- Psyence Group (PSYG) has amended and closed the first tranche of its previously announced amended, non-brokered private placement

- The private placement was changed from an offering of unsecured convertible promissory notes to an offering of units

- Each unit consists of one $1,000 note and 1,667 share purchase warrants

- Psyence is a public life science biotechnology company focused on natural psychedelics

- Psysence Group Inc. (PSYG) opened trading at C$0.10 per share

Psyence Group (CSE:PSYG) has closed the first tranche of its amended, non-brokered private placement for gross proceeds of $1.273 million.

The private placement was changed from an offering of unsecured convertible promissory notes to an offering of units.

Each unit consists of one $1,000 note and 1,667 share purchase warrants. The notes are convertible at any time and will be automatically converted upon the occurrence of certain events at a 20 per cent discount to the market price of the company’s common shares at the time of conversion. The notes will mature 24 months from the date of issuance and bear interest at a rate of 8 per cent per annum.

Each warrant is exercisable to purchase one common share at any time prior to September 2, 2024 at a price of $0.30.

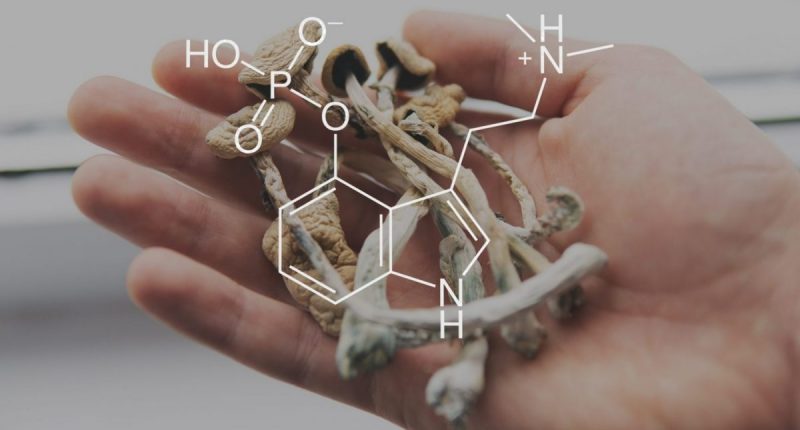

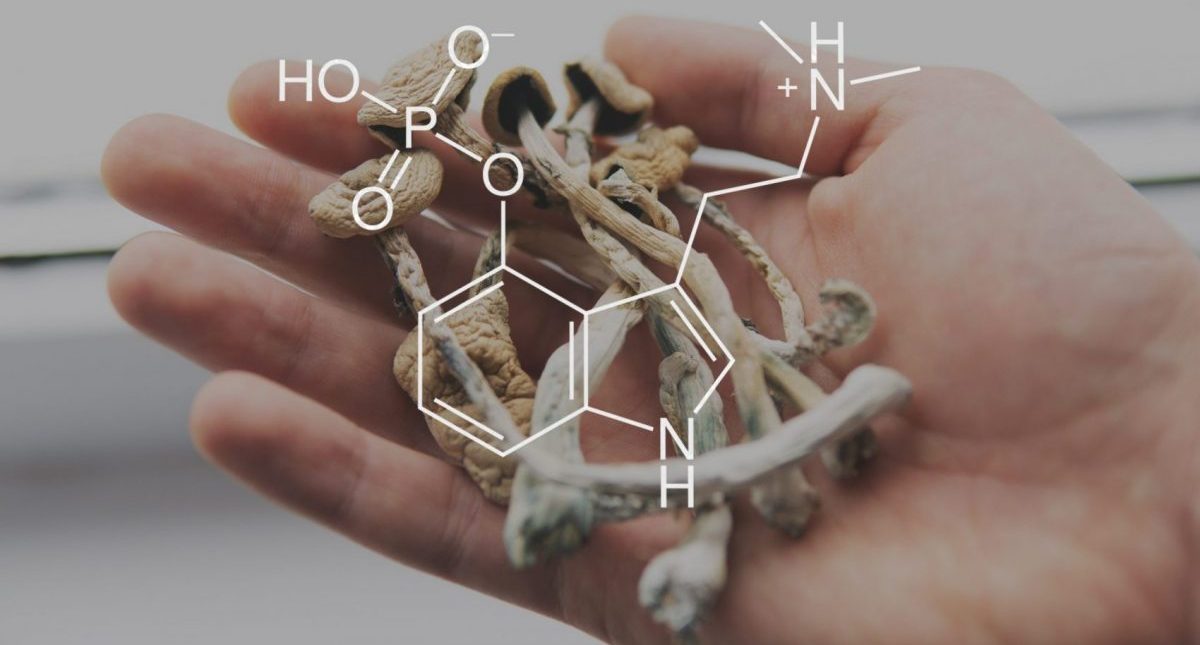

Psyence is a public life science biotechnology company with a focus on natural psychedelics. Psyence works with natural psilocybin products for the healing of psychological trauma and its mental health consequences in the context of palliative care.

Pysence operates one of the world’s first federally licensed commercial psilocybin mushroom cultivation and production facilities in Lesotho, Southern Africa.

Psysence Group Inc. (PSYG) opened trading at C$0.10 per share.