By Dr. Ryan D. Long

In my last article on Silvercorp Metals (TSX:SVM, NYSE:SVM), I highlighted the golden potential of its silver operations, located in the gold-rich Qinling Orogenic Belt (Figure 1). Since then, the Company has published an updated Technical Report for the Ying Property, which outlined a Measured and Indicated Mineral Resources Estimate of 18.7 million tonnes at a grade of 242 grams per tonne (g/t) silver, 0.27 g/t gold, 3.51% lead, and 1.03% zinc, containing 146 million ounces (oz) silver, 657 thousand tonnes lead, 193 thousand tonnes zinc and 161 thousand oz gold.

This is a 64% increase in contained gold compared to the previous resource estimate and highlights the importance of gold’s contribution to Silvercorp’s future development plans, which expect to see annual gold production increase 262% by 2025 to 12,305 ounces of gold.

Gold production is expected to generate over US$20 million in revenue during FY2025 and over US$168 million over the life of mine to 2037, at the current gold price of US$1,637.35/oz, which is an impressive return from a by-product.

In this new article, I am able to give more detail on the exciting gold assay results announced to date, which highlight the potential for the Company to generate significant levels of revenue from gold mining at each operation.

What is particularly surprising about the gold mineralization within Silvercorp’s silver mines is both the prevalence of the low-angle gold-bearing structures at each operation and the high gold grades associated with each structure.

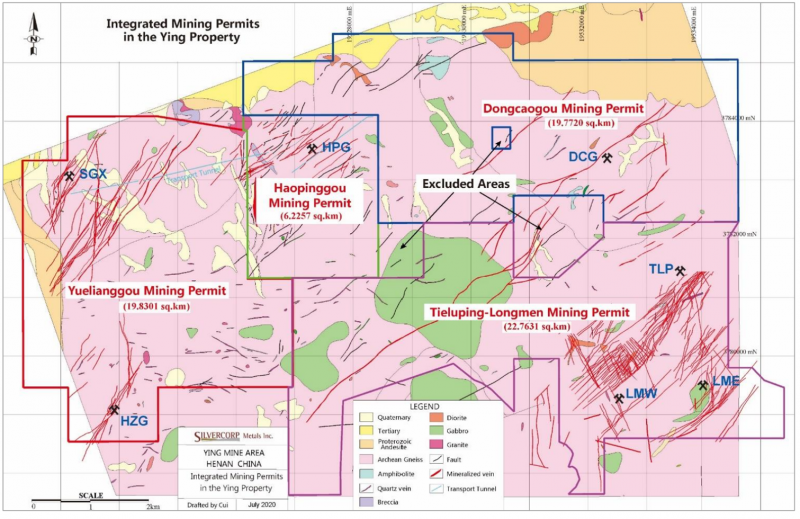

Figure 1: A Map of Silvercorp’s Ying Mining District Operations

DCG Mine

At the DGC Mine, two sub-horizontal gold-bearing veins have been discovered, C9 and C76.

The C9 Gold Vein has been defined over a strike length of 850 metres and over 150 meters down-dip. C9 is a gold vein striking north-northwest, with a dip varying between 30° and 50° to the east. It is associated with quartz and sericite alteration and minor K-feldspar alteration, with disseminated pyrite and some overprinted galena and sphalerite. The thickness of the vein ranges from 0.5 metres (“m”) to 6 m.

Over 69 holes have been drilled to define the C9 Vein, but it remains open laterally along strike and at depth. The drilling also intersected additional splay and parallel gold veins, including C9_1, C9_1E, C9E, C9W, and C9a.

Drill results from the C9 Gold Vein include:

- 3.57 m at a grade of 7.17 g/t Au and 15 g/t Ag from 81.99 m (ZKDB51BC902)

- 7.17 m at a grade of 2.92 g/t Au and 4 g/t Ag from 74.54 m, including 1.39 m at a grade of 8.93 g/t Au and 9 g/t Ag from 74.54 m (ZKDB51C903)

- 2.87 m at a grade of 4.67 g/t Au and 51 g/t Ag from 62.10 m (ZK50C903)

The C76 Gold Vein is controlled by a fault striking approximately 225° and dipping 40°-50° to the northwest. The vein pinches and swells, with horizontal thickness ranging from 0.5 to over 10 m.

The gold mineralization is associated with dark grey quartz alteration, disseminated fine-grained pyrite, and black gouge with minor galena and sphalerite. This structure intersects vein C9 with sinistral apparent displacement of around 35 m. The drilling also discovered additional splay and parallel gold veins, including C76W, C77 and C77E.

Cross-cuts from the C76 Gold Vein include:

- 5.46 m at a grade of 5.66 g/t Au, 78 g/t Ag, 1.22% Pb, 0.57% Zn, and 0.07% Cu (DCG-XPD-C76-800-400NMW-CM5)

- 1.17 m at a grade of 19.17 g/t Au, 54 g/t Ag, 0.15% Pb, 0.09% Zn, and 0.01% Cu (DCG-XPD-C76-843-400SMW-CM2)

LME Mine

At the LME Mine, sporadic drill intercepts from over 20 holes have defined a gold mineralized area of >1,500 m in length and >800 m down dip, defining a new target structure termed LM4E2.

Results include:

- 3.31 m at a grade of 4.57 g/t Au (ZKLDB2101)

- 4.21 m at a grade of 4.53 g/t Au (ZKL6713)

- 0.99 m at a grade of 4.94 g/t Au (ZKL58T1703)

- 1.10 m at a grade of 3.31 g/t of vein – ZKL5305_1 intersected

Hole ZKL6713 also discovered another low-angle dipping gold structure – LM66W. It returned a 4.51 m intercept (3.11 m true thickness) grading 4.53 g/t Au without other metals present. LM66W is believed to be another low-angle dipping gold structure located approximately 100 m below the LM4E2 structure.

LMW Mine

At the LMW Mine, a series of gently-dipping stacked gold mineralization zones, have been discovered.

Results include:

- 1.63 m at a grade of 1,984 g/t Au and 0. 49% Cu, which includes 1.08 m at a grade of 2,985 g/t Au and 0.73% Cu (ZKX0940) LM8_1

- 1.81 m at a grade of 1,715 g/t Au and 0.30% Cu (ZKX0118) LM25W

- 4.43 m at a grade of 343 g/t Au, which includes 0.89 m at a grade of 1,185 g/t Au (ZKX0934) LM12_1

- 1.89 m at a grade of 37.08 g/t Au and 0.53% Cu, which includes 1.25 m at a grade of 55.80 g/t Au and 0.56% Cu (ZKX0535) LM22

- 6.13 m at a grade of 5.23 g/t Au, which includes 1.58 m at a grade of 12.70 g/t Au (ZKX0723) LM50

- 2.34 m at a grade of 8.51 g/t Au, which includes 1.22 m at a grade of 13.30 g/t Au (ZKX0527) LM50

HPG Mine

The HPG Mine contains gently dipping veins, similar to those found at the LMW and LME mines. These veins consist of quartz and calcite veinlets with quartz-calcite-pyrite alteration and are generally dipping to the northwest at dips of around 10 degrees, with true thickness ranging between 0.5 and 2 m.

Both surface and underground diamond drilling have tested some artisanal workings in the northeast part of the HPG mining permit area and intersected high-grade gold veins. Silvercorp is planning a follow-up drilling program to further test this discovery.

- 1.45 m at a grade of 20.78 g/t Au (ZK3817)

- 4.98 m at a grade of 9.86 g/t Au (ZK2410)

- 2.24 m at a grade of 11.39 g/t Au (ZK4401)

- 1.81 m at a grade of 10.15 g/t Au (ZK2019)

SGX Mine

Exploration drilling from both the surface and underground at the north and northeast sides of the resource area discovered numerous gold-bearing veins, S16W, S18E, S7-2E, S7_2, S74, S74a, and S75, at the SGX Mine.

Gold mineralization in Ag-Pb-Zn veins, such as S16W, shows an earlier phase of mineralization which has been overprinted by Ag-Pb-Zn mineralization. Depending on the degree of overprint, gold grades in the Ag-Pb-Zn veins may vary substantially.

Results include:

- 0.48 m at a grade of 24.45 g/t Au (ZKDB72S16W02)

- 0.62 m at a grade of 5.06 g/t Au (ZK74S16W1004)

- 1.10 m at a grade of 4.97 g/t Au (ZKDB34AS8001)

Looking forward:

Silvercorp has already posted production guidance for this year, which is expected to see a 109% increase in gold production, alongside increases in silver (17%), lead (9%) and zinc (24%). During 2022, Silvercorp plans to continue drilling the newly discovered gold veins in the resource area while also commencing step-out drilling from the resource area to search for new discoveries.

In addition to this, the Company awaits the mining permit for the reactivation of the BYP Gold Mine, which currently has a Measured and Indicated NI 43-101 Mineral Resource Estimate of 421,000 ounces of gold at a grade of 3.1g/t Au and 110,000 ounces of inferred resources at a grade of 2.3 g/t Au. It could produce as much as 30,000-40,000 ounces of gold per year once in operation.

As Silvercorp continues to advance its gold discoveries, its importance to the Company and its shareholders will continue to grow, giving this silver miner some golden upside potential.

Prepared by Dr. Ryan D. Long, CEO of Mining and Metals Research Corporation Ltd., on behalf of Silvercorp Metals Inc., a Stockhouse Publishing client.