- Loncor’s Makapela gold resource has an indicated mineral resource of 614,200 ounces of gold

- 2.20 million tonnes grading at an impressive 8.66 g/t Au

- Makapela Project is 100 per cent-owned by Loncor

- “Makapela represents a high-grade opportunity”

- Loncor Gold Inc. (LN) is up 3.23 per cent, trading at C$0.32 at 2:21 pm EDT.

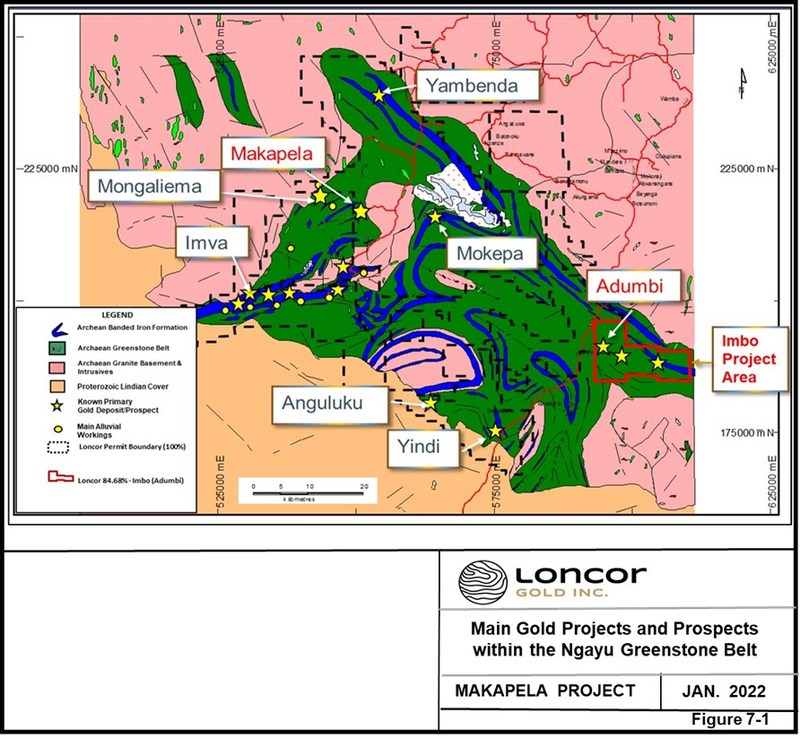

Loncor Gold (LN) has applied for a mining permit for its 1.164 million ounce Makapela gold resource at the Ngayu Greenstone Gold Belt.

The Ngayu Greenstone Gold Belt is located in the Democratic Republic of the Congo (DRC).

Makapela has an indicated mineral resource of 614,200 ounces of gold (2.20 million tonnes grading 8.66 g/t Au) and an inferred mineral resource of 549,600 ounces of gold (3.22 million tonnes grading 5.30 g/t Au) at a 2.75 g/t Au cut-off.

The Makapela Project is 100 per cent-owned by Loncor and is located approximately 50 kilometres from its flagship 3.66 million ounce Adumbi deposit, which has previously been granted a mining permit.

The Preliminary Economic Assessment (PEA) of the Adumbi deposit – the results of which were announced by Loncor in December 2021 – did not include the Makapela deposit.

Loncor’s Chief Executive Officer, John Barker, commented on this latest development,

“Makapela represents a high-grade opportunity either as a potential feed source for a future gold operation at Adumbi, or as an independent stand-alone high-grade project. The deposit remains open at depth, along strike, plus has a number of parallel zones that require further investigation. Within close proximity, there are a number of other deposits such as Mokepa and Mongaliema that historically have been drilled and could hold the potential of future ore feed for Makapela.

He added,

“The award of a mining permit at Makapela would create a second avenue to release value held within our deposits, and the company will continue to analyze both practical and corporate solutions to maximize the value attributed to all of Loncor’s assets.”

The Makapela mineralization is hosted by a sequence of steeply-dipping basaltic volcanics containing thin BIF (banded ironstone formation) units.

A total of 83 core holes have been drilled at Makapela with several significant drill intersections including 7.19 metres grading 64 g/t Au, 4.28 metres at 32.6 g/t Au, 3.47 metres grading 24.9 g/t Au, 4.09 metres at 21.7 g/t Au and 4.35 metres grading 17.5 g/t Au.

Loncor is a Canadian gold exploration company focused on the Ngayu Greenstone Gold Belt in the northeast of the DRC. The Loncor team has over two decades of experience of operating in the DRC.

Loncor Gold Inc. (LN) is up 3.23 per cent, trading at C$0.32 at 2:21 pm EDT.