- Organigram Holdings (OGI) has announced the launch of HOLY MOUNTAIN, the company’s newest value brand

- It features an initial lineup of dried flower strains and value pressed hash

- Organigram is a licensed producer of cannabis and cannabis-derived products

- Organigram Holdings Inc. (OGI) is down 0.75 per cent, trading at C$1.33 per share at 12:47 pm ET

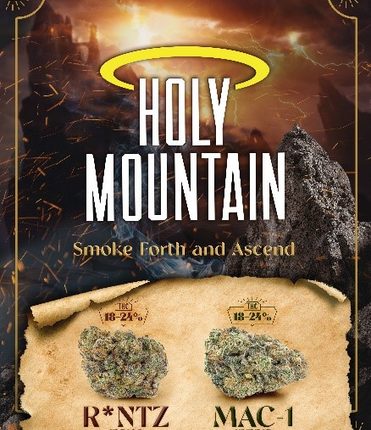

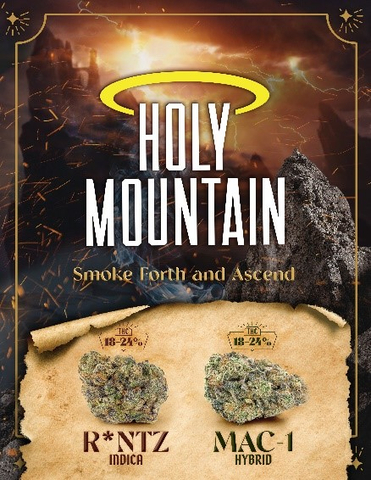

Organigram Holdings (OGI) has announced the launch of HOLY MOUNTAIN, the company’s newest value brand.

It features an initial lineup of dried flower strains and value-pressed hash. With the introduction of HOLY MOUNTAIN, Organigram will now offer value-priced flower in an expanded range of sizes. At launch, it starts with 3.5g offerings, with additional sized formats expected soon after.

Eric Williams, Senior Director of Marketing at Organigram commented on the news.

“The HOLY MOUNTAIN brand will feature iconic flower cultivars, including MAC-1 and R*NTZ. Additionally, the 2g Pressed Hash Cube represents the newest hash product. It is produced at our Quebec-based hash facility located in the foothills of the Tremblant Mountain.”

The first HOLY MOUNTAIN products to come to market are:

- R*NTZ: it features fruit, berry and gas aromas and offers a THC range of 18-24 per cent

- MAC-1: MAC-1 buds pair 18-24 per cent THC with citrus, diesel and spice aromas

- PRESSED HASH: is a 2g hash cube. It features classic rich, spicy and herbal aromas and THC of 29-36 per cent

The company has also launched a new value brand Wô Lá, which has the same value flower focus as HOLY MOUNTAIN. However, it is created specifically for the Quebec market. Both HOLY MOUNTAIN and Wô Lá are now available at select retailers across Canada.

Organigram is a licensed producer of cannabis and cannabis-derived products.

Organigram Holdings Inc. (OGI) is down 0.75 per cent, trading at C$1.33 per share at 12:47 pm ET.