- Paycore Minerals (CORE) has completed its previously-announced bought-deal offering

- The company sold 11,293,000 common shares at a price of $1.63 for total gross proceeds of approximately $18.4 million

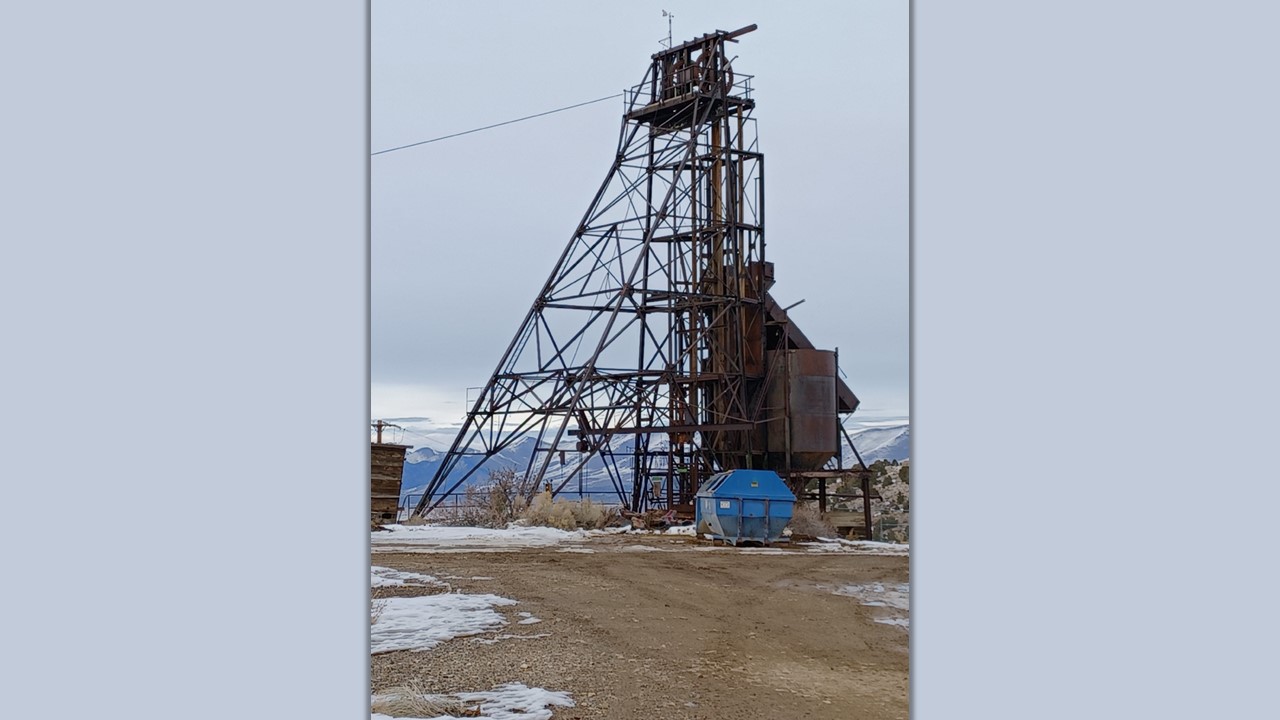

- The company plans to use the net proceeds to fund ongoing development and permitting activities at its FAD Property in Nevada

- Paycore Minerals is a Canadian mineral exploration company which holds an interest in the FAD Property located on Nevada’s Eureka-Battle Mountain Trend

- Paycore Minerals (CORE) was down 1.818 per cent, trading at $1.62 per share

Paycore Minerals (CORE) has completed its previously-announced bought-deal offering.

The company sold a total of 11,293,000 common shares at a price of $1.63 for gross proceeds of approximately $18.4 million, including the full exercise of the over-allotment option.

The offering was led by PI Financial Corp. and CIBC Capital Markets, with participation from Canaccord Genuity Corp. and Paradigm Capital.

The company plans to use the net proceeds to fund ongoing development and permitting activities at its FAD Property in Nevada, as well as for working capital and general corporate purposes.

Paycore Minerals is a Canadian mineral exploration company which holds an interest in the FAD Property located on Nevada’s Eureka-Battle Mountain Trend.

Paycore Minerals (CORE) was down 1.818 per cent, trading at $1.62 per share as of 1:52 pm ET.