Graphite has long been renowned as a top conductor of heat and electricity and boasts the highest strength of any natural material. While being a well-established and crucial material in steel making, graphite has been overlooked as an essential part of vehicle electrification – a hot sector for the mining industry, as well as investors engaged with this market and looking for other critical battery materials to invest in besides lithium.

Focused on mine-to-market commercialization of graphite products for a range of mass-market products, NextSource Materials Inc. (TSX: NEXT, Forum) is intent on becoming a fully integrated, global supplier of critical battery and technology materials needed to power the sustainable energy revolution. And based on NextSource’s current stage of development, it is well ahead of the pack in achieving its goal.

The Toronto-based company’s Molo graphite project in Madagascar is one of the largest known and highest-quality graphite deposits globally, and the only one with SuperFlake® graphite. Most importantly, the company is scheduled to commission Phase 1 of its Molo mine this fall and once complete, will be the only junior graphite company outside of China to enter production this year. NextSource is also the only graphite company to have 100 per cent of its planned Phase 1 production secured with long-term commercial offtake agreements with thyssenkrupp Materials Trading GmbH, an international trading and services company headquartered in Essen, Germany, and with a Japanese trading company that is the main provider of flake graphite to Japan’s largest graphite anode processor for lithium-ion batteries for electric vehicles (EVs).

There is a significant increase in demand of high-quality flake graphite, which NextSource’s Molo project is blessed with, due to graphite’s critical role in lithium-ion batteries that power EVs. A lithium-ion battery is made of two electrodes — an anode (negative) on one side and a cathode (positive) on the other. Graphite makes up more than 90 per cent of the anode and currently is the only material that can be used in the anode and there are no substitutes.

Flake graphite is the feedstock used in battery anodes. Anode material requires the flake graphite produced in mines to be upgraded through spheronization and purification (called spheronized, purified graphite or SPG) and then followed by coating (called CSPG). Only flake graphite upgraded to 99.95 per cent purity can be used in a battery. The only competition to natural flake graphite is synthetic/artificial graphite, which is nearly twice as expensive and extremely energy intensive to produce.

Almost all graphite processing for anode (battery) applications takes place in China because of the ready availability of graphite there, weak environmental standards and low costs. Nearly 60 per cent of the world’s mined production of graphite comes from China, making it a dominant player in every stage of the graphite supply chain. After China, the next leading graphite producers are Mozambique, Brazil, Madagascar, Canada and India. The US does not produce any natural graphite; therefore it must rely solely on imports to satisfy domestic demand. The strangle hold China has on graphite reserves and processing, coupled with its poor environmental track record is not ideal for original equipment automotive manufacturers (OEMs) looking for secure sources of ESG compliant anode supply.

This represents a massive market opportunity with limited competition, and NextSource Materials is just one of only a few graphite companies even capable of delivering a complete and vertically integrated solution to produce CSPG; meaning it can supply graphite from “the mine to the battery” and the only one utilizing commercially proven technologies due to its exclusive joint venture with a Japanese technology partner that already supplies anode material to the Tesla and Toyota supply chains.

Huge Demand Coming:

According to the World Bank, graphite accounts for nearly 53.8 per cent of the mineral demand in batteries, the most of any. Lithium, despite being a staple across all batteries, accounts for only 4 per cent of demand (Mining.com)

An average plug-in EV has 70 kg of graphite, and 10 kg for a hybrid. Every 1 million EVs requires about 75,000 tonnes of natural graphite, equivalent to a 10 per cent increase in annual flake graphite demand.

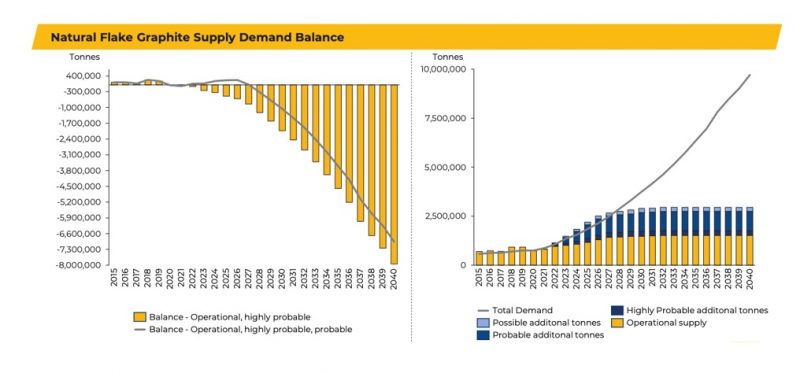

According to Benchmark Mineral Intelligence (BMI), the flake graphite feedstock required to supply the world’s lithium-ion anode market is projected to reach 2.5 million tonnes per annum by 2025 and 10.0 million tonnes by 2040. The amount of mined graphite for all application uses in 2021, was just 1 million tonnes. (USGS). Furthermore, Fastmarkets forecasts the CSPG market to increase from approximately US$1 billion to US$18 billion by 2030, and in capacity, expects EV anode demand to grow from 200,000 tonnes per annum (tpa) in 2020 to 2.8 million tpa by 2030, and 7 million tpa in 2040. Regardless of the forecasts – all are predicting a massive increase in flake graphite demand.

Natural flake & smaller flake sizes will move into a structural deficit by 2023 as global demand growth for spherical graphite begins to outstrip supply:

The Molo Project:

Located in the Tulear region of south-western Madagascar between two port cities, the Molo Graphite Project is a Full Feasibility-stage project and ranks as one of the largest-known and highest quality flake graphite deposits in the world.

It hosts a National Instrument 43-101 compliant total combined graphite resource of 141.28 million tonnes (Mt) at 6.13 per cent total graphitic carbon (C), with a contained ore reserve of 22.44 Mt at 7.02 per cent C.

One of the first movers, Molo mine’s commercial production is on schedule to commence in the fall of 2022, with Phase 2 expansion of an additional 150,000 tpa expected in late 2024. The company estimates that their Phase 1 battery anode facility (BAF) will be operational next year with full capability to produce CSPG.

The Molo mine has ability to scale to more than 1 million tpa of concentrate, which equals more than 500k tpa of CSPG (Fact: Producing CSPG is an inefficient process, requiring 2.2 tonnes of flake to make 1 tonne of CSPG). The modular design of Molo and the BAF allows NextSource to easily scale production with industry demand.

Unique amongst peers with access to proprietary anode blending technology, NextSource’s “technology alliance” provides one-stop anode shopping, providing the ability to blend natural flake, synthetic, and silicon to provide cell manufactures a complete anode solution, while its peers are only working on mostly SPG and CSPG solutions. Construction of the Phase 1 BAF is expected to commence in early 2023.

Madagascar has been a traditional producer of high-quality flake graphite for more than a century but has never exceeded 35,000 tonnes of annual production. As the current annual production of flake graphite averages about 5,000 tonnes, the Molo deposit represents the first new and substantial graphite discovery in the country in over 50 years.

Construction of Phase 1 of the Molo Project is underway, with commissioning expected in Q3 2022. This is in-line with the potential for graphite’s 5 to 10 times expanse, because of the demand associated with lithium-ion batteries, there are not enough projects to meet this demand currently, making those few sources all the more valuable.

In the News:

Most recently, NextSource announced that a Madagascar subsidiary of CrossBoundary Energy has commenced the construction process for the solar and battery hybrid power plant for Phase 1 of the Molo Graphite Mine in Madagascar after the Company executed a definitive energy services agreement with CrossBoundary Energy’s Madagascar subsidiary.

Earthworks and civil construction at the mine site are nearly complete with the imminent arrival of the processing plant and auxiliary buildings by July 31st, 2022. Completion of the plant re-assembly and commissioning is expected at the beginning of Q4 2022, followed by a ramp up period of up to three months to achieve nameplate capacity.

The Phase 1 processing plant was designed and built using an all-modular approach and is capable of processing 240,000 tpa of ore and producing approximately 17,000 tpa of high-quality SuperFlake® graphite concentrate. Fabrication and assembly of the processing plant at an offshore location was completed early this year, followed by completion of Factory Acceptance Testing and final verification of equipment design specifications and end-to-end functions of the processing plant before it was dismantled and packaged for delivery to the mine site. NextSource is already prepared for rapid expansion, having completed this earlier this year a PEA had considered an enhanced Phase 2 expansion consisting of a stand-alone processing plant with an additional production capacity of 150,000 tpa of flake graphite concentrate over a 26-year life of mine (LOM). The PEA assumed the Phase 2 processing plant will be built adjacent to the 17,000 tpa Phase 1 processing plant, that is expected to arrive shortly in Madagascar.

The current preliminary economy assessment (PEA) estimated that Phase 2 capital costs will be US$155.8 million resulting in a pre-tax NPV utilizing an 8 per cent discount rate of US$904.8 million (previously US$929.6 million) and a pre-tax IRR of 40.4 per cent (previously 41.1 per cent).

Powering a new generation of energy:

As the power revolution prepares to move into a new phase and people realize the role graphite plays as a key raw material, a company such as NextSource Materials is likely to gain more and more attention in the coming months as it becomes the only graphite company outside of China to enter production in 2022.

This company represents one of the few opportunities out there to fill the supply void – and the only one with well-established strategic partners with proven technology already producing CSPG for the Tesla and Toyota supply chains.

On its way to be the next graphite concentrate supplier by Q4 2022, and the first commercial anode supplier outside of China by 2023, there is a lot more to say about this company’s endeavours. In part 2 of our coverage on NextSource Materials, we will look into the executive team leading at the helm and investigate NextSource’s position as a key supplier of graphite.

Until then, visit nextsourcematerials.com for more updates from the company.

FULL DISCLOSURE: This is a paid article produced by The Market Herald.