- Rockcliff’s $2.5 million fully funded drill program is now permitted

- The drill program is focused on two priority targets: the Copperman Property and the TGR NI-PGE Prospect

- Wildfire activity in the Snow Lake area resulted in the Manitoba Government restricting exploration in the region affecting the company’s Tower TGR Ni-PGE Prospect and planned airborne survey

- Rockcliff has chosen not to exercise its option to lease the Bucko Mill from CaNickel Mining Limited

- Rockcliff is a Canadian resource development and exploration company

- Rockcliff Metals Corporation (RCLF) opened trading at C$0.07 per share

Rockcliff Metals (RCLF) is pleased to provide an update on its 2021 exploration program.

The $2.5 million fully funded drill program is now permitted to begin at the Copperman Property where +5,000 metres of drilling is planned to commence this month.

Don Christie President and CEO commented,

“Extreme wildfire activity in the Snow Lake area resulted in the Manitoba Government restricting exploration activities in the region including the recently announced drill program at our Tower TGR Ni-PGE Prospect as well as our planned airborne flying. Our Copperman drill permit has just been reinstated with drilling to commence shortly. While we are disappointed that our other exploration programs have been curtailed for now, the safety of our field crew and contractors remains our top priority. We intend to resume our additional exploration as soon as possible once all other permits are reinstated”.

The drill program is focused on two priority targets.

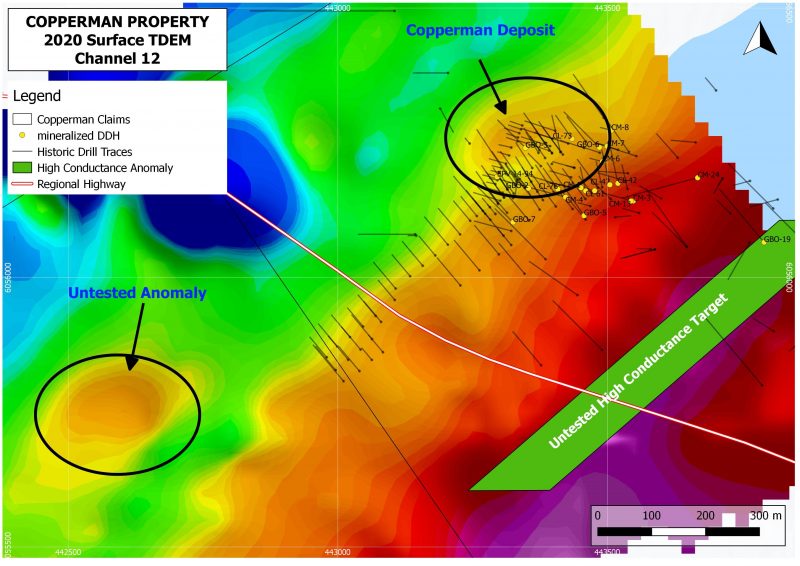

The first target is the Copperman Property where two high-priority geophysical targets remain untested as well as the historical high-grade Copperman deposit.

The second target is the TGR NI-PGE Prospect discovered in 2020 at the Company’s Tower Property.

Both of these projects are 100% owned by Rockcliff. In addition to the drill program, the company will complete over 2,200 kilometres of airborne geophysical flying and geological and ground geophysical surveys scheduled for September, weather permitting.

Copperman Cu-Zn Deposit and Nearby Anomalies, Copperman Property:

Planned 10 holes, +5,000 metres.

Approximately ten holes totalling 5,000 metres are planned. The drilling will test the historical Copperman Cu-Zn Deposit and several nearby untested surface geophysical anomalies. The Copperman Cu-Zn Deposit was discovered in 1927 by surface trenching. Mineralization is associated with at least three high-grade lenses. Historical near-surface drill results documented in the Manitoba Mineral Deposits Database; Deposit # M63J/12-004 included:

- 8.3 metres grading 3.62% copper, 2.59% zinc

- 9.7 metres grading 1.69% copper, 5.05% zinc

- 7.0 metres grading 8.09% copper, 7.29% zinc

- 7.6 metres grading 1.85% copper, 4.58% zinc

Historical drill results cannot be relied upon for a basis for future drill results.

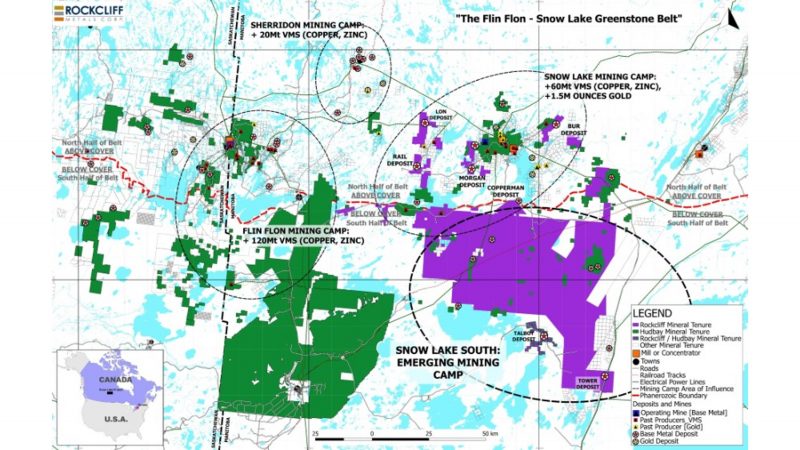

TGR Ni-PGE Prospect, Tower Property:

Planned 4 holes, 1,000 metres.

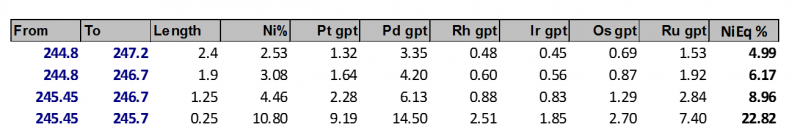

Four holes totalling 1,000 metres are planned (pending the lifting of fire restrictions) at the high-grade TGR Ni-PGE Prospect to follow up on the discovery hole and additional drilling completed in 2020. The TGR Ni-PGE discovery hole was initially tested for potential VMS mineralization associated with a large interpreted VMS target located 600 metres south of the Company’s copper-rich Tower Deposit. The 2020 discovery hole intersected significant nickel-PGE mineralization at a downhole depth of 244.8 metres.

Nickel Equivalent (“NiEq”) metals values used were US$6.10/pound nickel, US$1,450/ounce palladium, US$865/ounce platinum, US$6,000/ounce rhodium, US$1,675/ounce Iridium, US$400/ounce osmium and US$280/ounce ruthenium. No process recoveries or smelter payables were included in the calculation. True thickness is not presently known at this time.

SLS #1-#5 Properties:

Airborne VTEM survey.

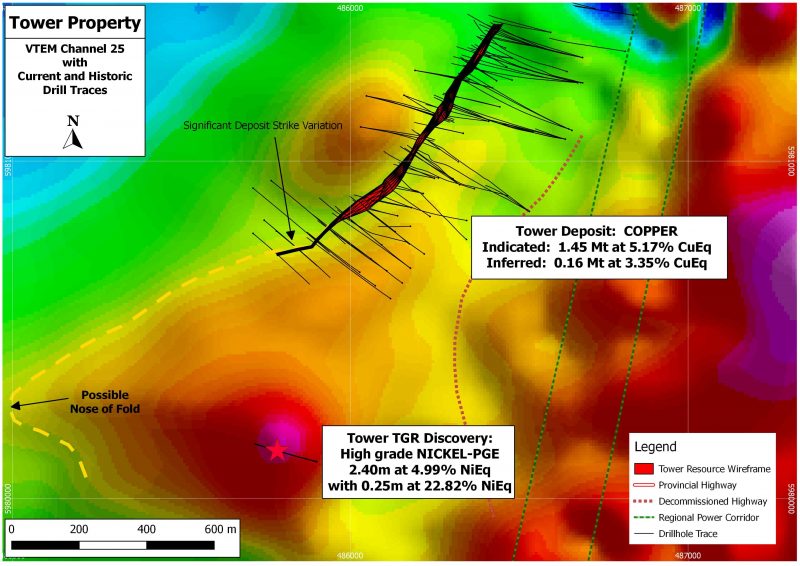

The favourable VMS geology within the Company’s 100% owned SLS properties are buried under a thin limestone cover. The SLS properties represent a significant and strategic land package of underexplored VMS potential located in the southern half of the prolific Belt that hosts the Flin Flon and Snow Lake VMS mining camps. A total of over 2,200 kilometres of airborne VTEM flying will be completed over specific strategic areas of the properties that represent high-priority areas interpreted as VMS conductive trends. The purpose of the program will be to isolate anomalies with potential VMS upside in preparation for a planned drill program in early 2022.

Bucko Mill

The company has decided not to exercise its option to lease the Bucko Mill from CaNickel Mining Limited. Management has determined that the capital cost and milling capacity of currently available, portable on-site milling facilities will provide a superior milling solution for Rockcliff’s multiple deposits. As an owned, not leased asset, the portable mill represents better value-for-money and provides the company with more long-term milling certainty on an acceptable life-of-mine basis which is not available under the current terms of the Bucko Mill lease agreement.

Rockcliff is a Canadian resource development and exploration company with several advanced-stage, high-grade copper and VMS dominant deposits in the Snow Lake area of central Manitoba.

Rockcliff Metals Corporation (RCLF) opened trading at C$0.07 per share.