- MCAPM, LP, and Michael Mork (the Morks) have signed subscription agreements with NXT Energy Solutions (SFD)

- The Morks agreed to subscribe for an aggregate of 8,750,000 common shares of NXT in a non-brokered private placement

- The subscription will be at a price of C$0.195 per common share for total consideration of approximately C$1.7 million

- When the private placement is concluded, the Morks will own about 19.38 per cent of the issued and outstanding common shares on a non-diluted basis

- NXT Energy Solutions Inc. is a company which offers geophysical services to the upstream oil and gas industry

- NXT Energy Solutions Inc. was up 7.50 per cent, trading at $0.215 at 3:55 PM ET

MCAPM, LP, and Michael Mork (the Morks) have signed subscription agreements with NXT Energy Solutions (SFD).

In accordance with the agreements, the Morks have agreed to subscribe for an aggregate of 8,750,000 common shares of NXT in a non-brokered private placement at a price of C$0.195 per common share for total consideration of approximately C$1.7 million.

Closing is expected to occur in January 2022 and is subject to certain conditions, including conditional listing approval of the TSX.

The Morks currently own an aggregate of 6,171,233 common shares. When the private placement is concluded, the Morks will own 14,921,233 common shares. This represents approximately 19.38 per cent of the issued and outstanding common shares on a non-diluted basis.

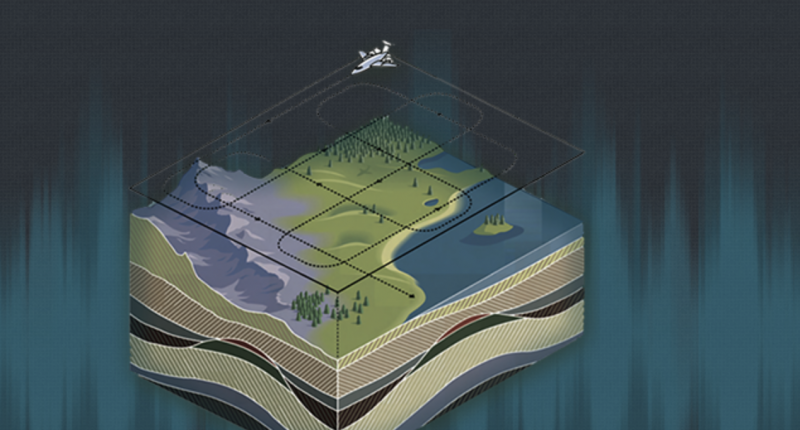

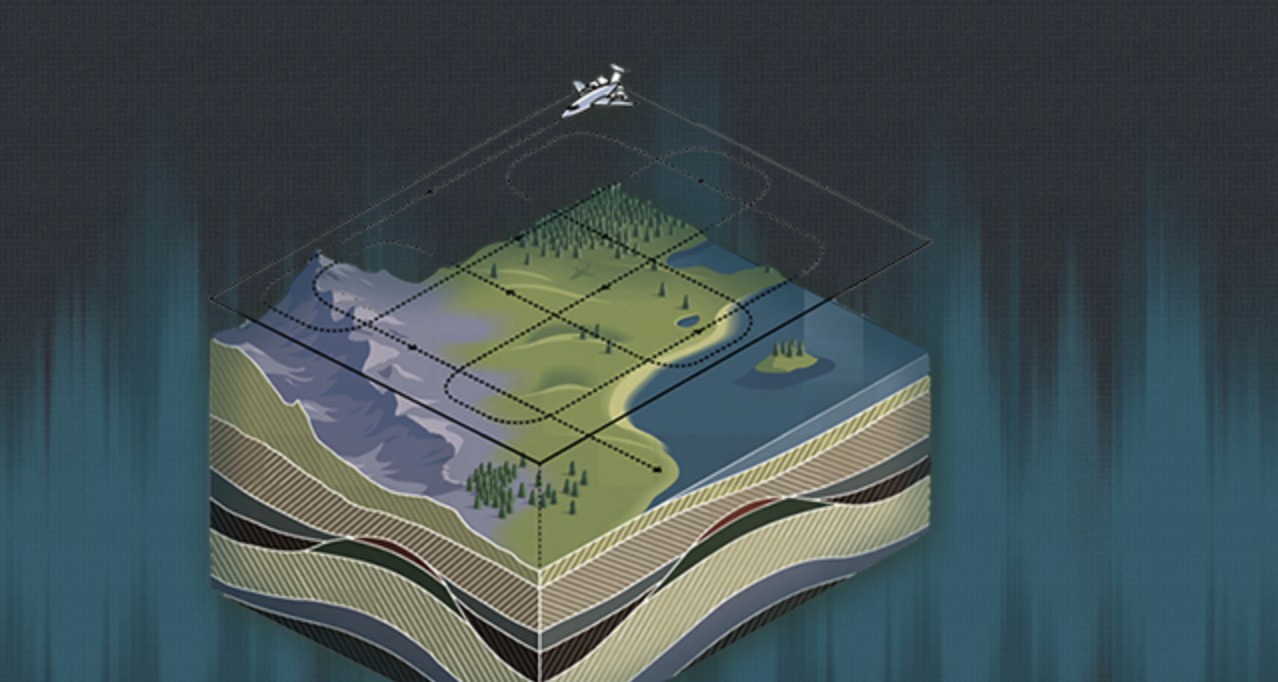

NXT Energy Solutions Inc. is a company which offers geophysical services to the upstream oil and gas industry using its gravity-based Stress Field Detection (SFD) remote-sensing survey system.

NXT Energy Solutions Inc. was up 7.50 per cent, trading at $0.215 at 3:55 PM ET.