Investors looking to capitalize on the increasing demand for lithium-ion batteries for both the electric vehicle and mobile devices should take stock of what is happening in Québec.

The lithium market’s value was projected by Fortune Business Insights to eclipse US$190 billion by 2028, which we believe creates a great opportunity for many companies.

Jourdan Resources Inc. (TSXV:JOR) is an exciting Canadian story, one that we believe represents an undervalued lithium proposition with a market cap of just C$22.9 million. Having signed a major partnership that could catapult quickly into the production of one of its lithium properties, the junior exploration-stage mining exploration company’s properties are in Québec, primarily in the spodumene-bearing pegmatites of the La Corne Batholith, around Sayona’s historically producing North American Lithium Mine.

Moving Jourdan towards the goal of production…

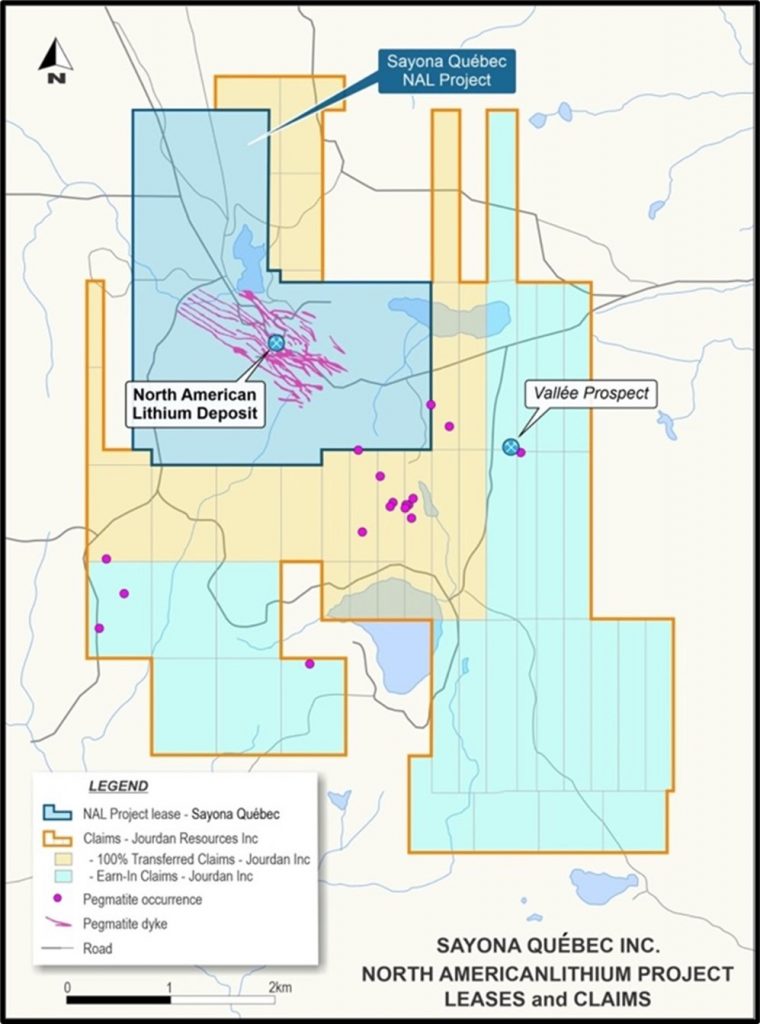

The company has signed two agreements with Sayona Mining relating to its Vallée Lithium Project. It agreed to permit Sayona to earn up to a 51 per cent stake in 28 claims within the Vallée Project, which includes pegmatite targets close to and along strike from Sayona subsidiary North American Lithium’s (NAL) neighbouring orebody.

This purchase is contingent on North American Lithium spending C$4 million within the first year of the agreement to earn an initial 25 per cent interest. Sayona has already deposited this money into an escrow account, and a corresponding work program is currently being jointly planned by Jourdan’s & Sayona’s management.

An additional C$6 million must be spent within two years for NAL to earn the further 25 per cent interest, while the remaining 1 per cent can be claimed by NAL completing a feasibility study and arranging to fund the construction of a mine at Vallée.

As a part of this agreement, Jourdan has transferred 20 claims outright to Sayona to provide for potential future infrastructure expansion at the Northern American Lithium mine and its processing facility.

Additionally, another subsidiary of Sayona, Sayona Québec Inc., has closed a private placement agreement to acquire 27 million common shares of Jourdan Resources, approximately 9.99 per cent of all common shares, for C$1.5 million. Upon closing, Jourdan issued 27 million common shares to Sayona.

The company intends to use the net proceeds of the private placement for working capital and general corporate purposes.

“Sayona is delighted to join forces with Jourdan Resources in expanding our Abitibi lithium hub, with our agreement concerning Jourdan’s Vallée Lithium Project set to provide a major boost to our North American Lithium operation,” said Sayona’s Managing Director, Brett Lynch.

“I am delighted to join Jourdan’s board to further progress this partnership as we look at advancing this and other mutually beneficial opportunities to add value for Jourdan’s shareholders.”

Most importantly, Jourdan’s arrangement with NAL contemplates Jourdan having reasonable access to NAL’s processing facilities. Suppose commercial production commences at the Vallée property in accordance with the agreement. In that case, Jourdan intends for ore to be trucked from the Vallée property directly to NAL’s processing facilities, which are projected by Sayona to be restarted in 2023. This would move Jourdan from an exploration company to a potential producer.

Sayona has witnessed its market cap move from just over A$20 million to over A$2 billion within the last 48 months. Both Jourdan & Sayona are eager to work together to move the Vallée project forward to production.

Through its work with Sayona Mining Ltd., an emerging leader in the supply of lithium for North America’s electrification, the team is planning exploration work, including geochemistry, geophysics, and several drilling programs on its various projects. The exploration team has already confirmed multiple high-potential target areas for drill testing.

The Vallée lithium property:

Since starting its drilling program in September 2021, Jourdan has drilled 58 drillholes for a total of 11,600 metres.

The Vallée Lithium project comprises 166 claims neighbouring the NAL mine tenure, with 20 of the leases located within 800 metres of the mine tenure boundary. Known pegmatites have been recorded in past exploration and are orientated/striking towards the NAL orebody. The tenure secures the prospective granodiorite host and its contact zone, which appear to be important mineralization controls in the NAL deposit.

14 pegmatite occurrences are recorded in government data more broadly within the claims, indicating the high exploration upside for the discovery of mineralization for blending into the NAL operation.

The phase 3 drilling was located to the east of the previous phases and aimed at the eastern strike extension of the known pegmatite swarm with its anticipated lithium-bearing spodumene mineral.

The company intends to use the results of the drilling and assaying to update its geological model and, together with future drilling and assaying, to help establish an initial mineral resource estimate on the Vallée property.

Jourdan’s Chief Executive Officer, Rene Bharti, believes that this drilling will be critical for the project’s geological model, which, together with future drilling and assaying, will be the basis of the initial mineral resource estimate.

“We see that lithium demand continues to surge, and we believe that establishing such a resource is a critical next step in our goal of becoming a lithium producer in Québec.”

The company’s Executive Chairman, Dr. Andy Rompel, added that this latest phase of exploration proved the presence of a lithium-bearing pegmatite swarm even further to the east than previously anticipated.

“Its existence is deeply encouraging, and we intend to continue to pursue exploring the spodumene-rich veins eastwards.”

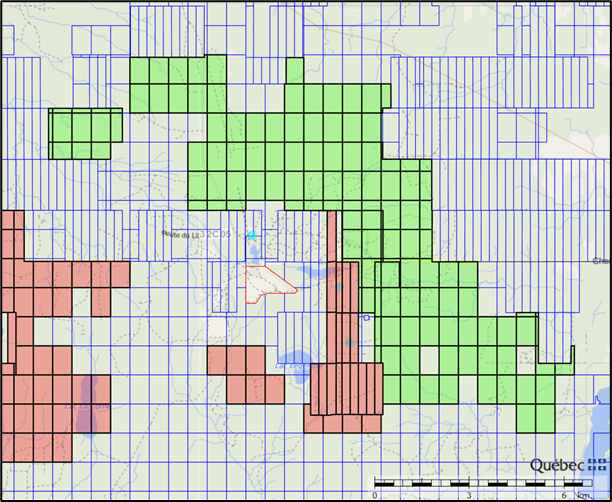

In mid-November 2022, the company acquired an additional 138 mining claims adjacent to its other lithium mining properties north of Val d’Or, Québec.

As consideration for the acquisition, Jourdan paid a total cash payment of C$50,000 and granted net smelter return royalties to the vendors ranging from 0.25 per cent to 0.5 per cent, payable up to a maximum of C$1 million.

CEO Bharti stated that these additional claims border the company’s current land position.

“We anticipate that pegmatite showings with spodumene (lithium-bearing pyroxene) occurrences that we identified on our current properties extend into these newly acquired areas.”

“We are very pleased to have added a complementary land package to the east of our flagship Vallée project,” added Chairman Rompel. “The strike of our known pegmatite swarm indicates an eastern extension aiming towards these newly acquired claims, and we are very enthusiastic to explore these in the new year (2023).”

A significant bonus to working in this part of Québec is that since there isn’t any swamp land, the team can conduct summer and winter drilling without interruption.

Meet the team:

In another move to advance its business on the management side, the company appointed Mr. Lynch to its board of directors.

Lynch was appointed Managing Director/Chief Executive Officer of Sayona Mining Limited on July 1, 2019. As a senior mining engineer and manager, Lynch has more than 30 years of experience in the global industry. In connection with the appointment, Jourdan granted Lynch 2 million stock options pursuant to the company’s stock option plan.

He joins CEO Bharti, who himself has more than two decades of experience serving key roles in both public and private companies, including those in the resource and technology sectors. He was the former VP Business Development at Avion Gold Corp., which was later acquired by Endeavour Mining Corporation for C$389 million. He is also the founder and Chairman of Future Fertility Inc., an Artificial Intelligence company focused on women’s health.

Chairman Dr. Rompel, who also serves as VP Exploration, is a seasoned professional with more than 30 years of mining and exploration experience in a wide range of roles in many countries and on several continents.

From VP Exploration and Project Manager to Country Manager and Corporate Development Manager, he was the President and CEO of Cobalt Power Group. He has also worked in a variety of commodities, including precious metals and base metals, as well as cobalt. For more than a decade, he evaluated capital projects within Anglo-American and was on the board of Spectrem as Technical Director (an Anglo-American company).

Investment summary:

We believe that lithium is a key player in the global decarbonization effort, as it is a key component of lithium-ion batteries as well as the next-generation lithium-iron-phosphate batteries used to power electric vehicles. As the green revolution gains momentum over the coming decades, we expect the demand for lithium will also increase. This essential mineral is also widely used in other industrial applications, such as cell phones, laptops, glass, and ceramic production.

Since there is currently no commercially viable replacement for lithium in the battery industry, we believe Jourdan Resources Inc. is one to watch.

Due to decreasing lithium-ion battery costs, growth in the energy storage systems and the electric vehicles market, global lithium is expected to grow in future.

Sustainability consultancy firm ERM projected that by 2025, vehicle manufacturers will spend US$365 billion to produce electric vehicles, with Volvo committed to selling 1 million electric vehicles per year by 2024.

The U.S. government has also expressed its desire to participate in the financing of viable projects in the strategic minerals sector in Canada to counter the growing influence of China in this critical sector for both consumer products and national security.

The company’s stock has already risen more than 99 per cent since this time last year. We think that investors looking to get in on the ground floor of an opportunity with serious growth potential would be wise to engage in due diligence into Jourdan Resources Inc. as soon as possible.

We believe that there are very few opportunities for a Canadian exploration-stage lithium company to move toward production in the current marketplace. Indeed, Jourdan, through its transaction with Sayona, has potentially saved itself the cost and burden of building a processing facility. If commercial production at the Vallée project commences, this transaction would make Jourdan, along with its partner Sayona, the first lithium producer in Canada.

FULL DISCLOSURE: This is a paid article produced by the Market Herald. Jourdan is not basing any production decisions on a feasibility study of mineral reserves demonstrating economic and technical viability at the Vallée lithium project. As a result, there is increased uncertainty, and there are multiple technical and economic risks of failure which are associated with any such production decision. These risks, among others, include areas that are analyzed in more detail in a feasibility study, such as applying economic analysis to resources and reserves and a number of specialized studies in areas such as mining and recovery methods, market analysis, and environmental and community impacts.