- Spearmint (SPMT) has drilled up to 1,810 ppm Li at its McGee Lithium Clay Project

- The hole in question includes 537 feet averaging over 960 ppm Li, as well as 485 feet averaging 1,003 ppm Li

- The company believes its recent results could significantly increase McGee’s resource estimate

- Spearmint Resources is a mineral exploration company focused on projects in Canada and Nevada

- Spearmint (SPMT) is up by 11.11 per cent trading at $0.15 per share

Spearmint (SPMT) has drilled up to 1,810 ppm Li at its McGee Lithium Clay Project.

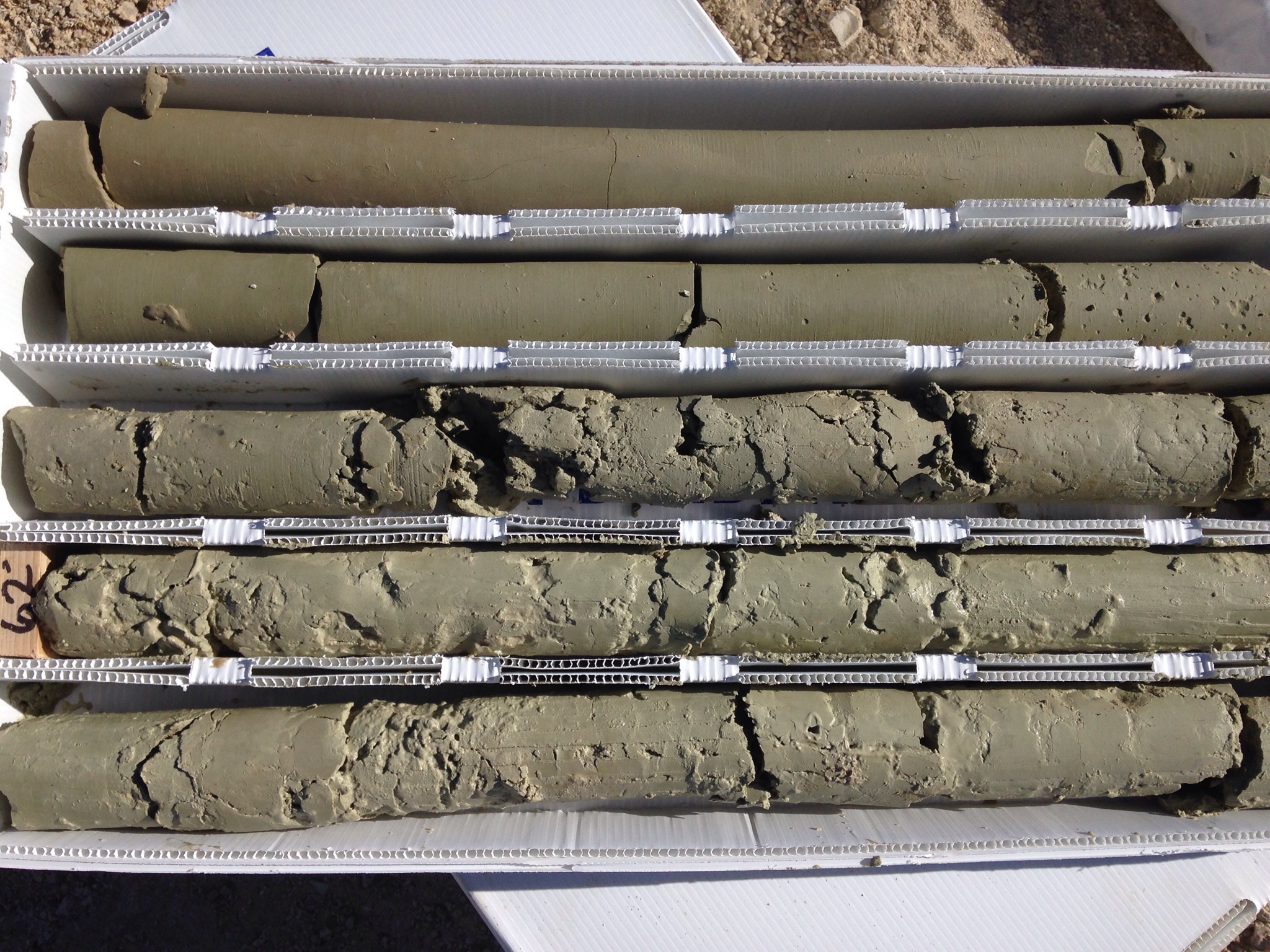

The result stems from phase III drilling on the Nevada property, which yielded the highest range of reported drill holes in the history of Clayton Valley, Nevada.

Phase III highlights:

- Hole 15 yielded 1,810 ppm Li within 537 feet averaging over 960 ppm Li, including 485 feet averaging 1,003 ppm Li

- Hole 18 yielded 1,760 ppm Li within 652 feet averaging over 895 ppm Li, including 455 feet averaging 1,004 ppm Li

- Hole 17 yielded 1,390 ppm Li within 170 feet averaging over 862 ppm Li, including 95 feet averaging 1,044 ppm Li

- Hole 16 yielded a high of 1,120 ppm Li

The company drilled holes 15 and 18 approximately 2,500 feet and 3,700 feet to the west of any hole in previous phases, suggesting they could significantly increase McGee’s resource estimate.

The property’s maiden resource estimate (June 2021) stands at 815,000 indicated tonnes and 191,000 inferred tonnes for 1,006,000 tonnes of lithium carbonate equivalent.

“We are extremely pleased to announce that our phase III drill program has discovered our best results ever on our flagship project,” stated James Nelson, President of Spearmint Resources.

Spearmint Resources is a mineral exploration company focused on projects in Canada and Nevada.

Spearmint (SPMT) is up by 11.11 per cent trading at $0.15 per share as of 10:30 am EST.