- Sabina Gold & Silver (SBB) completes the first two drill holes demonstrating additional high-grade mineralization at Umwelt

- Results from drill hole 22GSE605 demonstrate the excellent potential for additional mineralization outside of the current mine plan

- These new assays continue to support the continuity of higher-grade portions of mineralization modelled in the resource

- Six of the drill holes (results pending) tested mineralization within the resource envelope over a plunge extent of 200 m

- All samples are sent to ALS Global laboratories locations in Yellowknife and Vancouver, where they’re processed for gold analysis by 50-gram fire assay

- Sabina Gold & Silver Corp (SBB) is up 1.74 per cent, trading at $1.17 at 11:38 pm ET

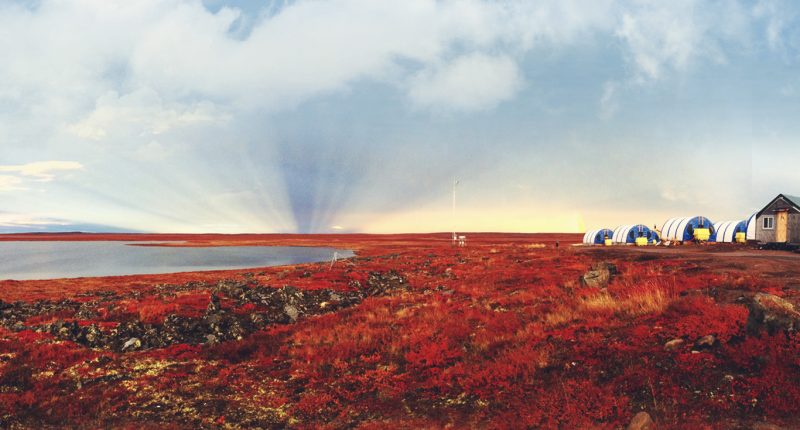

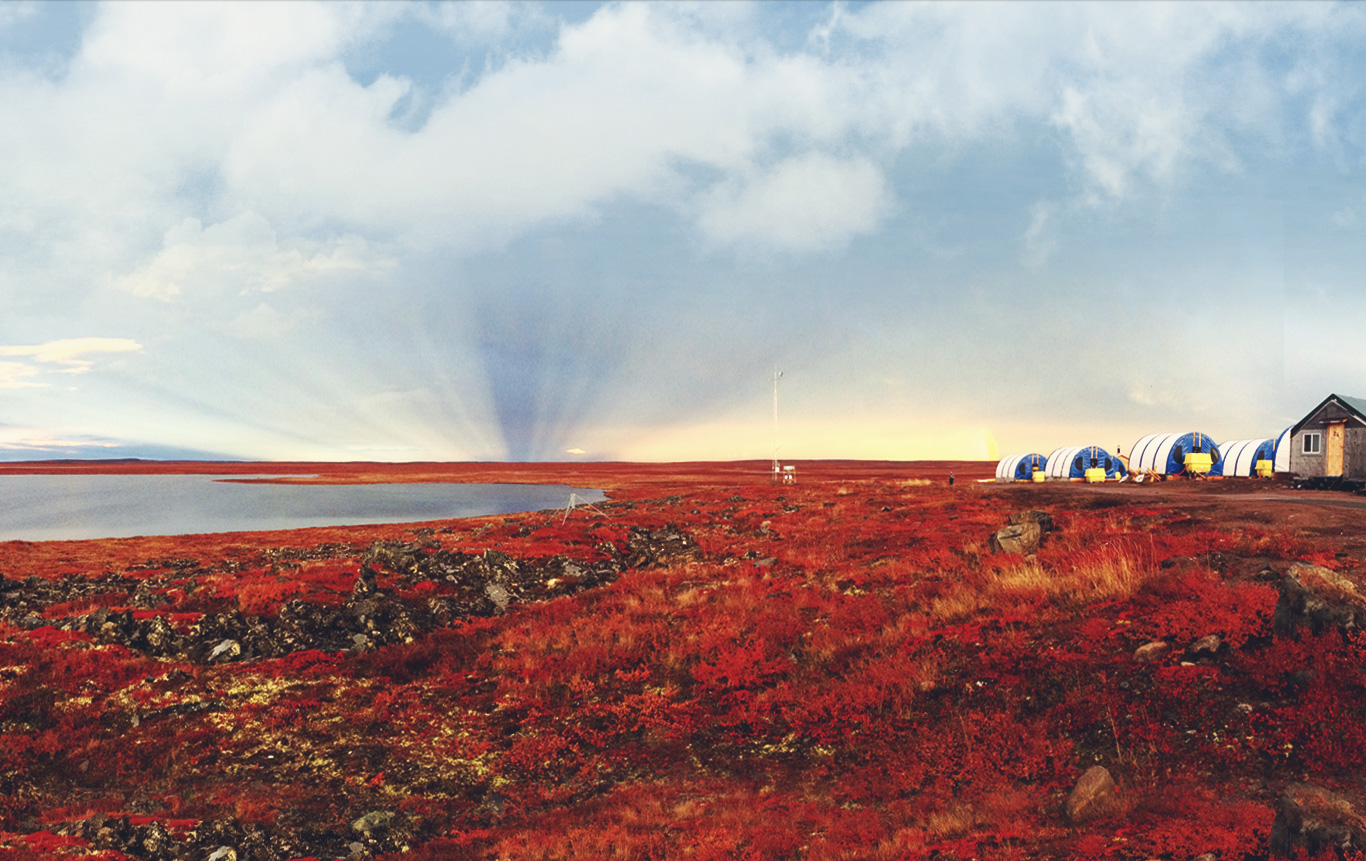

Sabina Gold & Silver (SBB) recently completed the Umwelt drilling program on its Back River Gold Project in Nunavut.

This eight-hole drilling program at Umwelt targeted select areas near the interface of the planned open pit and upper portions of the underground where potential exists for optimization of the mine plan.

Results from drill hole 22GSE605 demonstrate the excellent potential for additional mineralization outside of the current mine plan, and drill hole 22GSE606 highlights the continued opportunity for optimization of the current resource model.

These new assays continue to support the continuity of higher-grade portions of mineralization modelled in the resource.

Six of the drill holes (results pending) tested mineralization within the resource envelope over a plunge extent of 200 m with a vertical distance from the surface ranging between 115 m and 200 m.

Two additional drill holes were completed; one tested the anticline structure to the west of the high-grade corridor and outside of current planned underground mining areas.

A second was completed as a geomechanical test within the open pit.

Planned drilling for the Hook zone was deferred and announced as part of this drilling program.

“We continue to demonstrate and better define these structures two to three times the average grade of the current Umwelt underground reserve,” said Bruce McLeod, President & CEO.

“This current drilling follows on the strong results of drilling completed in 2020 at the Umwelt V2 zone, continuing to support the value of advancing the exploration ramp for better access to evaluate, grow and optimize this higher-grade material, which if accessed earlier in the mine life could improve already robust project economics,” added McLeod.

Sabina’s focus on the Umwelt deposit with drilling, core review, detailed modelling and structural interpretation over the last six years has yielded substantial exploration and optimization opportunities, both at the deposit and across the Goose Property.

A set of six drill holes targeted the intersection of the Quartz Feldspar Porphyry with the Lower Iron Formation within the short limb of the antiform/synform system; a plunging structure with significant width of exceptionally high-grade gold mineralization.

Understanding and supporting mineralization continuity down plunge through this zone is essential for planning and expansion since the deposit is open along with limbs and depth.

Drill hole 22GSE605, targeting the intrusion of a Quartz Feldspar Porphyry Dyke through the Lower Iron Formation, intersected over 30 m of mineralized iron formation, with a 10 m interval of particularly robust mineralization characterized by heavily disseminated arsenopyrite, disseminated to semi-massive pyrrhotite, and several occurrences of visible gold.

This interval corresponds with assays that returned 30.98 g/t Au over 9.90 m within a larger scale zone of strong gold mineralization.

This intercept is situated immediately below the currently planned open-pit and 10 m up-dip of the planned stopes in the permanent crown pillar, an area not presently included in the estimated Reserves.

Drill hole 22GSE606, located approximately 100m down plunge of 22GSE605, targeted the intrusion of a Quartz Feldspar Porphyry Dyke through the Lower Iron Formation within the current planned underground workings to further test the continuity of the high-grade V2 gold zone.

Like hole 22GSE605, the drill hole intersected over 40 m of well-mineralized iron formation, with an 8.0 m interval of particularly robust mineralization characterized by heavily disseminated arsenopyrite, disseminated to semi-massive pyrrhotite, and several occurrences of visible gold.

All drill core samples selected within the exploration program are subject to a company standard of internal quality control and quality assurance programs, including the insertion of certified reference materials, blank materials, and duplicate analysis.

All samples are sent to ALS Global laboratory locations in Yellowknife, Northwest Territories and Vancouver, British Columbia.

They are processed for gold analysis by a 50-gram fire assay with a finish by atomic absorption and gravimetric methods.

Additionally, analysis by screen metallic processes is performed on select samples.

Sabina Gold & Silver Corp. is an emerging gold mining company that owns 100 per cent of the district scale, advanced, high-grade Back River Gold District in Nunavut, Canada.

Sabina Gold & Silver Corp (SBB) is up 1.74 per cent, trading at $1.17 at 11:38 pm ET.