- Largo (LGO) is a leading manufacturer of high-quality vanadium products and vanadium-focused energy storage solutions

- Operations at its Maracás Menchen Mine make Largo one of the lowest-cost primary vanadium producers in the world

- Management believes it is well positioned to play a significant role in the long-duration energy storage market as it reaches 1.4 TWh by 2040

- The company has achieved positive net income in four out of the last six quarters and positive operating cash flow in five out of the last six quarters

- Largo (LGO) stock has succumbed to macro pressures from the pandemic and hawkish central bank policy, finding itself range-bound between $10-$20 over the past two years and 80 per cent down from its 2018 high

With inflation at 5.9 per cent in January, public companies are feeling the crunch of higher prices.

With the Bank of Canada (BoC) raising its benchmark interest rate to 4.5 per cent in tow, and with it the cost to borrow money, and unemployment near a record low, the current macro environment is especially difficult to operate at an optimal level without adequate capital on hand.

This is why, during uncertain times such as the present moment, many investors tend to limit their pool of prospective allocations to the cash-flowing and the cash-rich.

With this thesis in mind, The Market Herald’s Cash-Rich Report introduces you to profitable companies with coffers fortified to weather a multitude of headwinds.

One of the world’s preferred vanadium companies

Our next featured company is Largo (LGO), a leader in manufacturing high-quality vanadium products and vanadium-focused energy storage solutions.

VPURE and VPURE+

The company’s VPURE and VPURE+ products – sourced from its Maracás Menchen Mine in Brazil, one of the world’s highest-grade vanadium deposits – are used in master alloying, steel and aerospace applications, chemicals, catalysts, and vanadium redox flow batteries (VRFBs), which are scalable batteries that use a vanadium electrolyte liquid solution.

Vanadium-micro alloyed rebars minimize steel used in construction, reducing CO2 emissions by hundreds of millions of metric tons per year. The metal also supports ESG principles through non-degrading, fully recyclable electrolyte and alloying applications.

The operation at Maracás makes Largo one of the lowest-cost primary vanadium producers in the world at US$4.85 – 5.25/lb V2O5. The 17,690-hectare property boasts a reserve life of 20 years, 2023 sales guidance ranging between 10,300 – 11,300 tonnes, and projected 2023 production of 11,000 – 12,000 tonnes.

Clean energy business

Largo’s clean energy division is led by its VCHARGE vanadium batteries, which offer a recyclable, scalable, virtually degradation-free fossil fuel power plant alternative with an over 25-year lifespan.

The non-flammable, water-based electrolyte in VRFBs makes them ideal for densely populated areas, including airports, schools, and wooded areas, where mitigating fire and smoke risk is paramount.

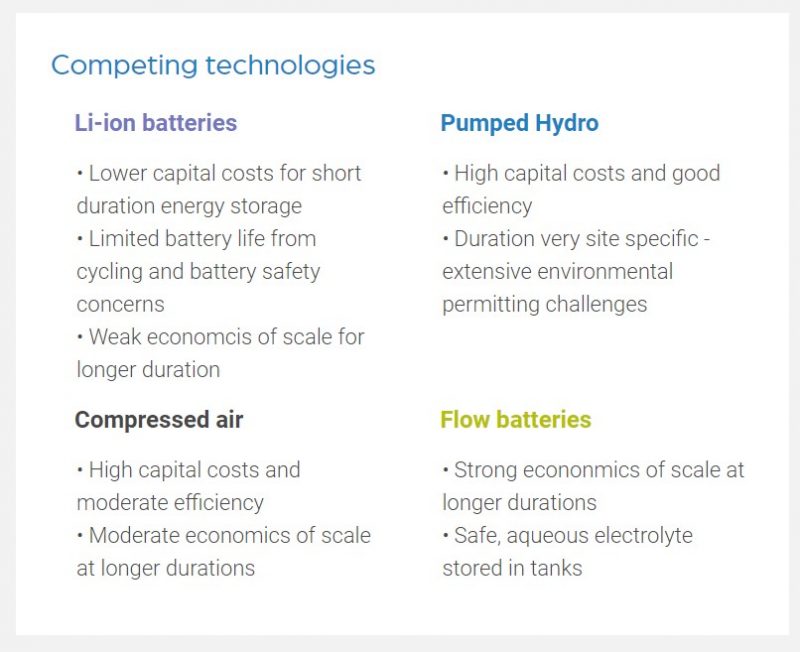

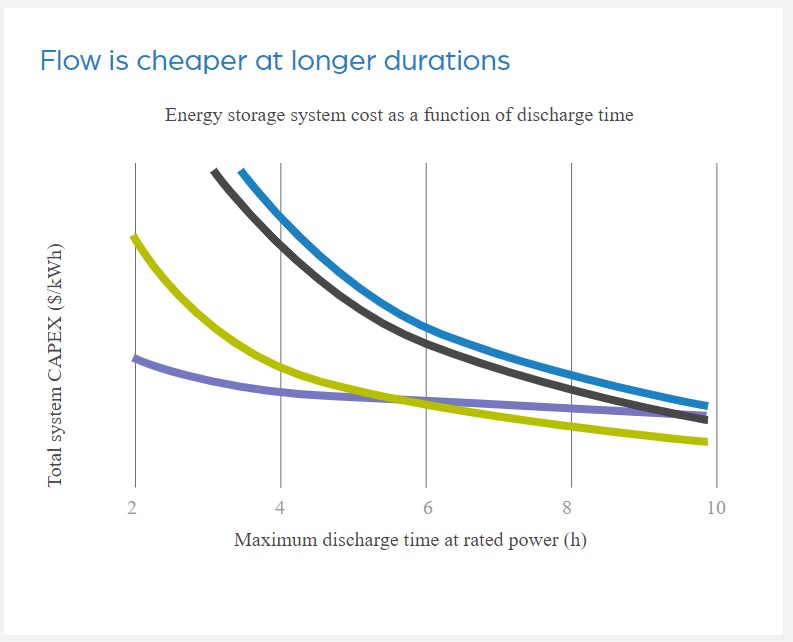

Here is how flow batteries match up against competing energy storage technologies:

Management believes it is well positioned to play a significant role in the long-duration energy storage market as it soars past 1.4 TWh by 2040. This belief is backed by Largo’s in-house vanadium source and its leasing model, which lowers upfront costs for customers and creates a predictable source of value for shareholders.

Margin of safety

According to Paulo Misk, Largo’s President and CEO, “Global market uncertainties, including continued inflationary pressures and a challenging supply chain environment, continued to affect the company in Q3 2022. Impacts to our financial performance in the third quarter 2022 were largely attributable to lower sales of our produced material, the effects of lower production and increased consumable costs.”

“Despite near-term uncertainties, long-term market fundamentals for vanadium and outlined growth opportunities for the company remain highly attractive,” he added. “I am optimistic that the expected upside derived from our two-pillar strategy as a leading vanadium company will be positive for all stakeholders as global conditions improve.”

Misk’s cautious optimism is backed by Largo’s financials, which are especially robust given rampant recessionary fears over the past year. While Q3 2022 produced negative income of over US$2.6 million for the aforementioned reasons, the company has achieved positive net income in four out of the last six quarters and positive operating cash flow in five out of the last six quarters.

It also ended Q3 2022 with US$62.7 million in cash on hand, as well as minimal debt, which is covered over 5x by assets.

Largo is experiencing a strengthening in vanadium demand driven by strong aerospace inquiries and new VRFB deployments (which led to price increases in recent months), placing it on a path to maximizing the value of its vanadium assets.

Looking ahead

Management sees demand for low-carbon technology requiring 173 per cent more vanadium production by 2050. To secure Largo’s space on this rising wave, the company is focused on meeting planned objectives for 2023, completing its ilmenite concentration plant, and delivering its inaugural VRFB for Enel later this year.

Phase I of the ilmenite concentration plant at the Maracás Menchen Mine considers a production capacity of 150,000 tonnes of ilmenite concentrate per year from the Campbell Pit’s non-magnetic concentrate.

The majority of the ilmenite concentrate will be fed through Largo’s new titanium dioxide pigment chemical processing plant in Camaçari, Brazil, with production planned for later this year. Millions of tons of the pigment are used each year in paints, coatings, plastics, papers, inks, foods and medicines. The plant is expected to produce 30,000 tonnes of titanium dioxide pigment per year beginning in 2024.

Another of the company’s key growth streams worth keeping tabs on is Largo Physical Vanadium (TSXV:VAND), an exchange-traded investment offering direct exposure to physical vanadium.

Largo will release Q4 and annual 2022 results on March 9, 2023, after the close of market trading.

Largo (LGO) stock has succumbed to macro pressures from the pandemic and hawkish central bank policy, finding itself range-bound between $10-$20 over the past two years and 80 per cent down from its 2018 high. Given its profitable operations and leadership position in the vanadium market, the stock being out of favour suggests the efficient market hypothesis isn’t all it’s cracked up to be.