- New Gold (TSX:NGD) has posted a $27 million loss for its first quarter, due to coronavirus shutdowns

- Revenue fell to $142 million, down from $167 million year-on-year

- The company’s Rainy River mine had to shut down for two weeks due to coronavirus-related travel bans

- Production fell across all minerals, including an approximately 13,000 ounce gold ounce dip

- New Gold (NGD) is down 4.9 per cent, and trading for $1.16 per share with a $790 million market cap

New Gold’s (TSX:NGD) 2020 first quarter results show a minor loss, after COVID-19 affected operations at the Rainy River mine.

Revenues fell to $142 million for the quarter, down from $167 million the year before. The company blamed this on the two-week shutdown at the Rainy River mine earlier in the year.

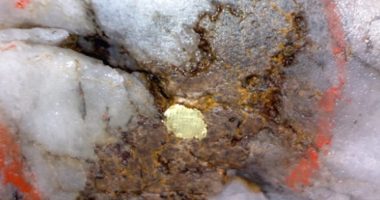

The Rainy River mine is unique, as it sits close to the US border, and has a workforce including US workers. In addition, the Canadian citizens working on the mine had been crossing frequently into the US in their down time. This meant the vast majority of Canadian and US workers had to self-quarantine, forcing the mine into a 2-week closure.

Total production was 66,790 gold ounces, 131,417 pounds of silver and 18.5 million pounds of copper. When broken down, this was an approximately 13,000 ounce drop in gold and a 1 million pound drop in copper production.

New Gold currently has $600 million in available liquidity, including $400 million cash and equivalents.

New Gold’s CEO, Renaud Adams, said that he was encouraged by the financial results for the quarter.

“They were impacted by the 2-week suspension at Rainy River in the latter part of March, and the enhanced COVID-19 safety protocols put in place at both operations.

“Following the close of a strategic $300 million partnership with the Ontario Teachers Pension Plan, the company now has a very strong liquidity position of $600 million, which is more than adequate to fund business during this COVID-19 period.

“Throughout this challenging time, New Gold will continue to prioritise the safety and well-being of our employees and local communities. We will continue to work with local governments and our Indigenous and community leaders to implement and coordinate actions to reduce the risk of the spread of COVID-19” he said.

New Gold (NGD) is down 4.9 per cent and trading for $1.16 per share at 12:43pm EDT.