- Solar Alliance (SOLR) has released its audited financial results for 2020 highlighted by a 59 per cent increase in revenue

- Gross profit was C$914,097 in 2020 compared to C$173,541 in 2019, an increase of more than 425 per cent

- The company completed numerous solar projects in 2020, including a 200 kW system for Maker’s Mark Distillery in Kentucky

- 2021 highlights include a 56 MW facility for Green Data Center Real Estate

- Solar Alliance Energy is an energy solutions provider focused on residential, commercial and industrial solar installations

- Solar Alliance (SOLR) is up by 4 per cent and is currently trading at $0.39 per share

Solar Alliance (SOLR) has released its audited financial results for 2020 highlighted by a 59 per cent increase in revenue.

Financial Highlights

- Revenue was C$3,500,747 compared to C$2,203,699 in 2019, an increase of 59 per cent

- Gross profit was C$914,097 compared to C$173,541 in 2019, an increase of more than 425 per cent

- Operating and selling expenditures were C$2,088,345 compared to C$2,546,334 in 2019, a decrease of 18 per cent

Business Highlights

Solar Alliance signed contracts for and completed several large solar projects in 2020.

- On November 9, 2020, the company signed a contract to build a 500 kW solar system in Kentucky. The contract included an option to build an additional 500 kW system at the same location. LG&E/KU subsequently picked up the option and the full 1 MW project is currently being built

- The company completed a 2.4 MW commercial solar project for Bridgestone Americas, a subsidiary of Bridgestone Corporation, in South Carolina

- On February 27, 2020, the company announced that it had completed a 200 kW solar system at Maker’s Mark Distillery in Loretto, Kentucky

Solar Alliance has also had a noteworthy 2021 thus far:

- On February 18, 2021, the company closed a private placement for total gross proceeds of C$5,752,530

- On March 8, 2021, the company signed an agreement with Green Data Center Real Estate to commence design and detailed feasibility analysis on a 56 MW ground and roof mount solar project at a hyperscale data center in Illinois

Myke Clark, Solar Alliance’s CEO, commented,

“With the closing of our C$5.7 million financing in the first quarter of 2021 and a pipeline of projects under various stages of agreement with combined capital costs totaling approximately US$66 million, Solar Alliance is positioned for a strong 2021 and beyond.”

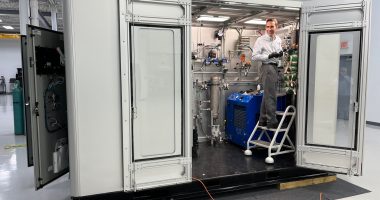

Solar Alliance Energy is an energy solutions provider focused on residential, commercial and industrial solar installations. The company operates in Tennessee, Kentucky, Illinois and North/South Carolina and has an expanding pipeline of solar projects.

Solar Alliance (SOLR) is up by 4 per cent and is currently trading at $0.39 per share as of 9:30 am ET.