Resouro Gold (TSXV:RAU) is a gold exploration and development company with its operational focus in an emerging gold-copper district in Brazil (outside the Amazon rainforest).

Resouro Gold completed an RTO on the TSX-V in May of 2022 and has four prospective gold properties in the mining-friendly states of Mato Grosso, Tocantins/Goias, and Pernambuco.

The Company’s flagship Novo Mundo Gold Project is located in Mato Grosso, along the Alta Floresta Gold Belt. Initial drill results from September 21, 2022, have already identified (new) high-grade mineralization on the property, including:

- 11.65 metres @ 5.1 g/t Au (from 65.89 metres)

- 4.6 metres @ 6.3 g/t Au (from 72.94 metres)

High-grade gold intercepts are located near enough to the surface to permit open-pit mining. That’s a combination that will immediately catch the eye of experienced mining investors.

Now Resouro Gold has released more high-grade gold assays from Novo Mundo, with further results pending.

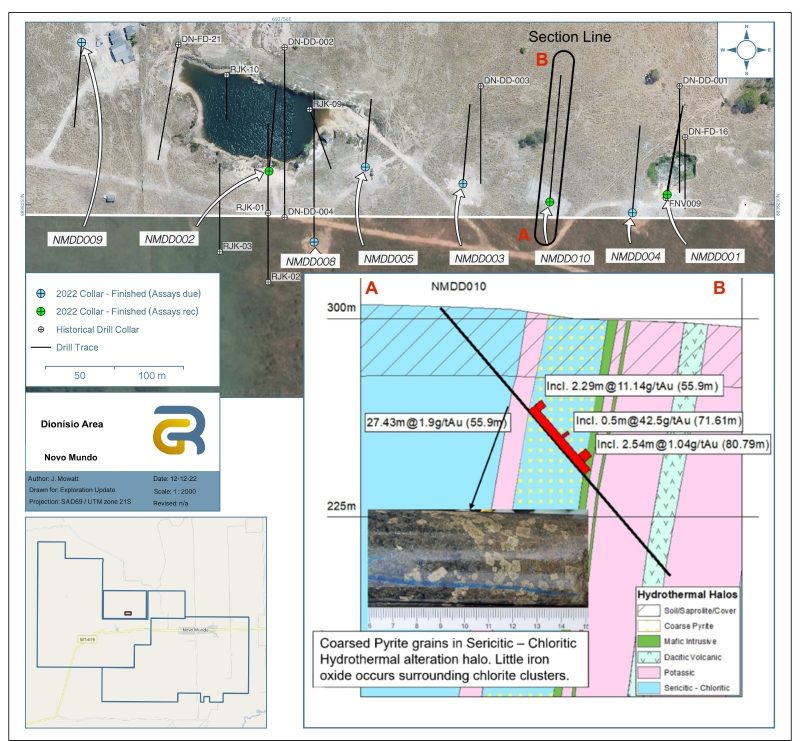

On December 13, 2022, Resouro released assay results for drill hole NMDD 010, situated between the Dionísio and Luisão pits. More near-surface gold mineralization.

- 16.21 m @ 2.97 g/t Au (from 55.9 m), including 2.29 m @ 11.4 g/t Au and 1.08 m @ 19.93 g/t Au (71 m depth)

These results are similar to the assays of a historic drill hole located 84 m east of drill hole NMDD 010.

- 6.61 m @ 5.47 g/t Au (from 62.73 m), including 5.26 m @ 6.82 g/t Au

In addition to the drilling, the Company also released sampling results: rock chip samples both along-strike of the major gold trend and also from a parallel trend ~100 metres to the south.

Samples from the Luisão and Dionísio Pits registered the highest grades of 27.3 g/t Au and 32.9 g/t Au. Four of the 19 samples produced grades above 10 g/t Au.

The Company shared its insights with investors from these latest exploration results.

Both the drilling program and rock chip sample results confirm the model of multiple outcropping high-grade ore shoots already defined and reported in this round of drilling.

Channel samples and rock chip samples at surface indicate that the mineralization in these intercepts may have continuity all the way to the surface and could be converted to a high-grade resource with substantial true widths that may be amenable to mining in shallow open pits. [emphasis mine]

Resouro indicated in the news release that the next phase of exploration will consist of infill drilling of the discovered ore shoots. Further exploration drilling is also planned to identify other high-grade shoots of gold mineralization.

Regular readers of The Market Herald might already be familiar with Resouro Gold from previous coverage in October.

Building a new Brazilian gold company in the prolific Alta Floresta Gold Belt

Resouro owns 100% of 4 license packages totaling nearly 34,000 hectares. The licenses are spread across 3 pro-mining states of Brazil.

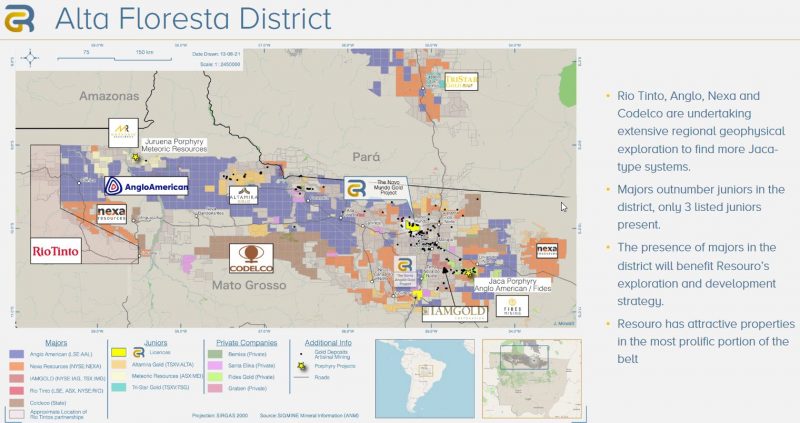

Resouro Gold is far from alone in seeking to tap into the gold and copper riches from this emerging mining district. Companies like Rio Tinto, Anglo America, Codelco, Nexa Resources, and IAMGOLD are already active here.

These major mining companies bring with them increasing infrastructure development that will help Resouro conduct its own exploration operations more efficiently.

In addition, as Resouro advances exploration at Novo Mundo (and its other properties), any significant resource developed here would immediately make the Company an acquisition target.

Most of the majors here are exploring for copper porphyry systems, following the copper discovery by Anglo-Americans on its Jaca Property. However, Resouro’s exploration team sees the “main potential” here as shallow epithermal gold deposits.

A non-43-101 compliant gold resource of 1.67 million tonnes at a grade of 2.99 g/t gold (~160,000 ounces Au) was estimated from the previous drilling. Resouro Gold is currently working to advance the Project to a new and larger NI 43-101 resource estimate.

Water and electricity are adjacent to the Project. A gravel road provides access to Novo Mundo.

Brazil offers an experienced mining workforce, a mining-friendly licensing system, and a favourable exchange rate. While this region of Brazil is mineral-rich, the flat topography is very conducive to mining operations.

Gold is hot once again. News of record gold-buying by central banks of 399 tonnes of gold in Q3 alone has sent the price of gold surging above $1,800 per ounce.

For investors looking for gold mining candidates, Resouro Gold’s (TSXV:RAU) high-grade, near-surface gold drill results and the potential for a commercial-scale, high-grade open pit gold mine will put it on the radar of many mining investors.

DISCLOSURE: This is a paid article by The Market Herald.