merits and risks involved. The securities of Vox Royalty Corp. have not been approved or disapproved by the United States Securities and Exchange Commission.