- Nickel Creek Platinum (NCP) has closed a private placement for total gross proceeds of approximately $2.7 million

- The company issued a total of 3,197,060 units and 25,539,500 “flow-through” units

- The company’s largest shareholder, Electrum Strategic Opportunities Fund L.P., exercised 11.4 million warrants and invested $100,000 in the private placement

- Proceeds from the private placement will be used to fund the company’s 2022 exploration program

- Nickel Creek Platinum (NCP) is a Canadian mining exploration and development company

- Nickel Creek Platinum Corp. is up 6.25 per cent on the day, trading at C$0.085 per share at 3:45 pm ET

Nickel Creek Platinum (NCP) has closed a private placement for total gross proceeds of approximately $2.7 million.

Stuart Harshaw, President and Chief Executive Officer of Nickel Creek commented on the capital raise.

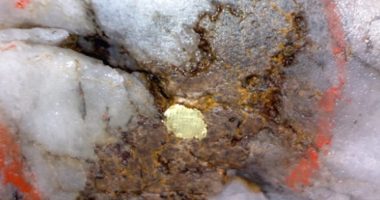

“The completion of this capital raise allows us to build upon the success of our 2021 drilling campaign on the Arch target where we intersected high-grade nickel sulphides. In addition, we expect to carry out all the necessary fieldwork to advance our 100 per cent owned Nickel Shäw Project toward Pre-Feasibility Study. This strategy should allow Nickel Creek to capitalize on an exceptionally strong nickel outlook, particularly at a time when so few emerging producers are located in safe geopolitical jurisdictions such as the Yukon, Canada.”

The company issued a total of 3,197,060 units and 25,539,500 “flow-through” units. The units were priced at $0.085. Each FT Unit was priced at $0.095.

Each unit consists of one common share and one-half of one common share purchase warrant exercisable for one additional share for $0.125 for a period of three years. Each FT unit consists of one “flow-through” common share and one-half of one common share purchase warrant., Each FT warrant is exercisable for one common share at an exercise price of $0.125 for a period of three years.

The company’s largest shareholder, Electrum Strategic Opportunities Fund L.P., exercised 11.4 million warrants for approximately $911,000. Electrum invested an additional $100,000 in the private placement for a total investment exceeding $1.0 million.

All shares and warrants issued will be subject to a statutory four-month hold period.

The warrants and FT warrants, if fully exercised, would represent additional gross proceeds of approximately $1.9 million.

The proceeds will be used to fund the company’s 2022 exploration program, holding costs at the Nickel Shäw Project, and for working capital purposes.

Nickel Creek Platinum (NCP) is a Canadian mining exploration and development company whose flagship asset is its 100 per cent owned Nickel Shäw Project in Yukon.

Nickel Creek Platinum Corp. is up 6.25 per cent on the day, trading at C$0.085 per share at 3:45 pm ET.