- Northern Graphite (NGC) charts path to carbon neutral project at Bissett Creek

- This was from its Bissett Creek deposit in order to guide the company in developing a carbon neutral project

- Minviro is undertaking an additional study to quantify the benefits of an electric mining fleet to further reduce the project’s carbon footprint

- Accordingly, synthetic graphite produced in Inner Mongolia has an even higher GWP due to the large volumes of electricity required

- Northern Graphite is a Canadian company focussed on becoming a world leading producer of natural graphite and upgraded

- Northern Graphite Corporation (NGC) is down 3.61 per cent, trading at C$0.80 at 12:12 pm EST

Northern Graphite Corp. (NGC) has completed a Life Cycle Assessment of its Bissett Creek deposit.

Additionally, Minviro benchmarked the potential carbon footprint of Bissett Creek against the production of Chinese natural and synthetic graphite and their upgrade into battery anode material.

Minviro estimated that by powering the mining fleet with natural gas rather than diesel and replacing the planned natural gas-fired generating plant with hydroelectric power, the Global Warming Potential of the Bissett Creek project could be reduced by more than half, from 2.2 kilograms of CO2 eq. per kg of graphite produced to 1.0 kg of CO2 eq.

Minviro is undertaking an additional study to quantify the benefits of an electric mining fleet to further reduce the project’s carbon footprint.

Minviro estimated that Li-ion battery anode material, also known as coated spherical purified graphite, manufactured from Bissett Creek mine concentrates under the optimized scenario would have a carbon footprint of 7.3 kg of CO2eq. per kg of product.

In comparison, the carbon footprint of Chinese CSPG produced from natural graphite is estimated at 16.8 kg of CO2eq.and 17 kg of CO2eq. if produced from synthetic graphite.

Gregory Bowes, CEO commented, “…The Minviro report indicates that the carbon footprint of the Bissett Creek project can be reduced to levels that create a clear and economic path to carbon neutrality by investing in the creation of credits or purchasing carbon offsets.”

He added, “the report also highlights the substantially higher carbon footprint of Chinese production, particularly of synthetic graphite.”

Minviro’s estimate for the carbon footprint of synthetic Chinese CSPG production is based on a plant in Fujian Province where the regional power grid mix has a lower environmental impact than Inner Mongolia where many plants are located and where the grid is largely coal-based.

Accordingly, synthetic graphite produced in Inner Mongolia has an even higher GWP due to the large volumes of electricity required.

ESG concerns, as well as shutdowns due to high emissions or power shortages/rationing all, create significant supply concerns with respect to Chinese synthetic BAM production.

The EV and battery industries need to be transparent about the environmental impacts of producing both natural and synthetic graphite and manufacturing battery anode material therefrom as graphite is the largest single component of a lithium-ion battery.

The evolution from internal combustion engines to EVs will require multiples of current graphite production and the environmental implications need to be well understood.

As part of Northern’s policy of transparency and full disclosure, and to foster further discussion on this important issue, Minviro’s report will be made publicly available here in the coming weeks after the effect of electrifying the mining fleet has been estimated.

The study follows the Greenhouse Gas Protocol which identifies three types of GHG emissions.

Scope 1 are all direct GHG emissions, Scope 2 are indirect GHG emissions from the consumption of purchased electricity, heat or steam and Scope 3 are embodied emissions, such as the extraction, production and transport of purchased materials and fuels, outsourced activities, waste disposal, etc.

In addition to global warming potential, four other impact categories were evaluated. These categories and the implications of the study results are as follows:

Firstly was acidification potential, which relates to the release of SO2 and NO2 into the atmosphere which causes acid rain and ecosystem impairment.

Secondly was the disease incidence measures the effect on human health from the release of particulate matter and was calculated to be 3.2E-7 DI per kg of graphite concentrate. There was also the consideration of the total water use for the project is 60.6 kg water eq. per kg of graphite concentrate.

Land use transformation calculates the project’s effect on biotic production, erosion potential, groundwater regeneration, infiltration reduction and physicochemical filtration.

An independent study has rated Bissett Creek the highest margin graphite project in the world including existing producing mines. This is due to its very high percentage of valuable large flake graphite, simple metallurgy and favourable location which provides ready access to equipment, supplies, labour, natural gas and markets.

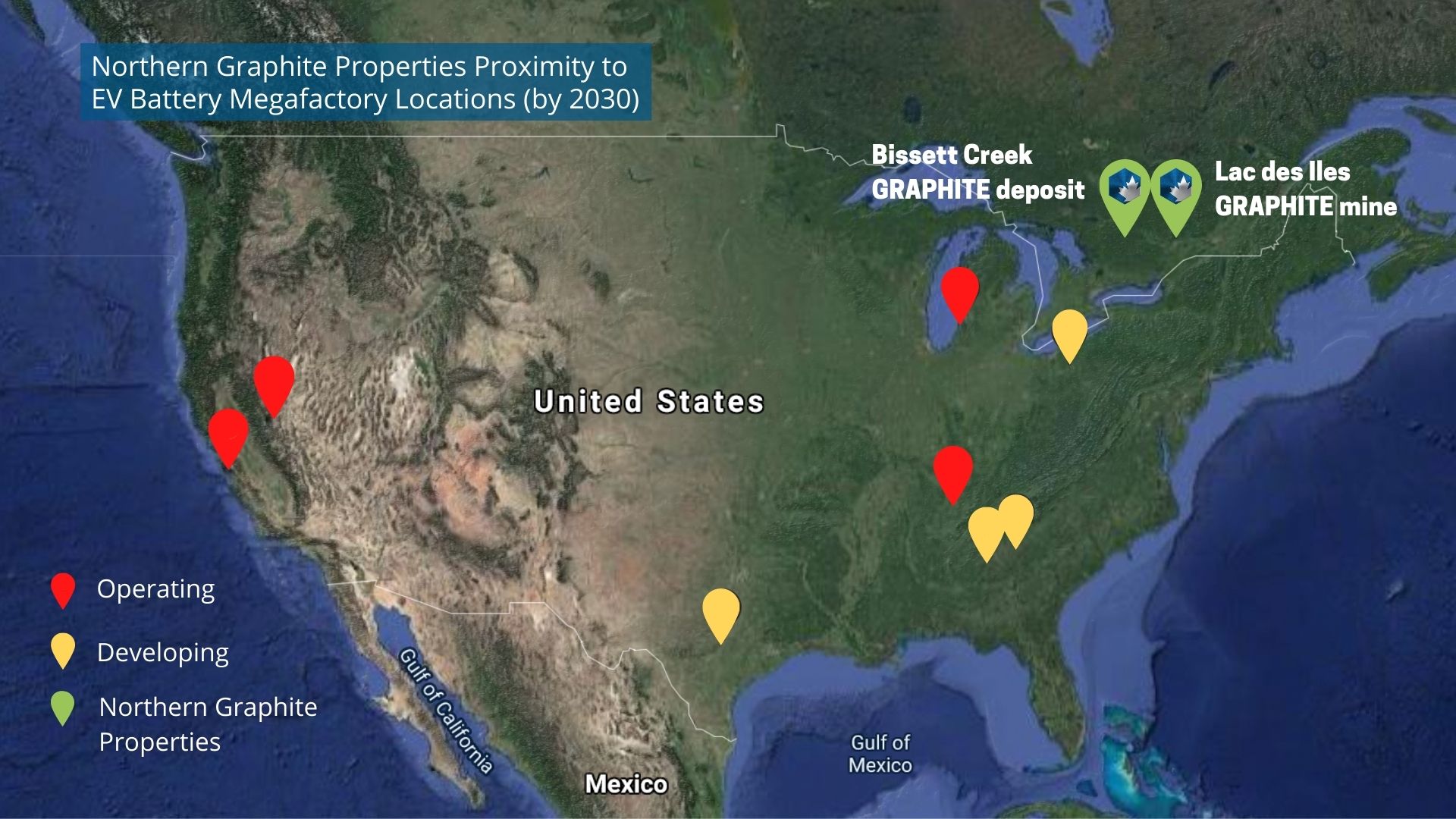

The Bissett Creek deposit is located in the southern part of Canada between the cities of North Bay and Ottawa and is approximately 15 km from the Trans Canada Highway.

Northern Graphite is a Canadian company focused on becoming a world-leading producer of natural graphite and upgraded, high-value products critical to the green energy revolution.

Minviro was formed to support the global community by ensuring that raw materials used for the low-carbon economy are sourced at a minimal environmental cost.

Northern Graphite Corporation (NGC) is down 3.61 per cent, trading at C$0.80 at 12:12 pm EST.