- Pure Gold Mining (PGM) has announced a non-brokered private placement for gross proceeds of $30 million

- The company will issue 200,000,000 units at a price of $0.15 per unit

- Pure Gold may elect to upsize the offering for aggregate gross proceeds of up to $40 million

- The offering is expected to close on or about May 13, 2022

- PureGold is a Canadian gold mining company, located in Red Lake, Ontario

- Pure Gold Mining Inc. (PGM) opened trading at C$0.185 per share

Pure Gold Mining (PGM) has announced a non-brokered private placement for gross proceeds of $30 million.

The company will issue 200,000,000 units at a price of $0.15 per unit. Each unit will consist of one common share and one common share purchase warrant. Each transferrable warrant will entitle the holder to acquire one additional common share at a price of C$0.18.

Pure Gold may elect to upsize the offering for aggregate gross proceeds of up to $40 million based on demand.

The company has agreed to pay a cash finder’s fee of 6 per cent of the aggregate proceeds raised from subscriptions arranged by certain finders.

AngloGold Ashanti Limited, Pure Gold’s largest shareholder, has the right to maintain its pro-rata ownership interest in the company of up to 19.9 per cent.

The offering is expected to close on or about May 13, 2022, and is subject to the receipt of all applicable regulatory approvals including the approval of the TSX Venture Exchange.

The securities issued will have a hold period of four months.

Terry Smith, Chief Operating Officer of PureGold commented on the capital raise.

“This financing will give the company the opportunity to get back on track to becoming a great new mining business in Canada. We have all the ingredients we need to turn around the operation including a strong geological understanding of the asset, a newly established lower cost base, and a talented team that can deliver. We are excited to get to Q3 when we’ll be operating a stable, cash-flowing operation, with a new technical report coming soon thereafter outlining the bright future that the PureGold Mine has.”

Proceeds will be used to ramp up the PureGold Mine to 800 tpd by Q3 2022 and for general corporate purposes.

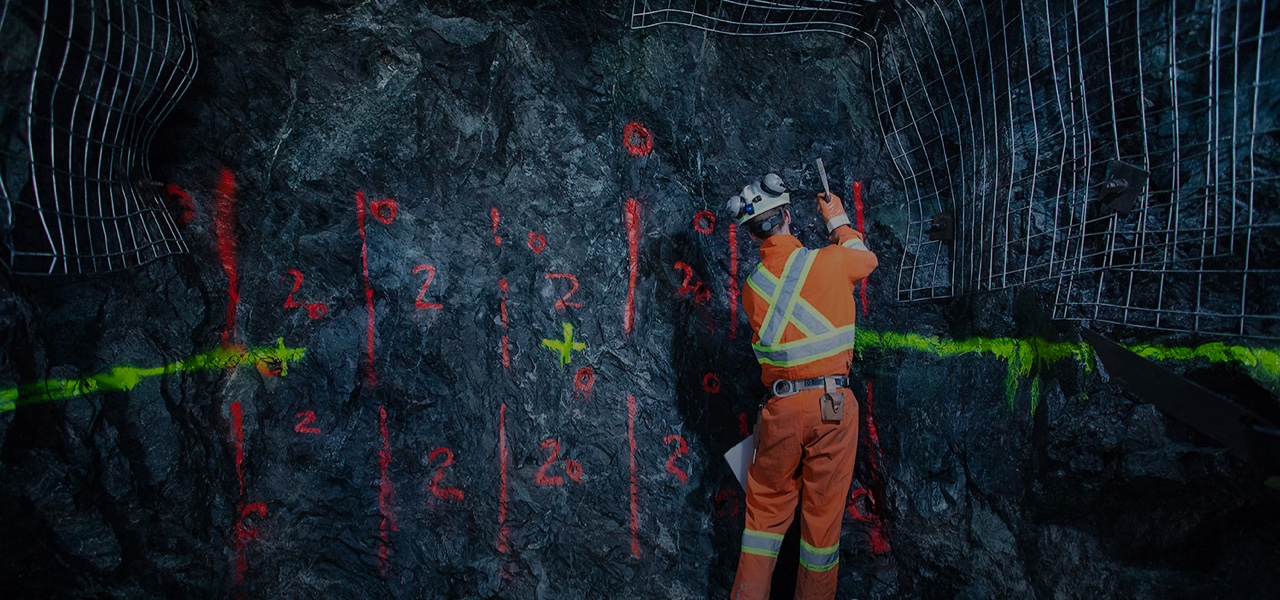

PureGold is a Canadian gold mining company, located in Red Lake, Ontario. The company owns and operates the PureGold Mine, which entered commercial production in 2021.

Pure Gold Mining Inc. (PGM) opened trading at C$0.185 per share.