When The Market Herald last caught up with Vancouver BC-based SKRR Exploration Inc. (TSXV:SKRR) and its “all-star management and board teams” back in November, our audience got a firsthand look into the company’s battery metals project portfolio – particularly nickel and zinc. Pedal to the metal today, and SKRR is revving just as high as the nickel market. And, it’s the EV revolution that’s driving a bull market in the battery metals sector.

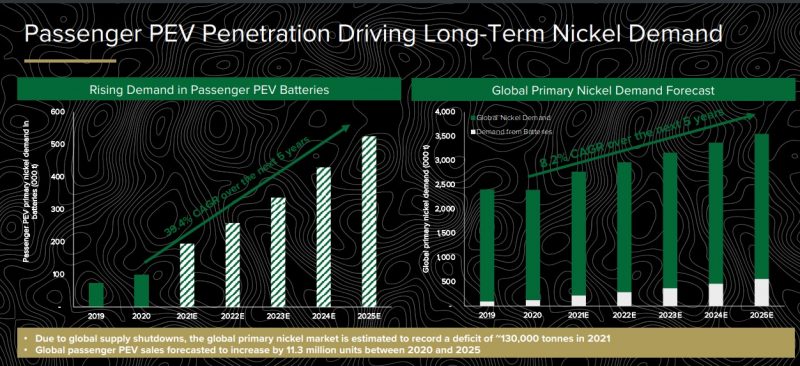

In fact, according to the latest research study on Battery Metals Market Forecast, the market size is projected to exceed $32 billion by 2028, up from $13.7 billion in 2021, and is expected to grow at a CAGR of 12.9% from 2021 to 2028. Needless to say, the sector is going to need a lot of nickel. And SKRR is placed in the right place at the right time – in the Fort St. James region of B.C. and Saskatchewan’s mineral-rich Trans-Hudson Corridor.

SKRR in the News

On June 7th, SKRR announced it had entered into a non-arm’s length share purchase agreement to acquire all of the issued and outstanding shares of 1364991 B.C. Ltd., which owns a 100% interest in the Nickel Peak Group’s Number 1 and Number 2 claim blocks located north of the Decar Nickel project of FPX Nickel Corp. (TSXV:FPX) – an advanced project targeting awaruite, a nickel-iron alloy mineral, hosted by serpentinized ultramafic intrusive rocks of the Trembleur ultramafic unit.

The Nickel Peak Group spans 1568 hectares and is approximately 110 kilometres northwest of Fort St. James, B.C., in the Omineca mining district. Metallic mineralization includes nickel, cobalt and chromium with the documented presence of awaruite. Assays by Acme Analytical Laboratories Ltd. in 2005 returned up to 1826 ppm 1734 ppm Nickel with 1113 ppm Chromium.

Sherman Dahl, Director, CEO and President of SKRR, commented:

“We are excited to begin exploration on the Nickel Peak Group this 2022 season. Recent spikes in demand for nickel is fueled by the meteoric rise in electric vehicles and the need for this important metal in the manufacturing of batteries that power them. Nickel prices have risen sharply this year with a massive 250% spike in early March of 2022, forecasts call for continued rise in Nickel demand with more and more electric vehicles and battery-powered devices coming to market.”

He added:

“The acquisition of our Nickel Peak Group of claims represents yet another example SKRR’s continued mission to build a world-class base and precious metal company and promise to drive value for shareholders. These Nickel Peak claims are situated in an active world-class Nickel camp and represent tremendous blue-sky potential with multiple historic high-grade Nickel samples and assays that have been underexplored until now. SKRR will be a leader with a diversified portfolio of high-quality long-life assets. The SKRR team has done an incredible job over the last few years of drilling, exploring, discovering, and positioning the company for success.”

Earlier in March, SKRR Exploration Inc. also began an airborne magnetic survey on its flagship Father Lake Project in Saskatchewan. SKRR’s Father Lake claims overlie four magmatic sulphide bodies hosting Ni-Cu mineralization within a series of northeast-trending norite sills. These mineralized zones, known as Dumas A, B, C & D, were drill-defined by Strongbow Exploration Inc. in 2008-2009. Better intersections returned 2.36% Ni & 0.26% Cu over 0.5 metres, 1.34% Ni & 0.94% Cu over 2 metres, and 0.26% Ni & 0.07% Cu over 14.6 metres.

“We are extremely excited to acquire the Father Lake Nickel property and add it to our expanding portfolio of assets in one of the world’s premier mining jurisdictions,” stated Sherman Dahl, CEO of SKRR. “The timing of this acquisition positions the Company well for a tightening nickel market.”

On SKRR’s precious metals ledger, in May, the company announced the completion of an airborne magnetic survey on its Irving Lake gold project in east-central Saskatchewan, located within 10 to 20 kilometres of SSR Mining’s (TSX:SSRM) very successful Seabee and Santoy Mines – Saskatchewan’s largest gold mining operation. Data is currently being analyzed and results will be processed to highlight target areas for geological follow-up and targeting high priority targets for drill testing.

About SKRR Exploration

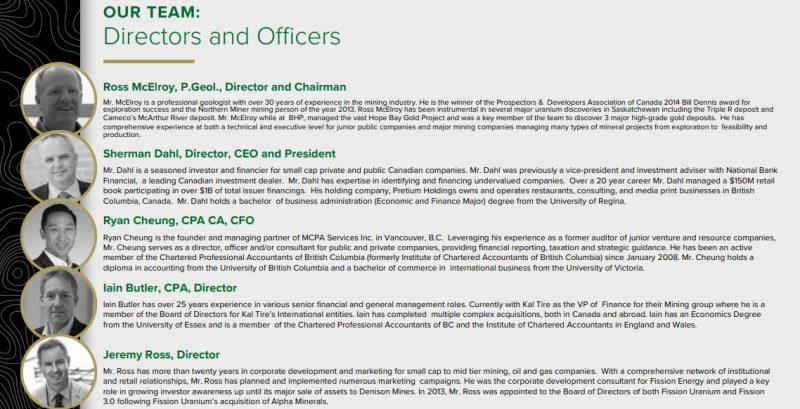

SKRR Exploration Inc. is a Canadian junior mining company with Saskatchewan-based operations. The company is led by a team of decorated mining veterans, boasting some of the longest cumulative experience in the region, with deep regional mining exploration and project development expertise and major mining discoveries.

For more information, please visit skrr.ca

FULL DISCLOSURE: This is a paid article produced by The Market Herald.