Market conditions have been brutal in recent weeks as mindless trading algorithms pound everything lower – including already-undervalued junior mining stocks.

The management of these companies remain undeterred. They have ‘their eyes on the prize’.

The new commodity super cycle bull

There are dozens of metals/minerals markets forecasting massive increases in demand, supply shortages, or both.

For investors looking to profit from this broad, long-term bull market for commodities, Noble Mineral Exploration Inc (TSXV:NOB / OTC:NLPXF) offers an exciting option. Simply, if you’re looking for exposure to any of these commodity bull markets, there’s a good chance that this project generator is already holding an interest.

Just in recent days, Noble Mineral Exploration has announced news on five fronts.

On October 17, 2022, the Company released several pieces of news:

- Completion of drilling on the Nagagami Niobium and Rare Earths Property

- Completion of drilling on the Calder Township property

- An airborne survey is now underway on the polymetallic Boulder Project

- Initial assays for 13 grab samples on the Company’s Buckingham Graphite Property returned graphitic carbon values of up to 86.52%

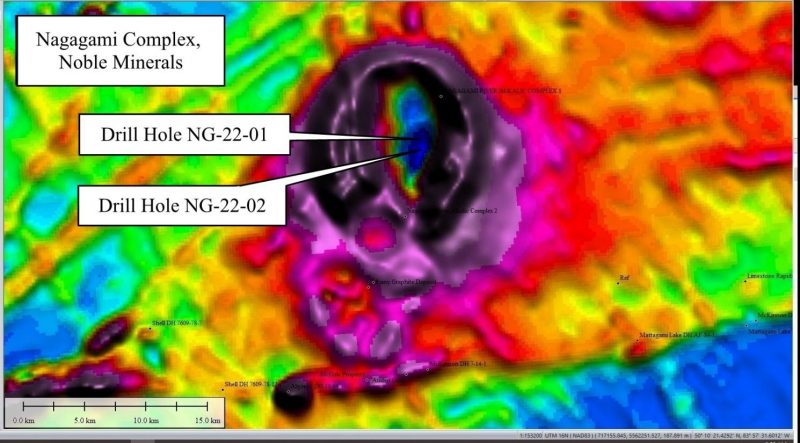

At the Nagagami Niobium and Rare Earths Property, a total of 1,302 meters of drilling were completed, spread between two vertical holes. Drilling was exploring a magnetic low previously identified on the Nagagami Carbonatite Complex.

Comparable complexes have shown mineralization of niobium and other rare earths. The Company is anticipating assay results in 4 – 6 weeks time.

Drilling on the Project was conducted with the knowledge and consent of the Constance Lake First Nation. Noble Mineral Exploration has committed itself to a “mutually beneficial, cooperative, and productive relationship” with this First Nation.

If the drillholes deliver favorable results, Noble has indicated that it plans to engage in follow-up drilling.

At the Calder Township property, two drillholes have been completed (865 meters). Assays are expected by the end of October or early November.

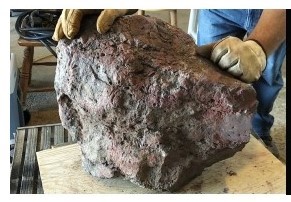

The airborne survey on the Boulder Project is motivated by a 2019 sample from the Ontario Geological Survey, which came from a 140 kg boulder. The sample registered: 71.8% copper, 3.25% lead, 1.09% zinc, 252 g/t silver, 3.79 g/t gold, 4.43 g/t palladium, and 2.22 g/t of platinum.

The airborne survey is seeking the source of the mineralization contained in this boulder.

Assays released from the Buckingham Graphite Property are just initial results from the 13 grab samples that were taken. Some of the highest readings came from a previously un-drilled section of that Property.

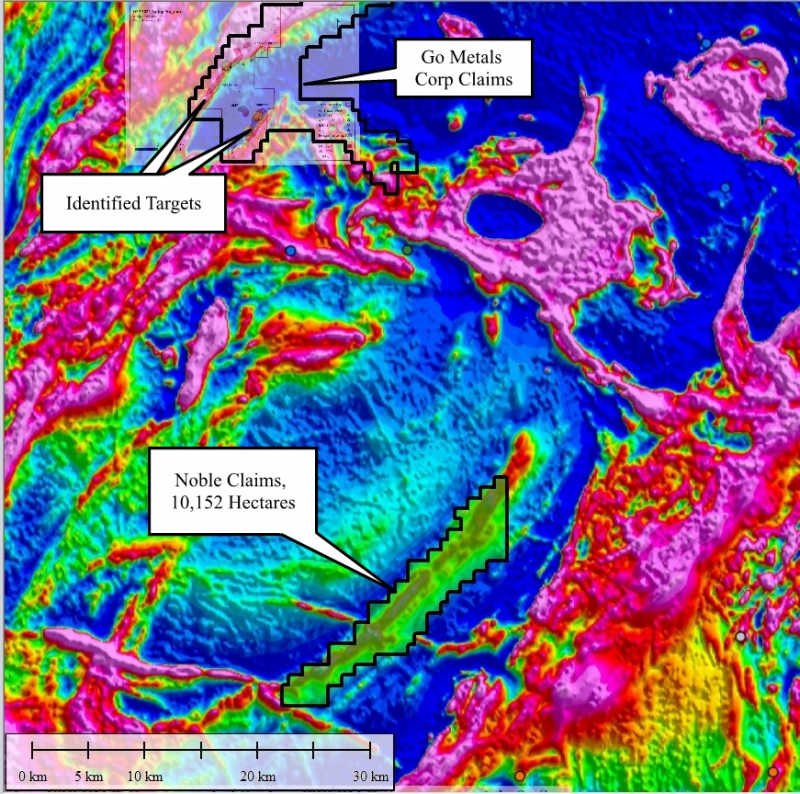

Even more recently, on October 20th Noble Exploration has announced the acquisition of 188 new mining claims (via staking). The claims total 10,152 hectares in the vicinity of the HSP Nickel Copper Platinum Group Project owned by Go Metals Corp.

This new land package covers geology known to host nickel, copper and PGE mineralization. Previous magnetic imaging indicates particularly sharp contrast across this area.

The claims are accessible by road and provide access to power. Along with the news of the acquisition, Noble announced its near-term exploration plans for these claims.

- AirTEM survey (conducted by Balch Exploration Corporation)

- Follow-up ground work in Spring 2023, leading to the identification of drill targets for diamond drilling

This is a very active junior mining company. Noble Mineral Exploration has put out a dozen material news releases on operations so far in 2022.

In addition to the Company’s deep pipeline of prospective mining properties, Noble Mineral Exploration also holds strategic investments in several other Canadian junior mining companies including ~CAD$3 million in Canada Nickel, whose Crawford Project is currently undergoing a Feasibility Study due by year end.

Management is not only seeking to add value for shareholders with these holdings. Building relationships with these mining companies also aids Noble in efficiently adding to its landholdings.

Go Metals Corp (CSE:GOCO) is one of the companies in which the Noble Mineral Exploration holds an investment. In staking the 10,152 hectares around Go Metals’ HSP Nickel Copper Platinum Group Project, it’s very likely that knowledge gained as a strategic investor in Go Metals facilitated the acquisition of these claims.

With their ability to turn over properties and generate near-term revenues, project generators are perhaps better suited than most junior mining companies to weather the current, extremely difficult market conditions.

Longer term, Noble Mineral Exploration (and its shareholder base) is well-positioned to capitalize on the new super-cycle in commodities.

FULL DISCLOSURE: This is a paid article of The Market Herald.