- StrikePoint Gold (SKP) has raised more than C$4.2 million to fund exploration work across its portfolio of precious metals assets in Canada

- Under the terms of the financing, the company issued 21,570,005 units at a price of $0.15 each, consisting of one common share and one common share purchase warrant

- StrikePoint also issued around 4.7 million flow-through units at a price of $0.21 each, consisting of one flow-through share and one share purchase warrant

- The financing included a lead order from Crescat Capital, a global macro asset management firm headquartered in Denver, Colorado

- StrikePoint Gold (SKP) is currently up 2.5 per cent and is trading at 20 cents per share

StrikePoint Gold (SKP) has raised more than C$4.2 million to fund exploration work across its portfolio of precious metals assets.

Under the terms of the placement, which was originally announced on September 8 before being upsized on September 10, the company issued 21,570,005 units at a price of $0.15 each to raise a total of $3,235,500.

These units are comprised of one common share in StrikePoint and one common share purchase warrant. Each warrant will entitle the holder to acquire an additional common share at a price of $0.25, exercisable over a period of two years from the date of issuance.

In addition, StrikePoint raised a further $1 million by issuing 4,761,906 flow-through units at a price of $0.21 each. These units were also comprised of one flow-through share and one warrant.

As consideration for their services in completing the offering, the company issued to certain finders a total of $15,597 in cash along with 103,980 share purchase warrant.

According to the original announcement on September 8, the financing included a lead order from Crescat Capital, a global macro asset management firm headquartered in Denver, Colorado.

Kevin Smith, Chief Investment Officer at Crescat, said the firm is taking a “friendly activist” approach to investing in the precious metals industry.

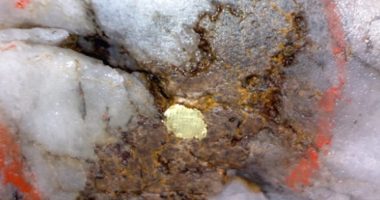

“Our goal at this stage of the cycle is to identify and invest in a portfolio of the largest and most economic new gold and silver deposits in viable jurisdictions around the world.

“We are excited about the high grade intercepts at StrikePoint’s Willoughby gold property and are eager to support the company in building out the deposit,” he added.

StrikePoint Gold (SKP) is currently up 2.5 per cent and is trading at 20 cents per share at 2:07pm EDT.