- Moneta Gold (ME) has closed its upsized and oversubscribed private placement for aggregate gross proceeds of $15,400,160

- The company issued 6,000,000 flow-through common shares and 608,000 common shares

- The over-allotment option was exercised in full

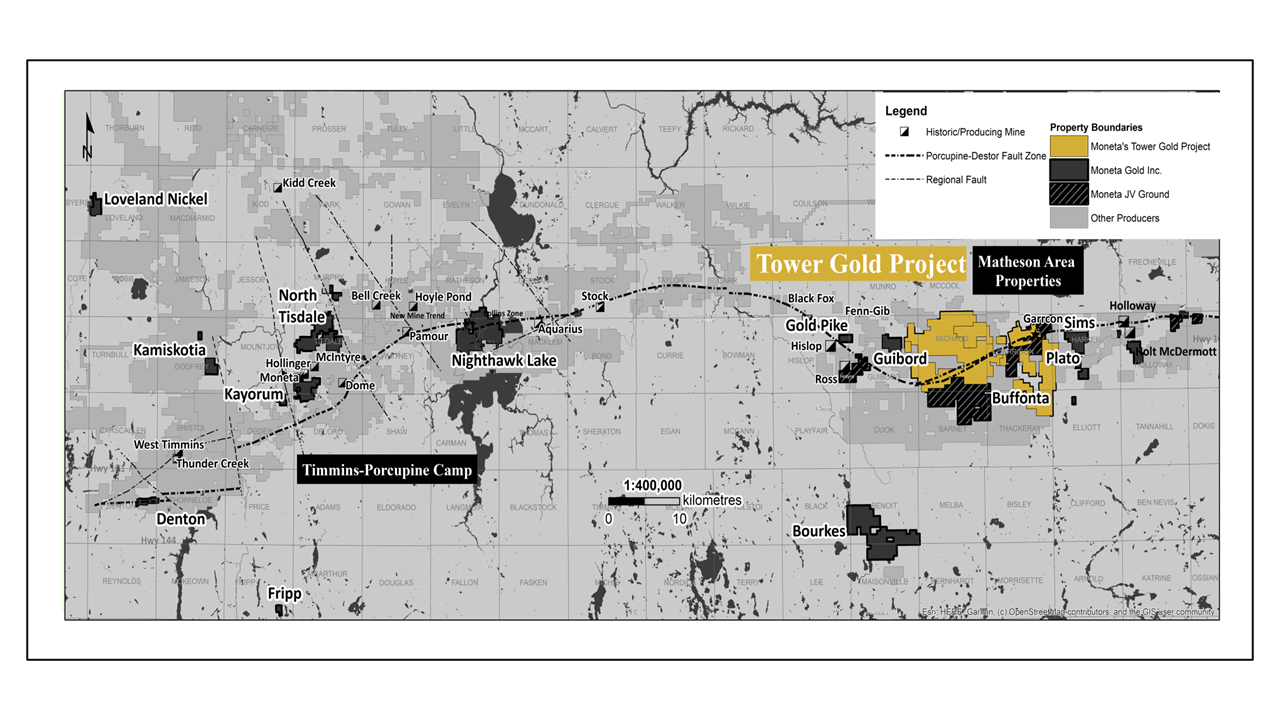

- The gross proceeds will be used to fund exploration of the company’s Tower Gold project in Ontario

- Moneta Gold is a Canada-based gold exploration company

- Moneta Gold Inc. (ME) is down 2.56 per cent on the day, trading at C$1.90 per share at 10 am ET

Moneta Gold (ME) has closed its upsized and oversubscribed private placement for aggregate gross proceeds of $15,400,160.

The company issued 6,000,000 flow-through common shares and 608,000 common shares.

The offering was led by Stifel GMP on behalf of a syndicate of underwriters that included Haywood Securities Inc., iA Private Wealth Inc., Paradigm Capital Inc., and Sprott Capital Partners LP.

Gary O’Connor, President, CEO and Director, commented on the successful capital raise.

“The successful closing of our upsized and oversubscribed financing has strengthened our balance sheet, allowing Moneta to continue de-risking the Tower Gold project. I would also like to welcome our new investors and thank all stakeholders for their continued support.”

The gross proceeds will be used to fund exploration of the company’s Tower Gold project in Ontario and for general corporate purposes.

All securities issued will be subject to a statutory four-month hold period.

Moneta Gold is a Canada-based gold exploration company focused on advancing its 100 per cent owned Tower Gold project.

Moneta Gold Inc. (ME) is down 2.56 per cent on the day, trading at C$1.90 per share at 10 am ET.