Gold investors are well versed with what Australia’s Central Victorian Goldfields and Canada’s own Abitibi greenstone belt have to offer, but what is emerging out of Newfoundland has a lot of investors excited.

Canstar Resources Inc. (TSXV:ROX) is an emerging player in this field, but for a small company, it has a massive land package right off the highway. Few others can boast such access to an established gold zone with plentiful opportunity.

It is, simply put, the type of high-risk/high reward play that even the most seasoned investors pause to focus their due diligence upon.

Canstar is a Toronto-based mineral exploration company focused on the discovery and development of new economic mineral deposits in Newfoundland and Labrador. The company has the option to acquire a 100 per cent interest in the Golden Baie Project in south-central Newfoundland, a large claim package with recently discovered, multiple outcropping gold occurrences on a major structural trend.

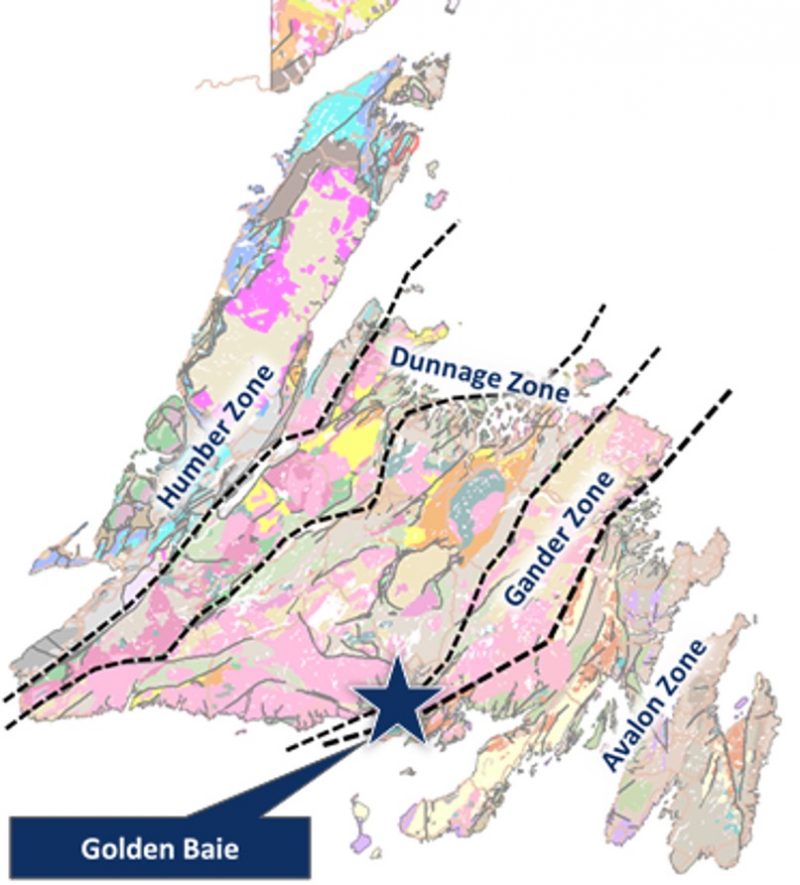

Because of recent high-grade orogenic gold discoveries along crustal-scale fault corridors, central Newfoundland has emerged as one of the most exciting new gold exploration districts. This company is focused on gold exploration on 939 sq. km. of mineral claim licenses in southern Newfoundland, including Golden Baie, which has multiple high-grade gold anomalies at surface along 40 km of strike and shallow drilling that has confirmed the presence of high-grade orogenic gold.

Let’s dig a little deeper and see what this company has to offer ….

Golden Baie Project:

In September 2022, Canstar began its third drill program on the Golden Baie Project.

Situated in a favourable setting, the project sits along the same crustal-scale fault corridor and geological setting as orogenic gold discoveries on New Found Gold Corp.’s (TSXV:NFG) Queensway Project.

The region is relatively underexplored, with very little historic drilling and modern exploration, which has created the potential for new discoveries, further supported by positive early exploration results. A 40 km trend of anomalous high-grade gold occurrences at surface yielded grab samples up to 4,485 g/t Au; the best drill intercept of 9.6 g/t Au over 7.8 metres.

To hear the company’s President and Chief Executive Officer, Rob Bruggeman (P. Eng, CFA) say it, the team is fully behind Newfoundland as the next top gold exploration district in Canada.

“We see the potential here where Newfoundland could be the next big thing, its size is similar to Abitibi, but you’re getting in really on the ground floor with district-scale properties.”

He added that the reason that the region hasn’t been picked over as aggressively as other jurisdictions is because of the presence of glacial till which obscures the geology with limited rock outcrop in the landscape. The structures there are tight, and it hasn’t been conducive to systematic exploration where you go in and drill a series of widely-spaced holes to discover gold. It is more complex and what that means is the exploration approach and the experience of the technical team become that much more important. It takes longer, but you need to use geophysics and geochemistry to understand the geology and to narrow down large areas into smaller targets that can be drilled cost-effectively.

Planned drilling in the fall of 20222 will test six target areas, including follow-up on winter drilling at the Kendell prospect, which returned near-surface intercepts, including 20.6 grams per tonne (g/t) gold over 3.5 metres. To date, gold mineralization at the Kendell prospect has been defined for approximately 180 metres downdip from surface, and mineralization remains open to the northwest and along strike.

Drilling is also planned to test at least five additional targets in the central portion of the Golden Baie claims that have been selected based on recent trenching, till sampling results, an IP survey completed this summer and historical data. Initial drill holes are expected to be shallow, averaging approximately 100 metres each, as the geology in this area is typically shallow, dipping to the northwest. Initial drilling is expected to total at least 5,000 metres in 50-60 holes.

2021 exploration highlights:

The team struck multiple new instances of visible gold since optioning the Golden Baie project. With a 2021 budget of $2.5 million focused primarily on the central portion of the large Golden Baie property, the maiden drill program on the Kendell prospect confirmed orogenic gold mineralization at the Kendell prospect. The best hole intersected 9.6 g/t Au over 7.75 metres (from 7.45 metres downhole).

The team also discovered a quartz boulder at the Skidder target grading 289 g/t Au. The first till sampling program confirmed anomalous gold with samples containing up to 502 gold grains from a nearby source. Extensive prospecting identified multiple new areas with anomalous gold and parallel trends along 40 km of strike length.

Future outlook:

From an exploration perspective, CEO Bruggeman calls this the biggest drilling season in company history. He added that “one drill hole can change everything,” noting that ”once you intercept gold in bedrock, you can chase it, and these deep-rooted systems can go very deep.”

“The structural controls on gold mineralization in this belt are complex, and we are becoming better and more efficient with our exploration over time. Our goal is to make a significant new discovery with the current drill program. I think there’s good potential for discovery with the number of targets we are testing.”

Citing the work done at Fosterville as an example, he added that a project of this size can take a long time to fully explore, especially if the higher-grade gold mineralization is found at depth. “We are seeing a lot of evidence of gold at surface over an extensive area. We see visible gold in multiple locations, which is very exciting. Once we intercept that gold at surface, it becomes easier because we can analyze and follow that mineralized system. We know we are getting close, and I think it’s just a matter of time before we make some new discoveries.”

Meet the team:

Canstar Resources has a very experienced technical team and board. Built essentially from scratch, the team came together from mining and capital markets backgrounds.

There were two elements to this prospect that drew CEO Bruggeman to take on this endeavour. The first was the potential of this new belt in Newfoundland. It was back in the summer of 2020 when he saw New Found Gold’s initial success at Queensway.

“It was pretty exceptional to have new gold discovered in Newfoundland, close to a highway and infrastructure. That was something that was compelling. I am a believer that gold prices certainly are going to go higher, so I wanted to find a new gold play in Newfoundland.”

He continues to serve on the board of AbraSilver Resource Corp. (TSXV:ABRA), a gold and silver exploration company focused on Argentina. He always liked the potential of its Diablillos silver-gold project and, upon getting involved with the company, helped take it from a $5 million market cap to a $200 million market cap after an overhaul of the team and the geological model. It is a success he wants to mirror with Canstar Resources.

“That’s the exciting thing about the mining industry,” he says. “Seeing those opportunities and being able to get those kinds of returns, there aren’t too many sectors you can do that.”

He’s backed by the company’s VP Exploration, Matthieu Lapointe P.Geo, who has more than 15 years of greenfield and brownfield precious metal exploration throughout Canada and internationally. Most recently, he was VP Exploration at Labrador Gold Corp. (TSX:LAB), where he led the team that discovered the Big Vein on the Kingsway property in Newfoundland. Before that, he was Chief Geologist at TMAC Resources (TSX:TMR), Senior Project Geologist at IAMGOLD (TSX:IMG), and Geologist at Sabina Gold & Silver (TSX:SBB).

Exploration Advisor Dr. David Palmer Ph.D., P.Geo has spent the last 25 years in the fields of management, technical and exploration in the Canadian and international mining industry.

From 2003 to 2015, he was the President and CEO of Probe Mines, where he led his team to two successful major mineral discoveries, including the multi-million-ounce Borden Gold deposit and the sale of the company to Goldcorp Inc. in 2015.

Exploration Advisor, Dr. Lawrence WinterPh.D., P.Geo is based in Newfoundland and has been the Vice President of Exploration for Altius Minerals (TSX:ALS) since 2006 and is responsible for Altius’ project generation efforts globally. He has worked extensively in mineral exploration across Canada and internationally.

Exploration Advisor Dr. Laurence (Laurie) CurtisPh.D., P.Geo brings more than 40 years of experience in the mining industry and capital markets, with a proven track record in corporate development, mine development and project financing. He was the founder of Intrepid Minerals (TSXV:INTR) and was a key member of the senior management and technical teams overseeing all aspects from discovery through operations. Under his guidance as CEO and COO, Intrepid transitioned through merger and acquisition to become a gold producer and developer, ultimately attaining a market capitalization in excess of $1.2 billion.

Finally, the company’s Chairwoman of the Board, Jacqueline AllisonCFA, Ph.D., P.Geo, FCIM, has more than 20 years of Canadian and international experience at major institutions in the fields of mineral economics, financial analysis, investment management and investor relations. She was previously VP Investor Relations and Strategic Analysis for Augusta Group of Companies (OTC:AUGG), with similar senior executive capacities at Dominion Diamond Corp. (TSX:DDC) and Hudbay Minerals Inc. (TSX:HBM) Prior to this, she served as a VP and Research Analyst at various banking institutions, including BMO Harris Investment Management Inc.

This team was assembled for its passion – the board isn’t paid any cash, and management does not receive cash bonuses, rather, their payment comes in the form of options of the company.

Investment summary:

Canstar Resources Inc. represents an exciting risk/reward opportunity for investors looking to enhance their portfolio in the Canadian mining space.

Newfoundland is mining-friendly, with straightforward permitting and policies. Multiple high-grade gold discoveries were recently made along a crustal-scale fault corridor in the central part of the province.

This company was an early mover, having acquired a large claim block with similar structure and geology to the south of other operators in the region and is backed by early evidence of orogenic visible gold mineralization.

Canstar’s Golden Baie project is intersected by a paved highway and near the island’s largest hydroelectric generating facility. The project has relatively low costs due to its location and can be drilled year-round.

Given its sensible execution strategy, Canstar puts itself in good company with other operators in the Atlantic. Although still in its early stages, this company offers an engaging opportunity where investors will want to deepen their due diligence.

“Now is the time to be looking at Newfoundland gold exploration companies. Share prices have come down 50 to 90% from the highs, so discoveries are no longer priced in. Unlocking the secrets of gold mineralization in a new district takes time, and those investors who are patient should be rewarded handsomely. Canstar holds a district-scale exploration project with known gold mineralization over a vast area, and one discovery hole could dramatically change our valuation. That will be thrilling, and that is why we do this.” – CEO Bruggeman.

FULL DISCLOSURE: This is a paid article produced by the Market Herald.