Northstar Gold has been making headlines over the past couple of years advancing its high-grade flagship Miller Gold Property.

Now Northstar Gold (CSE:NSG/OTC:NSGCF) is in the news again, but this time it’s announcing a new discovery on one of the Company’s other Projects: the Milestone Cu-Ni-Co Property.

Northstar Gold’s exploration operations are based in the prolific Kirkland Lake Mining District. When mining investors hear “Kirkland Lake”, they think “gold”. Canada is a major gold-producing nation and Kirkland Lake has become one of Canada’s leading gold districts.

The Kirkland Lake Gold Camp now boasts a total gold endowment of nearly 60 million ounces, with almost 42 million ounces of gold already produced. But this mineral-rich geology hosts more than just gold.

In 2022 alone, mining companies engaging in exploration activities in this District have also identified copper, silver, cobalt, nickel, and PGM mineralization. Even some rare earths have been found.

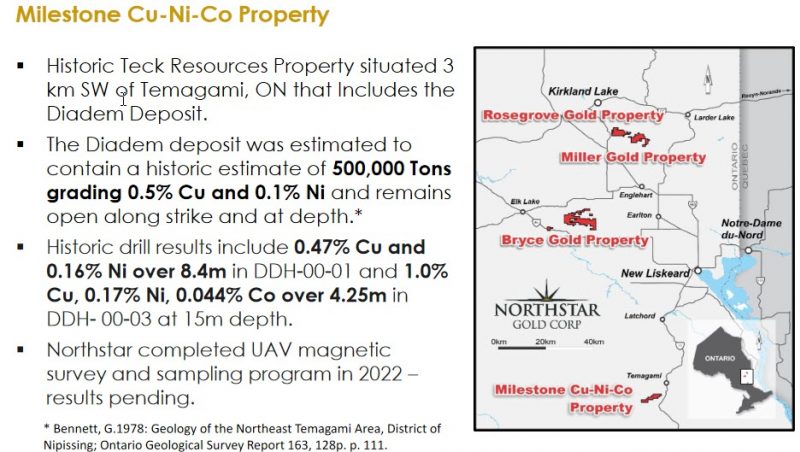

Northstar’s 100%-owned Milestone Cu-Ni-Co Property includes the Diadem Deposit identified by Teck Resources in the 1970s. Historically, copper, nickel, cobalt, gold, silver and PGM mineralization have been associated with this land package.

Now Northstar has made a new discovery on this Property.

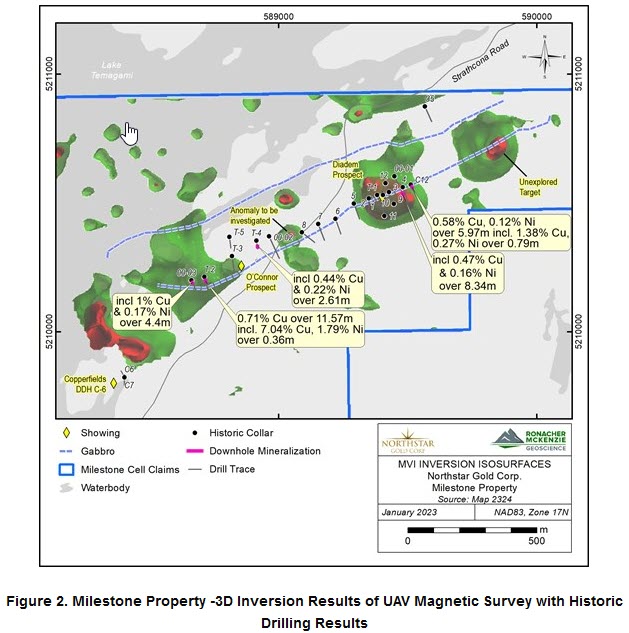

On January 25, 2023, Northstar Gold announced “significant” Cu-Ni-Co and “anomalous” precious metal assays, from numerous surface samples collected over a 1,000-meter distance along a metagabbro sill.

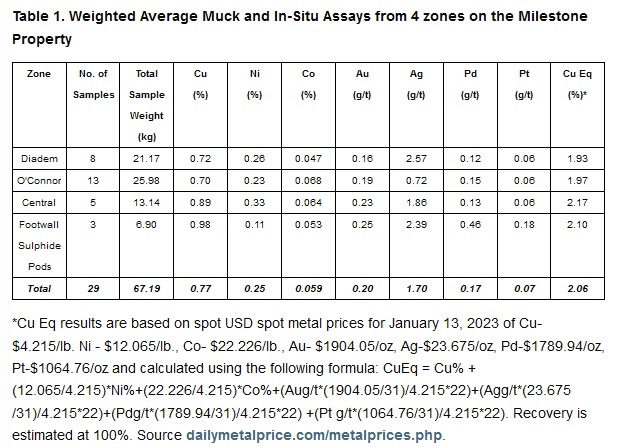

A total of 29 samples were assayed. Copper values ranged from 0.20% – 1.52% Cu. Nickel assays ranged from 0.05 % – 0.61% Ni. Cobalt numbers ranged from 0.005% – 0.134% Co.

Copper sample assay numbers are consistent with the historical mineralization reported at the Diadem Deposit. However, both the nickel and cobalt assays generally exceeded the historical numbers.

The best sample numbers came from a sample taken in the O’Conner Zone. Assays registered 1.25% Cu, 1.31 g/t Pd, 0.46 g/t Pt, 0.41 g/t Au and 6.35 g/t Ag. Another assay sample (taken from a muck pile) reported assays of 1.25% Cu, 0.61% Ni and 0.081% Co. A nearby trench sample also produced strong numbers: 1.0% Cu, 0.34% Ni, 0.066% Co, 0.2 g/t Pd, and 0.3 g/t Au.

While metals markets are generally strong these days, copper has been stealing the recent headlines. Commodities giant, Glencore, warned in December that it saw a “huge deficit” looming in the copper market.

Glencore CEO Gary Nagle added that he expected to see the price of copper roughly double to $15,000 per tonne (from the current $8,000+).

This certainly isn’t the first dire warning about major supply pressures facing the copper market. A 2022 report from S&P Global forecasts copper demand doubling (by 2035).

Even more astounding, S&P Global is predicting annual copper demand of 50 million tonnes by 2050. Put into perspective, 50 million tonnes of copper exceeds the total global copper demand from 1900 – 2021, more than a century of consumption.

This means dozens (hundreds?) of copper exploration projects going into production just to hopefully cope with the enormous surge in global copper demand.

Northstar CEO Brian Fowler shared some additional insights with investors regarding the sample results at Milestone.

“Program results have identified a number of near-surface, precious-metal enriched Cu-Ni-Co (Critical Minerals) exploration targets that warrant follow-up exploration. Northstar intends to pursue a critical minerals designation by a qualified professional geoscientist to certify, in the prescribed form and manner, that Milestone expenses will be incurred in accordance with an exploration plan that primarily targets Critical Minerals.” [emphasis mine]

Fowler is referring to Canada’s Critical Minerals Exploration Flow-Through Shares Tax Credit (CMETC) of 30%.

The gold market is hot right now, and investors will certainly be eager to see more work on the flagship Miller Gold Property, where the latest news indicated the potential for a 250,000 – 500,000 ounce gold resource based upon exploration completed to date.

However, Critical Minerals markets are also (not surprisingly) very strong. With additional robust tax credits available for critical mineral-based exploration, this provides Northstar’s management (and its shareholders) with a strong incentive to pursue further development of Milestone.

With share prices depressed for mining companies and Northstar’s market cap currently a very lean CAD$7 million, Northstar is already in line for an upward revaluation once mining share prices start to normalize.

Any additional good news from either Miller or Milestone can only generate even further upward momentum.

Mining investors may find it difficult to choose their “favourite” metals market at present, with so many experiencing bull-market conditions. With Northstar Gold, investors get exposure to several of these markets in a single package.

DISCLOSURE: This is a paid article by The Market Herald.