- Lithium Americas Corp. (LAC) and Arena Minerals (AN) have signed a definitive arrangement agreement

- Lithium Americas agreed to acquire all of the issued and outstanding common shares of Arena not already owned by Lithium Americas by way of a plan of arrangement

- Arena’s shareholders will receive 0.0226 of a Lithium Americas common share for each Arena share held

- When the transaction is concluded, the Arena shares are expected to be concurrently delisted from the TSXV

- Lithium Americas Corp. was down 2.203 per cent, trading at $28.86 at 11:34 AM ET

Lithium Americas Corp. (LAC) and Arena Minerals (AN) have signed a definitive arrangement agreement.

In pursuit of the agreement, Lithium Americas agreed to acquire all of the issued and outstanding common shares of Arena not already owned by Lithium Americas by way of a plan of arrangement.

Arena’s shareholders will receive 0.0226 of a Lithium Americas common share for each Arena share held.

The consideration to Arena implies a total equity transaction value of US$227 million (C$311 million), based on the closing price on December 19, 2022. As a result, Arena shareholders will own approximately 5.7 per cent of Lithium Americas.

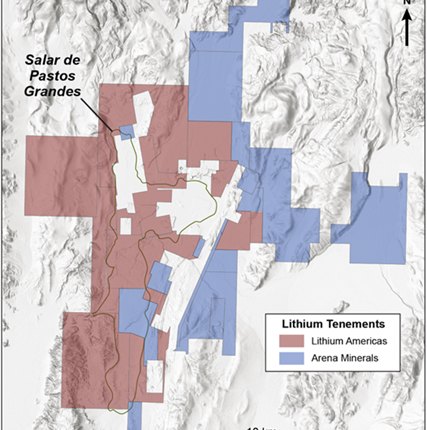

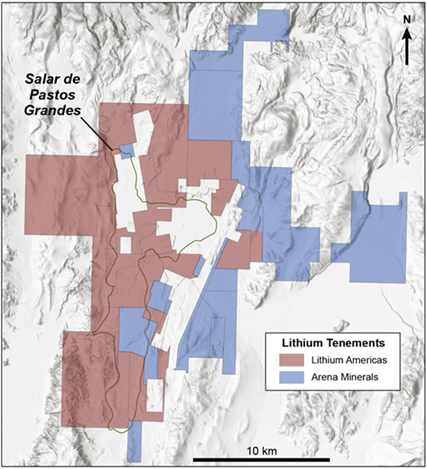

“This transaction will consolidate the highly prospective Pastos Grandes basin, and creates an exciting opportunity for Lithium Americas, a Canadian incorporated and headquartered company, to add incremental growth in one of the most important lithium producing regions in the world,” stated Jonathan Evans, President and CEO of Lithium Americas.

“The significant synergies between our two projects and a better understanding of the basin will enable us to advance development planning and maximize our growth pipeline in Argentina,” he added.

“The transaction allows Arena shareholders to realize a meaningful and immediate premium and represents a unique opportunity to participate in the development of a larger, consolidated project as we work with the Lithium Americas team to advance the Pastos Grandes basin,” said Will Randall, President and CEO of Arena.

When the transaction is concluded, the Arena shares are expected to be concurrently delisted from the TSXV.

Lithium Americas is focused on advancing lithium projects in Argentina and the United States to production.

Arena owns 65 per cent of the Sal de la Puna Project, covering approximately 14,000 hectares of the Pastos Grandes basin located in Salta, Argentina.

Lithium Americas Corp. was down 2.203 per cent, trading at $28.86 at 11:34 AM ET.