- Magnum Goldcorp Inc. (MGI) has provided an initial LH property exploration update

- Earlier this year, the company received a two-year multi-year area-based work permit for its LH property

- The program started once the weather conditions became calmer and allowed for access

- Highly anomalous gold results, up to 20.76 g/t over 11.0 m, were documented in the 2015 drill program

- The second 160 m south of the underground workings will test a magnetic lobe extending northwest

- Samples taken will be submitted for analysis shortly

- Magnum Goldcorp Inc. (MGI) is up 11.11 per cent, trading at C$0.05 at 1:58 pm EST

Magnum Goldcorp Inc. (MGI) has completed a diamond drill program on its LH Property near Silverton, British Columbia.

Earlier this year, it received a two-year multi-year area-based work permit for its LH property.

It initiated a diamond drill program to explore the property and the area surrounding the LH underground workings with a magnetic anomaly to the south.

The program started once the weather conditions became more calm and allowed for access. A water exemption in the permit required drilling to be completed by June 30.

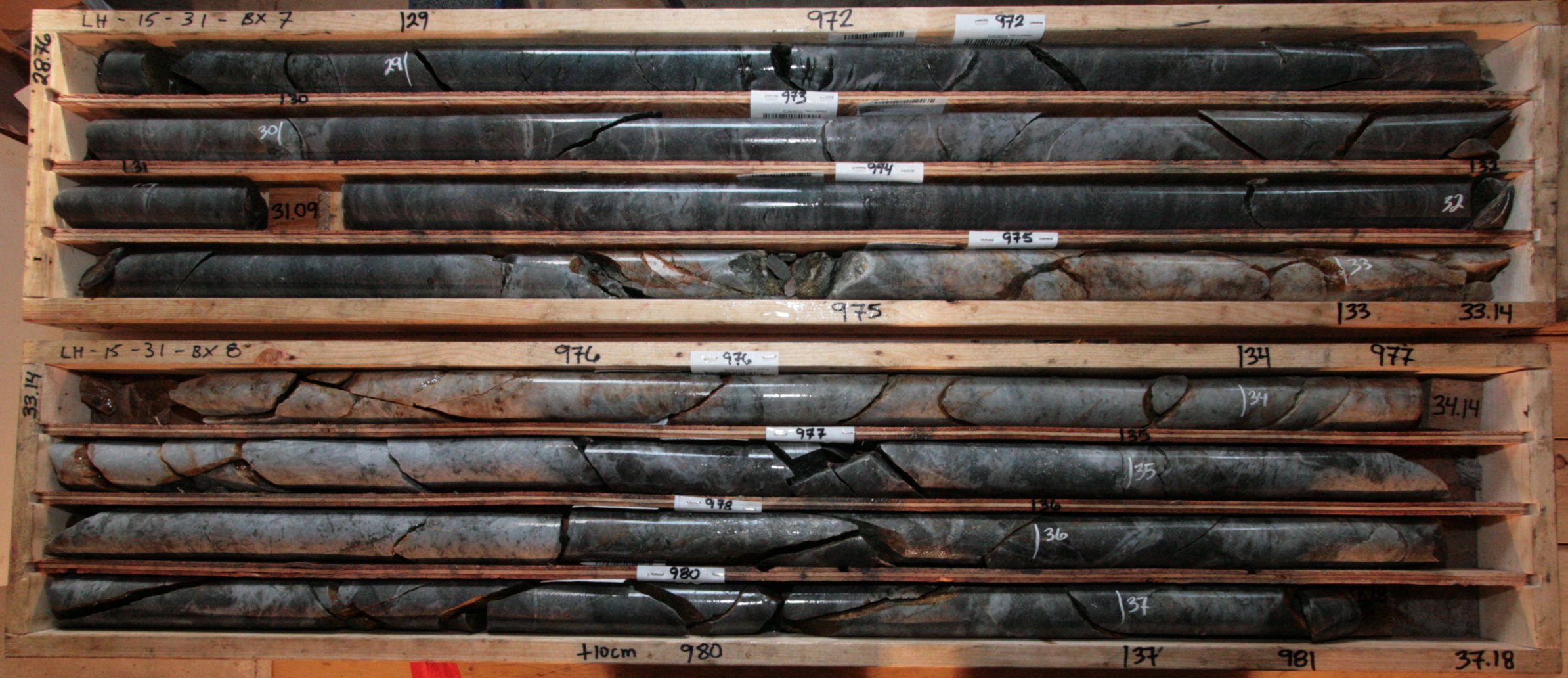

The drill program continued evaluation of an interpreted structurally controlled, pyrrhotite-bearing alteration and mineralization zone, interpreted to comprise, in part, multiple en echelon veins identified in both underground workings and previous drilling.

Highly anomalous gold results, up to 20.76 g/t over 11.0 m, were noted in a 2015 drill program from 11 drill holes drilled at shallow to moderate angles.

A follow-up program in 2017 consisted of five holes drilled at a moderate to high angle to the vein system.

These holes showed lower gold grades, up to 1.59 g/t over 11.97 m.

A third drill program in 2019 found four drill holes drilled at a moderate to high angle to the vein system, up to 5.15 g/t over 5.58 m.

True widths for mineralized intervals documented to date vary between approximately 0.5 to 9.00 m for sulphide-bearing breaks.

Drill intercepts from 2017 and 2019 were linked with less intense magnetic signatures and were interpreted to have tested a pyrrhotite mineralized halo rather than the mineralized system itself.

Magnetic highs were interpreted to represent gold-bearing zones within the mineralized system, given a strong correlation between pyrrhotite content and gold grade. They comprised the targets for the 2022 drill program.

A total of seven holes, totalling 1,248 m, were completed from two pads.

One of the holes came in at 47 m north of the underground workings, and the company has looked to test the down-dip extension of the mineralized system with depth.

The second 160 m south of the underground workings will test a magnetic lobe extending northwest from a more significant magnetic anomaly to the underground workings.

Samples taken will be submitted for analysis shortly.

However, five of the holes identified numerous mineralized intercepts elevated to, locally, semi-massive to massive pyrrhotite and arsenopyrite mineralization.

No analyses are currently available, but a summary of mineralized intercepts has given the company an estimated amount of mineralization and the significant width of mineralized intercepts.

From the previous drilling, there is a strong correlation interpreted between pyrrhotite abundance and strongly elevated to highly anomalous gold values.

In addition, arsenopyrite is often a pathfinder for gold mineralization.

Intervals of enormously elevated to semi-massive to massive pyrrhotite and arsenopyrite mineralization are expected to return high anomalous gold values from this year’s drilling.

The LH Property is a gold exploration property consisting of 19 contiguous crown granted claims and seven mineral claims. The area is located seven kilometres south of Silverton, British Columbia, on the east side of Slocan Lake.

Magnum Goldcorp Inc. (MGI) is up 11.11 per cent, trading at C$0.05 at 1:58 pm EST.