The health care market has seen rapid growth among stocks in the digital space.

Companies that utilize technology to drive improvements in medical products and healthcare services are powering much of this innovation as they advance their business.

In 2020, PwC Canada estimated the digital health market to be worth more than C$5 billion in Canada, and the global market size was greater than C$100 billion. Fast-forward just one year, and the global digital health market reached a value of C$389 billion. Looking forward, market analysts at ResearchAndMarkets.com expect the market to reach more than C$1 trillion by 2027.

These numbers represent growth in a world where COVID-19 is a part of our regular lives, and as it continues to put pressure on health systems in the months and years to come, experts expect this trend to accelerate.

Digital health includes medical wearables, and healthcare analytics, along with digital healthcare systems like EMR and EHR medical apps. One of the most significant elements is telehealth, with a number of intriguing plays seeing substantial growth in recent months.

One company that fits this bill is Mednow Inc. (TSXV:MNOW), a Canadian healthcare technology company that provides virtual pharmacy and telemedicine services via Mednow.ca, as well as doctor home visits.

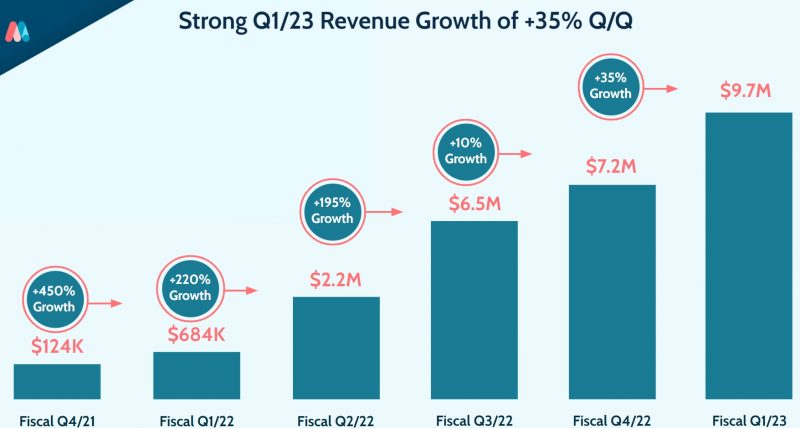

The company recently released its financial results for the period ending October 31, 2022 (Q1 2023).

In fiscal Q1, revenue increased by approximately 35 per cent quarter over quarter to $9.7 million and approximately 1,300 per cent year-over-year. The company reduced its costs by 30 per cent quarter over quarter from reduced headcount as well as selling, general, and administrative expenses while achieving additional cost savings post-Q1 2023 to further reduce cash burn.

Mednow’s patient count increased by approximately 13 per cent to roughly 35,000 in Q1 2023 versus around 31,000 in Q4 2022. New business partnerships were also signed, including Mednow’s partnership with Care Pharmacies.

A healthcare technology company offering virtual access with a high standard of care, Mednow’s platform is designed with accessibility and quality of care in mind. Mednow provides virtual pharmacy and telemedicine services as well as doctor home visits through an interdisciplinary approach to healthcare that is focused on the patient experience.

Mednow’s services include free at-home delivery of medications, doctor consultations, a user-friendly interface for easy upload, transfer, and refill of prescriptions, access to healthcare professionals through an intuitive chat experience and a specialized system called PillSmart that packages prescriptions in easy-to-use daily dose packs, each labelled with the date and time of the next dose.

Mednow’s founder and CEO, Ali Reyhany, brought his years of experience at the helm of Carepharmacies.ca, of which he is also CEO and a co-founder, to deliver a platform that people really need via a business that continues to scale.

Mednow stock has risen 38 per cent over the last three months and could trend even higher in the future. Investors would be wise to add this stock to their radar and deepen their due diligence into what Mednow Inc. has to offer.

FULL DISCLOSURE: This is a paid article produced by the Market Herald.