By Dr. Ryan D. Long

Silvercorp Metals Inc. has established itself as a leading silver miner.

Over the past 10 years it has produced over 56.1 million ounces of silver from its operations at the Gaocheng (“GC”) Mine and the Ying Mining District, however, it’s the gold potential at Ying that is expected take the company’s operations to the next level.

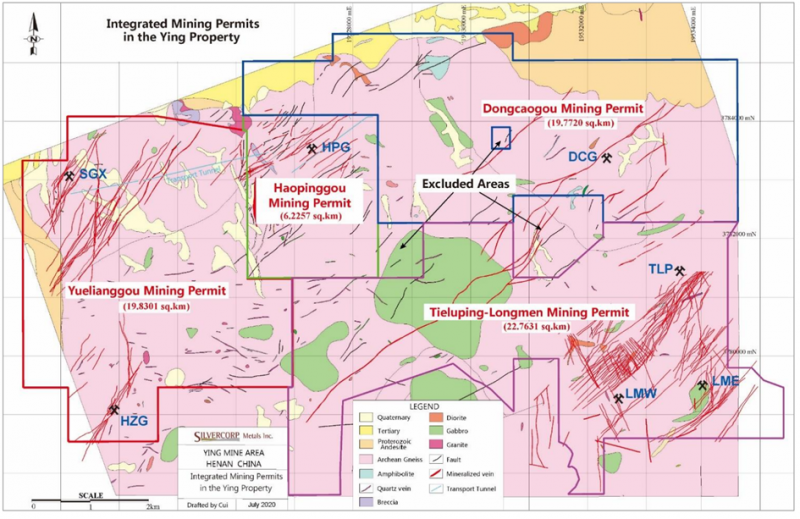

In May 2020, Silvercorp commenced its first ever drill program targeting gold, rather than silver, at the LMW, LME and TLP Mines within the Ying Mining District (Figure 1). Since Silvercorp first commenced exploration in the Ying area in 2004, it had encountered gold mineralization in many of its silver-focused drill campaigns, and even produced gold as a by-product for many years, but there was never understood to be any discreet areas of gold mineralization that could be mined separately to the silver veins.

Assume Nothing, Question Everything

A chance site visit by the management team in the months preceding this drill program changed all this. While inspecting the operations underground, CEO, Rui Feng, observed gently-dipping quartz-ankerite-sulphide shear zones (Figure 2 and 3). Sampling of these zones returned high-gold and copper grades and created a new exploration paradigm for the company.

Interestingly, as can be seen in Figure 2, the sub-vertical silver-lead-zinc veins cross-cut and over printed the sub-horizontal, gold-mineralized quartz-ankerite-sulphide shear zones, indicating that the gold veins formed earlier than the silver mineralization.

Can Lightning Strike Twice

While it may seem very unusual to have two different generations of mineralisation formed millions of years apart by different systems occurring in the same place, it is a known geological phenomenon.

In geologically active areas fluid pathways can become reopened by additional geological activity millions of years after the first mineralising event, once these pathways are open, the pre-existing mineralisation (sulphides) act as reducing agent encouraging the precipitation of additional phases of mineralisation.

A world-famous example of this is the Mount Isa lead-zinc ore bodies, which are located just a few hundred meters above several copper orebodies, despite the spatial association, the two types of mineralisation appear to have formed at completely different times and by very different fluids.

Re-examining Old Data with a Fresh Perspective

The discovery of the sub-horizontal nature of gold-related shear zones in the Ying District led Silvercorp to re-examine its database for drill intercepts with high gold grades. This study returned some impressive results, including:

- 0.28 meters at a grade of 22.65 g/t Au and 19.8% Cu (ZKX0308)

- 0.50 meters at a grade of 75.7 g/t Au and 0.35% Cu (ZKX0310)

- 0.28 meters at a grade of 63.5 g/t Au and 0.32% Cu (ZKX0309)

- 0.51 meters at a grade of 25.42 g/t Au and 15 g/t Ag (ZKX10505)

- 0.55 meters at a grade of 29.5 g/t Au (ZKL5033)

Most of these gold carrying intercepts were not mined as many tunnels advanced horizontally and did not hit these sub-horizontal shear zones, leaving the company significant gold targets for development now.

Should we be Surprised – A Silver Miner in a Gold District

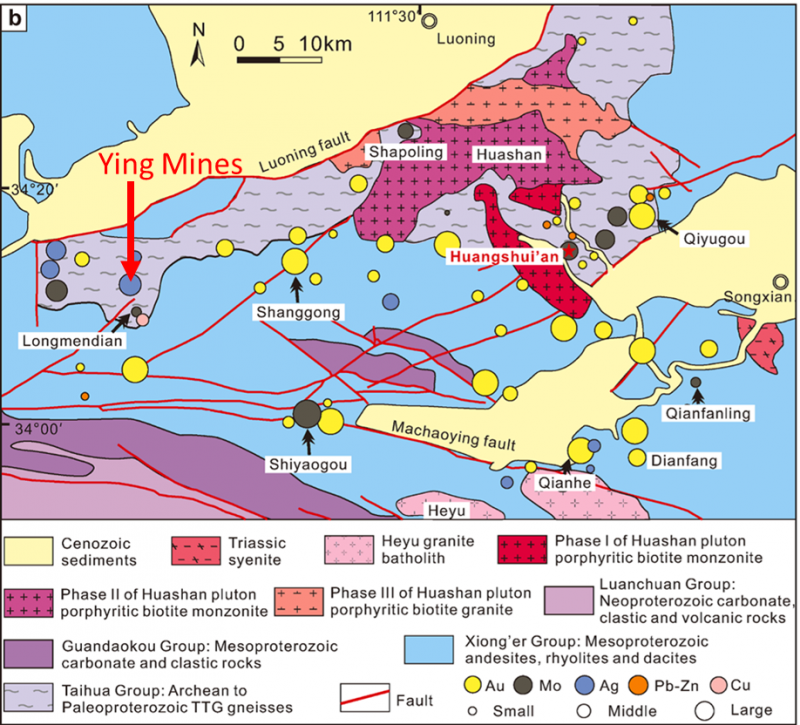

While the gold potential at Ying is a welcome surprise for shareholders, perhaps it shouldn’t have been, as gold deposits are actually the dominant deposit type in the Qinling Orogenic Belt (Figure 4). As a result, Silvercorp appears to be a silver miner in a gold camp .

Increasing Gold Production Capabilities

The exploration completed since the discovery of the first area of sub-horizontal gold-bearing mineralisation has proven that there are significant amounts of gold mineralisation within Silvercorp’s Properties.

This has led the company to increase its gold processing capabilities with the planned construction of a new 3,000 tonne per day flotation mill and tailings storage facility at a cost of US$68.7 million. The new No. 3 mill will be equipped with a Knelson gold gravity separation circuit and is designed to produce silver-lead, zinc, copper, and gold concentrates.

Once the new mill is completed, the old No. 1 mill will be decommissioned and the company will have a total processing capacity of approximately 5,000 tonnes per day.

The company expects that construction of the new mill will be completed by the end of 2023.

Prepared by Dr. Ryan D. Long, CEO of Mining and Metals Research Corporation Ltd., on behalf of Silvercorp Metals Inc., a Stockhouse Publishing client.