- Lion One Metals (LIO) has raised C$39.79 million in a private placement to fund exploration and development work at its Tuvatu gold project

- Under an initial tranche, the company issued 13,529,750 units at a price of $0.70 each for gross proceeds of $23,000,575

- The second tranche comprised 8,189,821 units at a price of $2.05 each for a total of $16,789,133

- Each unit is comprised of one common share and half of one common share purchase warrant

- Lion One Metals (LIO) is currently down 5.85 per cent to $1.93 per share a

Lion One Metals (LIO) has raised C$39.79 million in a private placement to fund exploration and development work at its Tuvatu gold project.

The financing, which was originally announced on July 23, was completed in two tranches: the first being a brokered bought deal private placement, and the second being a non-brokered private placement.

Under the first tranche, Lion One issued 13,529,750 units at a price of $0.70 each for gross proceeds of $23,000,575. These units were comprised of one common share in the capital of the company and half of one common share purchase warrant.

Under the second tranche, the company issued 8,189,821 units at a price of $2.05 each for a total of $16,789,133. These units were also comprised of one common share and half of one common share purchase warrant, with each whole warrant exercisable at a price of $2.75 per share over 12 months.

The offering was led by Haywood Securities and Echelon Wealth Partners as co-lead underwriters, who acted on behalf of a syndicate that also included Cormack Securities, Eight Capital and Laurentian Bank Securities.

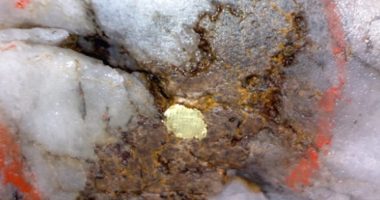

The proceeds raised under the offering will be used for exploration and development work at Lion One’s wholly owned Tuvatu gold project, which sits 24 kilometres northeast of the town of Nadi on the island of Viti Levu.

Lion One intends to develop a low-cost, high-grade underground gold mining operation at the project, which will be supported by additional regions for exploration across an under-explored alkaline gold system.

Lion One Metals (LIO) is currently down 5.85 per cent to $1.93 per share at 1:49pm EDT.