- Outcrop (OCG) has released results from three drill holes from its Santa Ana Project in Colombia

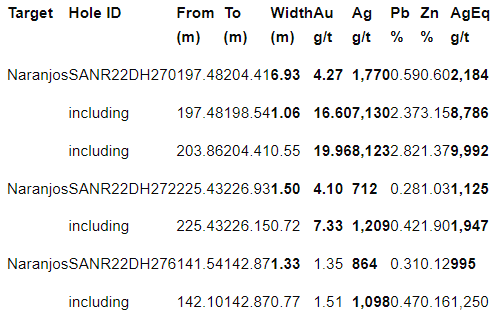

- Highlights include 6.93 m of 2,184 g/t silver equivalent, including 1.06 m of 8,786 g/t silver equivalent

- The company is confident it will be able to extend Santa Ana’s mineral resource as it tests additional vein systems

- Outcrop Silver & Gold is rapidly advancing five silver and gold exploration projects in Colombia

- Outcrop (OCG) is unchanged trading at $0.14 per share

Outcrop (OCG) has released results from three drill holes from its Santa Ana Project in Colombia.

Santa Ana comprises 36,000 hectares covering most of the Mariquita District, which is the highest-grade primary silver district in Colombia.

Drilling focused on the Los Naranjos vein yielding the thickest and highest-grade intercepts to date on Santa Ana.

The company has drilled eighteen holes on the vein to date; eight have returned high-grade assays while three holes have pending assays. Drilling shows a weighted average grade of 1,651 g/t silver equivalent over an average width of 1.72 m.

Los Naranjos is 200 m wide, extends from surface to 250 m in depth, and is open in all directions with common showings of native silver, coarse electrum and abundant silver-bearing sulfosalts.

Outcrop believes it can significantly expand Santa Ana mineralization along surface and at depth.

“We should be able to consistently increase resource potential as we test the virgin Aguilar vein system, which is notable for its thickness and high grades in historic adits, and our Frias Mine vein system, which has historic production of 7.8 million ounces at 1.3 kilograms silver equivalent per tonne recovered grade from a footprint about the same size as Naranjos,” stated Joseph Hebert, Outcrop’s CEO.

Outcrop Silver & Gold is rapidly advancing five silver and gold exploration projects in Colombia.

Outcrop (OCG) is unchanged trading at $0.14 per share as of 11:19 am EST.