Drill ready. First Nations compliant. A huge, underexplored, land package in one of Canada’s most historic and prolific metals & mining jurisdictions. This…is the proverbial motherlode when it comes to early-stage mining companies.

And, this is Noble Mineral Exploration Inc. (NOB) (TSXV:NOB, OTCQB:NLPXF, Forum) – a Toronto-based junior exploration company holding several highly prospective properties in some of Canada’s most prolific mining jurisdictions, namely the historic Abitibi Greenstone belt. Of note, Noble currently believes it may possess one of Canada’s few deposits of niobium and rare earth elements.

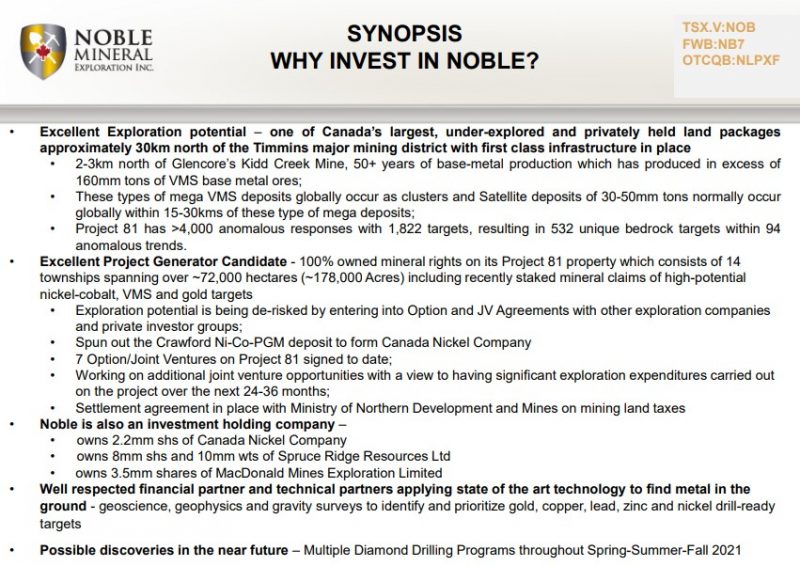

Operating essentially as a project generator, Noble minimizes risk on its projects through data compilation and exploration in order to generate option and joint venture exploration programs to benefit shareholders. The company has been incredibly successful in building a portfolio of securities, royalties, and joint venture (JV) partners and say they will continue to build wealth through its unique project generator business model.

In addition to its shareholdings in Canada Nickel Company Inc. (CNC) (TSXV:CNC, Forum), Spruce Ridge Resources Ltd. (TSXV:SHL), and MacDonald Mines Exploration Ltd. (TSXV:BMK), along with its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, NOB will continue to hold approximately 36,400 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81, including a 50% interest in recently acquired claims in Carnegie, Prosser, Wark, and Kidd Townships (6,600 hectares) and an Option on 4,800 hectares in Calder Township, as well as an additional 11,000-plus hectares in the Timmins area and approximately 14,400 hectares of mining claims in Central Newfoundland and Labrador.

Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal targets at various stages of exploration. The Company also holds its recently acquired ~14,600 hectares in the Nagagami Carbonatite Complex near Hearst, Ontario, as well as ~3,700 hectares in the Buckingham Graphite Property, over 500 hectares in the Laverlochere nickel, copper, PGM property and close to 500 hectares in the Cere-Villebon nickel, copper PGM property, all of which are in the province of Quebec.

In addition, Noble has recently optioned to acquire 100% of claims to 204 claim units near Hearst, Northern Ontario – the Boulder Project. A 140 kilogram boulder was found in the area containing significant concentrations of base and precious metals. The significant discovery of the highly mineralized boulder was in an area that has not seen much past exploration. The discovery of the source of the boulder would be an important mineral find.

To date, Noble has been incredibly successful in building a portfolio of securities, royalties and joint venture partners and will continue to build wealth through the project generator model.

Projects currently under development and their affiliated resources:

- Nickel-Cobalt / Volcanogenic Massive Sulphide (VMS) Gold in the Timmins-Cochrane area of Northern Ontario, for which it holds the mineral rights.

- Niobium and Rare Earths in the Nagagami River Carbonatite prospect near Hearst in Northern Ontario.

- Copper-PGM in the optioned claim units on the Boulder Project near Hearst in Northern Ontario.

- Graphite on the Buckingham Graphite property in the Outaouais area of Western Quebec.

- Copper-Nickel-PGM on the Cere-Villebon property near Val d’Or, Quebec.

- Nickel-Copper-Cobalt-Gold and PGM on the Laverlochere property near Rouyn-Noranda, Quebec.

- Volcanogenic Massive Sulphide (VMS) deposits of copper and gold in Central Newfoundland and Labrador.

In the News

On May 19th 2022, NOB reported on the proposed programs for a number of its active projects. Here are the details:

- Analyses received for Dargavel Drill Program

- Early Exploration Permit for drill program applied and circulated to First Nations for review for the Lennox Calder Project. Drilling expected to begin in July – August

- Crews mobilized to Buckingham Graphite Property for Phase 1 exploration

- Nagagami drill program set for September. Permit approved and talks with Constance Lake First Nation continue.

- Airborne Survey on Cousineau Boulder Project expected to be flown in July.

- An airborne geophysical survey on Island Pond, Newfoundland is scheduled for late September

- Ground program on Laverlochere and Cere Villebon planned for this summer.

From the CEO

H. Vance White is the President & Chief Executive Officer of Noble Mineral Exploration. And has served as President of the Company since 2003. He has served as a director since 1983. Mr. White has also been a director and/or officer of several other reporting issuers, including AfriOre Limited and Dickenson Mines Limited.

In conversation with the Market Herald Canada, Mr. White discussed Noble Mineral Exploration’s past, present, and future potential is some of the Abitibi Greenstone Belt’s most

TMH: To start off with, Vance, for those that may be discovering your company for the first time, can you please give us a little background history about yourself and a brief overview of your exploration operations, particularly in the Timmins-Cochrane area of Northern Ontario?

VW: My background has been primarily in the investment banking business and the mineral exploration and development field. In the mineral field I was part of the Executive team that ran the Dickenson Group of Companies which Operated the A W White gold mine in Red Lake until it was taken over by Goldcorp. I then put together a South African based company that later, discovered a Platinum deposit in the Bushveld and subsequently was taken over by UK based Lonmin. I then took control of Hawk Junction Capital (a predecessor of Noble Mineral) and we acquired control of 52,000 hectares of the Abitibi Bowater Camp 40 (now referred to as Project 81). This was a result of an equity financing by IBK and convertible debt financing from Franco Nevada. Our interest in the project was sparked by a reported drill hole by Inco in Kingsmill Twp (approximately 1265’ of 0.36% Nickel) drilled in the 1960’s in a totally underexplored area but with all the infrastructure one could want (road, rail, power, service suppliers in a geo-politically safe jurisdiction).

TMH: Can you update our investor audience and your Noble shareholders on any new company developments, especially an update on Dargavel, Nagagami, Island Pond, and Buckingham Projects?

VW: Dargavel results are out in Noble News release dated 19-05-22 and due to ground conditions, any follow up work would be a winter drill program. Nagagami – First Nation talks are underway, and we expect to have an Exploration Agreement in the very near term. We are currently lining up a helicopter supported drill program for this field season. At Island Pond Newfoundland – modern Airborne EM/Mag lined up for September for the 25km strike magnetic anomaly. We currently have a crew at Buckingham Graphite for drill collar locations, sampling, mapping, and to complete a surficial conductivity survey. They will then move on to Cere-Villebon and Lavelochere (both Ni-Cu-PGM projects).

TMH: What about the Boulder Play? Some amazing assay results here that you’ve called “a very significant discovery” including 140-kilogram Boulder discovered containing 71.8% Copper, 252 g/t Silver, 3.79 g/t Gold and 6.65 g/t PGMs.

VW: These are astonishing results and should the source of the boulder be found could very well lead to a very significant discovery. Airbourne EM/Mag scheduled for July with drill follow up in the summer.

TMH: Looking at the Canadian nickel industry what should investors know about its importance in the EV revolution?

VW: Think about the ~$15 billion being invested by the Federal Government, provinces and private sector in the Windsor and Beaconsfield battery plants and automotive sector alone. If they are to be brought online by 2025, where will they be getting their Nickel feedstock? If it is to be a domestic source the new Nickel discoveries such as the Canada Nickel Crawford deposit will likely have to be fast tracked.

TMH: And you just released your exploration update for year-to-date. What are some of the highlights from last year and what can investors expect moving forward into 2022 and beyond?

VW: The acquisitions of the new projects in unexplored or underexplored areas are a bonus. Any success in these projects will greatly benefit Noble.

TMH: What differentiates Noble from the competition in the critical minerals exploration space and what makes your business model unique?

VW: We feel it is likely that all the low hanging fruit has been picked so to find elephants you have to look where they ‘ain’t.’

TMH: Any other recent timely and topical company news we should know about?

VW: Several big projects in the works. Will release news as they evolve.

TMH: Can you discuss the long-term exploration strategy for the company moving into 2022 and beyond?

VW: Carry out the early risk (airborne and /or ground survey, drill 3-4 holes) and upon results bring in an Option/JV partner.

TMH: I have to mention your stock has been on a bit of a roller coaster ride this past year. What can you tell our investor audience regarding the current valuation of your stock and why you think it’s a good buy right now?

VW: The entire Junior Market has been hit. You must remember that a large part of the sell off in Noble is due to the Canada Nickel distribution in April which at the time was the equivalent of ~$0.05 per Noble share. At today’s market price it would be the equivalent of ~$0.10-11 ($0.065 + $0.037). We believe the Noble shares at today’s price with all that is going on is a buy.

The Bottom Line

The project generator model is not new, but for new investors looking to get into the metals & mining marketplace for the first time, a smart, well researched play by seasoned explorationists with strong working capital like Noble Mineral Exploration could be a value option. plus, getting on the watchword commodities of the time – nickel, copper, cobalt, graphite, niobium, rare earths, PGMs, and gold – always makes sense.

For more information, visit www.noblemineralexploration.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.