- Osisko Gold Royalties (OR) has signed a deal to establish a new company to advance its Cariboo Gold Project, as well as a number of other key assets

- Under the terms of the deal, the company will transfer the properties to Barolo Ventures, along with a portfolio of securities valued at roughly C$116 million

- In return, Osisko will receive shares in TSX Venture Exchange-listed Barolo, which will result in a reverse take-over and the formation of Osisko Development

- As part of the take-over, Osisko and Barolo will undertake a placement to raise up to $100 million

- Osisko Gold Royalties (OR) is currently up 6.97 per cent to $12.74 per share at 10:08am EDT

Osisko Gold Royalties (OR) is establishing a new company to advance its Cariboo Gold Project and a number of other key assets.

Under the terms of the agreement, Osisko will transfer a number of properties to TSX Venture Exchange-listed Barolo Ventures along with a portfolio of securities valued at approximately C$116 million.

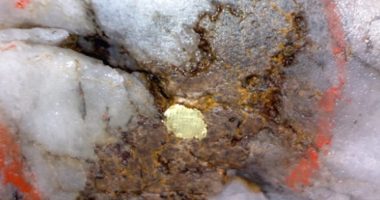

On top of the Cariboo Gold Project in British Columbia, these properties include the San Antonio Gold Project in Mexico, Bonanza Ledge II in British Columbia, and the James Bay and Guerrero properties.

In exchange, Osisko will receive shares in Barolo, constituting a reverse take-over and the formation of Osisko Development.

Sandeep Singh, President of Osisko Gold Royalties, said the spin-out transaction will simplify the company as a pure-play royalty and streaming entity.

“We are also transferring our exceptional technical team to Osisko Development in order to better leverage their mine building expertise, while retaining access to the team on an as-needed basis.

“Osisko Royalties will also retain royalty and streaming interests in the transferred assets that, when in production, could potentially deliver approximately 20,000 gold-equivalent ounces per annum to Osisko Royalties,” he added.

As part of the take-over, Osisko and Barolo will launch a bought deal offering to raise up to $100 million through the issue of 13,350,000 subscription receipts in Osisko Development at a price of $7.50 each.

The offering will be led by Canaccord Genuity and National Bank Finance on behalf of a syndicate of underwriters, who have the option to purchase an additional 3.3 milliion subscription receipts for a further $25 million.

Sean Roosen, Chairman and CEO of Osisko Gold Royalties, noted that Osisko Development is being established to advance a rare set of near-term producing gold assets.

“Our vision is to develop the Cariboo Gold Project into one of the predominant mining camps in Canada.

“Our belief in that vision has only strengthened in the past year and I couldn’t be more excited about leading this new company with the catalysts in front of us,” he said.

With Sean making the transition to lead Osisko Development, Sandeep will take over as CEO of Osisko Gold Royalties, pursuant to a succession plan that was developed earlier this year.

Osisko Gold Royalties (OR) is currently up 6.97 per cent to $12.74 per share at 10:08am EDT.