- The Flowr Corporation (FLWR) announced that the company and its subsidiaries will apply for an order for creditor protection under the Companies’ Creditors Arrangement Act (CCAA)

- The company will be submitting its application for the Initial Order on October 20, 2022

- The Initial Order would include a stay of proceedings in favour of the Flowr Group, approval of the DIP Loan and the appointment of Ernst & Young Inc. as the company monitor

- Flowr’s common shares will be transferred to the NEX Board of the TSX Venture Exchange, where trading will be suspended

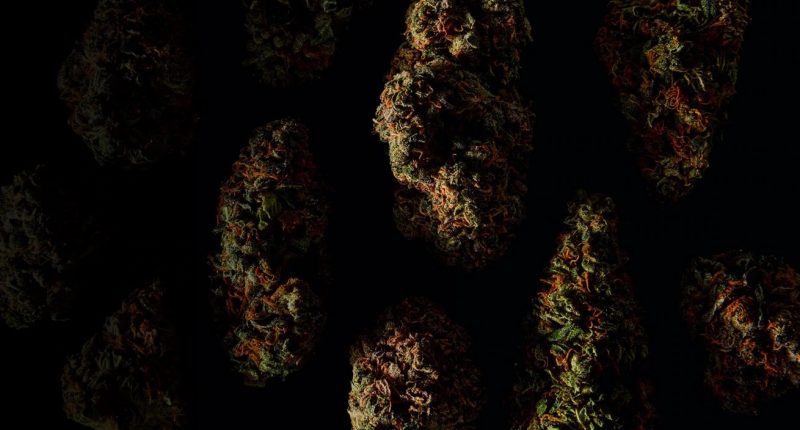

- The Flowr Corp is a cannabis company with operations in Canada and Europe

- The Flowr Corporation (FLWR) is currently trading at $0.025

The Flowr Corporation (FLWR) announced that the company and its subsidiaries will apply for an order for creditor protection under the CCAA.

The company will be submitting its application for the Initial Order on October 20, 2022.

After considering all available alternatives following consultation with legal and financial advisors, the directors of the company have determined that it is in the best interests of the Flowr Group to file an application for creditor protection under the CCAA.

The Initial Order being sought would include a stay of proceedings in favour of the Flowr Group, approval of the DIP Loan and the appointment of Ernst & Young Inc. as the monitor of the Flowr Group.

The Flowr Group is seeking creditor protection under the CCAA in order to receive a stay of proceedings that will allow the Flowr Group to facilitate a transaction that sees the company emerge from CCAA protection as a going concern.

If the Initial Order is granted, the company intends to operate in the ordinary course throughout the CCAA proceedings and while conducting the SISP. Management would remain responsible for the day-to-day operations under the general oversight of the Monitor.

The Flowr Group has executed a term sheet with 1000343100 Ontario Inc., under which the DIP Lender will advance a debtor-in-possession loan in the amount of $2,000,000. The DIP Loan is conditional on the issuance of the Initial Order.

Flowr’s common shares will be transferred to the NEX Board of the TSX Venture Exchange, where trading will be suspended. If the Initial Order is granted, the company will be authorized to incur no further expenses in relation to the filing of continuous disclosure documents, including press releases.

The Flowr Corporation is a Canadian cannabis company with an operating campus in Kelowna, British Columbia. Flowr strives to be the brand of choice for consumers and patients seeking the highest-quality craftsmanship and product consistency across a portfolio of differentiated cannabis products.

The Flowr Corporation (FLWR) is currently trading at $0.025.